Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

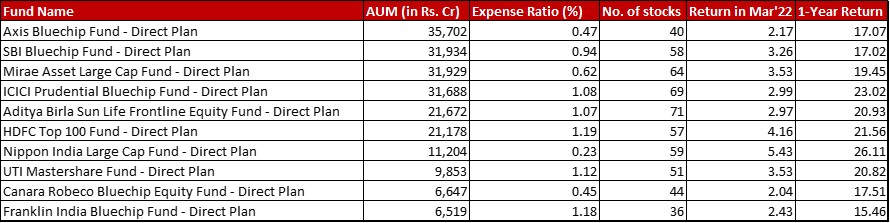

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by 3.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in March 2022 and giving a 1-year return of 20.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 31st March, 2022

Summary

Another month when the benchmark performed better than most of the top 10 funds. Only HDFC Top 100 and Nippon Large Cap showed better returns for the month. Even when it comes to the 1-year mark, only Nippon and ICICI were able to beat it.

When it comes to AUM, ICICI and Mirae keep switching for the third and fourth positions. The bigger shift though is Canara Robeco moving up from 10th to the 9th spot pushing Franklin down by a place.

There are some changes in expense ratio. For Nippon, as I mentioned in the introduction it is the inexplicable drop for about three weeks. Mirae has raised TER by little over 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Canara Robeco though sees an increase of 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to move their TER from the measly 0.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Canara Robeco also sees a bit of a trim in the number of stocks to come down from 49 to 44.

Market Cap Allocation

Officially the most unchanging or crawlingly changing section of the analysis. Mirae has trimmed it’s equity exposure by about 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while HDFC has increased theirs by about 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Franklin has increased it’s mid cap allocation slightly.

Top 5 sectors

Banks and Software remain the two favourites for the fund category.

Nippon sees Consumer Non Durables being edged out by Leisure Services for the fifth sectoral spot. In Consumer Non Durables, while ITC sees a bigger heft from 4.05 to 4.92 (aided in some measure by their 16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} up movement), HUL has been slashed by almost half to go down to 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, Indian Hotels which is the backbone of their Leisure Services portfolio gets a 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bump-up to reach 4.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In UTI, Auto had a slight edge with respect to Telecom in the sectoral allocation. Now, they are almost equal with Telecom just about 0.1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} higher.

In Canara Robeco, Consumer Non Durables now has a fairly higher allocation than Auto. Two main changes have led to this development. Tata Motors sees a 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction to 1.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. While in Consumer Non Durables, ITC makes an entrance with a 1.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation.

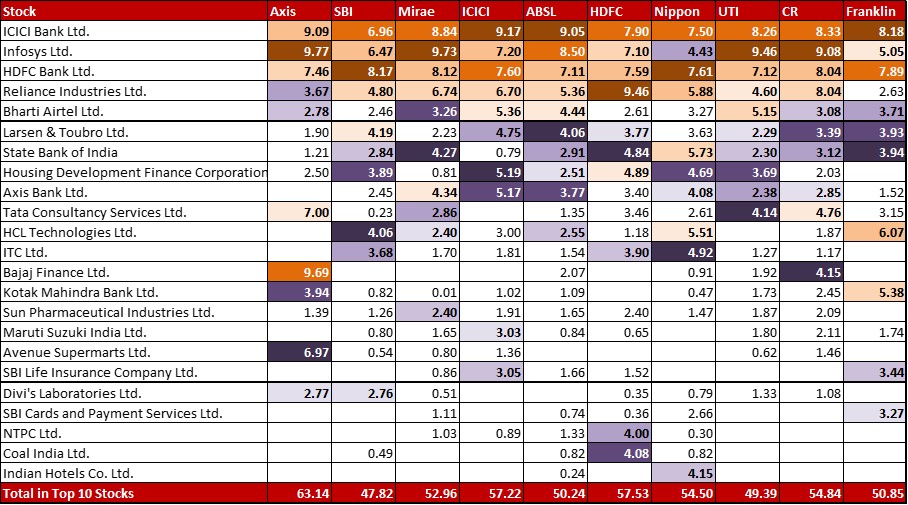

Top 10 stocks & Movements

Two noteworthy changes in Axis Bluechip. Avenue Supermarts sees a reduction of 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which could be to a large extent due to the 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} fall in price the stock witnessed in March. Reliance Industries on the other hand increased by 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} aided in a small part by a 12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} price increase in the month and possibly averaging out in the initial fall.

Mirae has trimmed it’s exposure to Tata Steel by 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} despite a 7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in it’s price. Looking at the stock’s chart and it’s price swings almost made my head spin!

Nippon, Canara Robeco and Franklin are the action heroes in the category.

In Nippon, three changes have already been mentioned in the sectors section above – ITC (increase by 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Indian Hotels (increase by 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HUL (reduction by 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). ICICI Bank sees an increase by a substantial 1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Bharti Airtel has been trimmed by the exact same amount.

For Canara Robeco too, ITC (new allocation of 1.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Motors (trim by 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) find a mention earlier. Some other big changes are trims in SBI (-1.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HDFC Ltd (-0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) along with increased allocations in HCL Tech (0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tata Steel (0.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HDFC Life Insurance (0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

But in stock shuffle, Franklin takes the lead. There is a complete exit from the 1.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in BPCL and trims in TCS (1.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), United Spirits (0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Axis Bank (1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). HDFC Bank is beefed up by 1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and the timing couldn’t have been better considering this is just before the news of merger. There are also three new substantial positions – Reliance Industries with a heavy 2.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, United Breweries with 1.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Gland Pharma with 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Check out the other categories and what the funds there were up to:

Leave a Reply