My first ever intensive brush with a financial product was with, as you guessed it, loans. I was a marketer for Home and Car Loans. I was fortunate enough to be with an employer where everyone working on a product HAD to be educated in it.

You might be thinking to yourself, ok Aparna, you got educated in Loans, why do you need to bore me with it? I know everything anyway. I borrow money from the bank, then I repay in small installments with some interest.

Alas! That’s exactly why I started this series of complete guides. Our knowledge of what we consider “basic financial products” is woefully less and very few people know almost anything about it.

Borrow -> Repay is really an extremely superficial surface knowledge for Loans and this quick guide will dive into more things that you should know. If you are in a hurry, scroll down to the end to get all the information in a neat infographic.

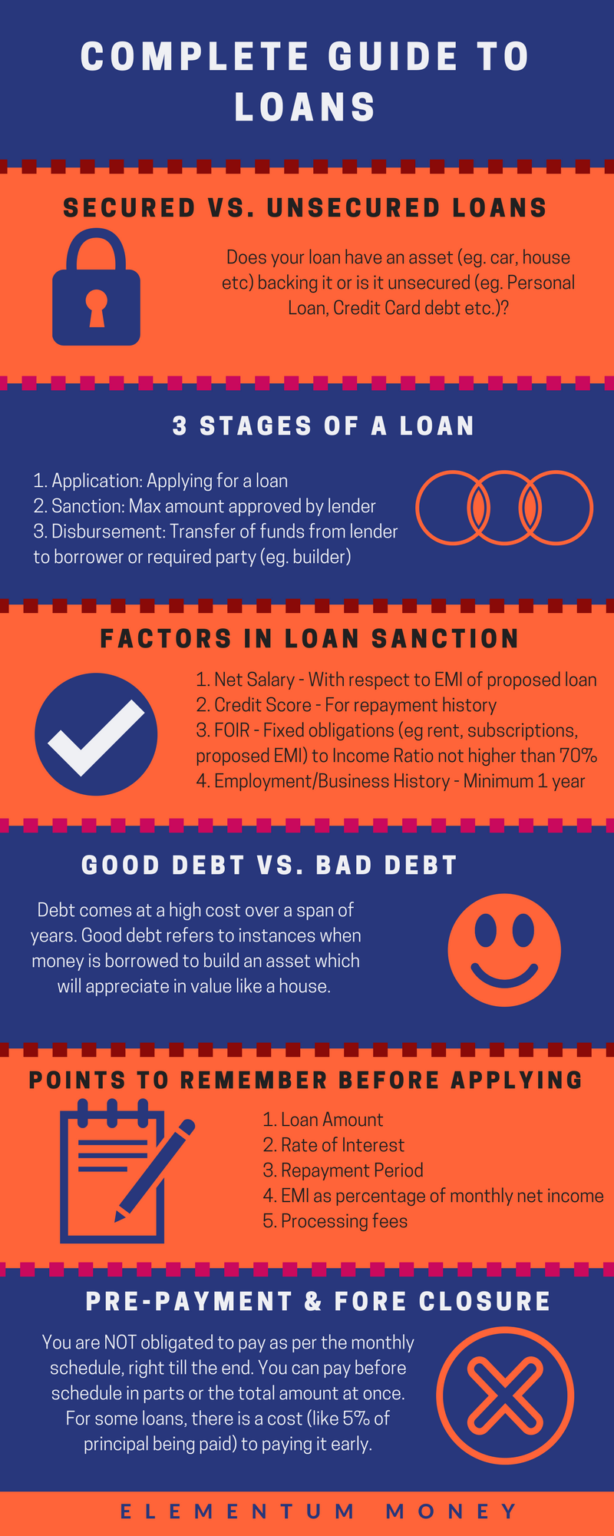

Secured vs. Unsecured Loans

There are two basic categories of loans – secured and unsecured. Secured loans refer to the set of loans which have an asset backing it whereas unsecured loans are untethered.

