I know, I know my analysis is quite delayed this month. We are just about a week away from the month getting done but setting up some new processes took much more time than I anticipated. Well, here we are with the analysis and yet another promise of attempting to be on better timelines next month onwards.

January 2022 was a month when I had to do a double take in case any of the funds dared to show a positive movement. Yup, it was mostly red all around. Surprisingly, Mid Cap was the market cap that took the maximum battering. But then, most analysts were also looking at it as the most frothy segment.

Off late I realised that just giving a monthly view is slightly myopic. So, starting this month onwards I am adding a 1-year performance to everything, be it indices or funds.

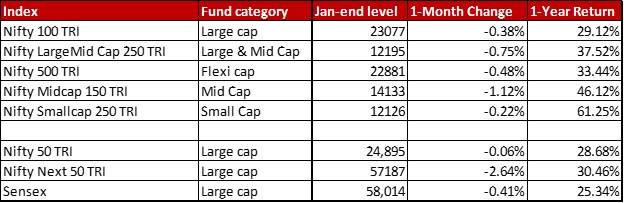

Check out how all the major indices moved last month. By the way, while all other indices are in TRI or Total Returns Index mode (meaning stock dividends add to the returns), Sensex is plain jane Sensex.

As you can see, even with the slight negative movement last month, Indian equity markets have given a very healthy return in the last one year. Like any bull market, Small Cap has ruled the roost.

Does this mean we are done with the up-cycle? Personally, I believe there are still some things going for the levels to keep inching up. But, it will not be a smooth journey and may not be for the faint-hearted. But, if you belt up and hold on tight to your seats, I am sure equities will as usual remain a fun ride.

Check out how the portfolios of the top 10-by-AUM funds in different categories stack up against each other.

In case, you are curious what brought about this segment on the blog or how is this analysis even being done, then check out the introduction post where I go into all those details

Leave a Reply