For instance, if you take a loan for a car or a home, it is important to know that till the time you repay that loan, the car or the house is in some ways owned by the bank. In a scenario where you are unable to repay the loan, the bank is legally allowed to transfer that asset to its’ name.

This makes Secured Loans a safer bet for banks which translates to a slightly lower rate of interest. In some ways, this is what you would do too if you were into peer-to-peer lending right? Safeguard your interest.

On the other hand, unsecured loans like Personal Loans or Credit Card Loans do not have any financial assets backing that lending. So, in case the borrower is not able to repay, there is no asset that the bank can use to recover the loan not repaid.

Generally, the amount of secured loans approved is quite low, except in cases like Nirav Modi!

3 Stages of a Loan

In the case of a loan, there are 3 main stages. This does not apply to some small loans like instant loan on a credit card.

- Application stage: In this stage, the borrower fills out the application form and gives the required documents.

The type of documents required vary with the type of loan that you are applying for. Typically, home loans need many more documents than a personal loan.

- Sanction: Once the borrower has given all his/her documents, the file is sent to the credit processing center.

There the file generally goes through multiple stages and people to arrive at a maximum figure of the loan that can be given out for the particular case.

This is your loan sanction amount. You CAN choose to finally opt for a loan lesser or equal to the sanctioned amount. Often, your relationship manager might call you during the process for queries or extra documents in case you are not meeting the requirement for the applied loan amount.

- Disbursement: This is the term given to the process when the money is actually transferred from the bank to the beneficiary. For instance, if you are buying a car, the amount that you choose to be disbursed, is transferred to the dealer from whom you are buying it.

In case of a personal loan, the amount is generally transferred to your bank account.

Factors in a loan getting sanctioned

There are a few fixed elements that go into sanctioning of a loan

I don’t recall where I read it, but one of the funniest sayings with respect to loan has to be:

In order to get a loan, you need to prove you don’t need one.

Today, to get a loan there are a lot of documents that you need to share – be it pay slips, income tax returns, identity documents, bank account statements, PAN card etc. However, from my first-hand experience, I know most of the documents are actually used and scrutinized in the process of the bank sanctioning the loan.

The main concern of a bank while processing your application is, will the borrower be able to repay the loan amount (with interest0? Credit processing, in a nutshell, is a process where the bank predicts what amount of loan can you safely repay.

Some of the factors that are checked for while sanctioning the loan are:

- Net salary: Well, duh! If you apply to buy a Rolls Royce where the monthly installment comes to over a Lakh (Rs. 1,00,000) and your monthly salary is only about Rs. 30,000, trust me no bank is approving that loan. Unless you are Nirav Modi (This joke is getting old now. Need another banking scamster to name, I think).

For self-employed applicants, business income is considered. However, since it is easier to predict a consistent monthly salary, a lot of business women/men find it relatively more difficult to get their loans sanctioned, especially in the initial stage of their business.

- Credit Score: Credit score gives the lender an idea about the historical trends and patterns about how you have repaid your other loan installments or even credit card bills. Read this complete guide about credit score to get a better idea.

- FOIR: This was a revelation for me in my first few days, working at the bank. Initially, when I kept hearing FOIR around me, I honestly confused it with “foyer”.

FOIR is a ratio and it stands for Fixed Obligations/Income ratio. Each one of us has a few fixed payments that are paid out every month like rent, monthly installments of existing loans or any other subscriptions. These fixed payouts are clubbed under the term – fixed obligations.

Income, again is easier to predict for the salaried applicants. For business owners, generally, an average income is considered.

While calculating the loan amount to sanction, the credit processors add the EMI amount of the proposed loan and cumulatively the FOIR CANNOT stretch beyond 70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} as at least 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} margin has to be left by the bank for living expenses.

I know this sounds like jargon but the below example will simplify it.

Suppose, you have applied for a personal loan of Rs. 6,00,000 @ 11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} p.a. interest rate for a period of 3 years. The EMI amounts to almost Rs. 20,000 (Rs. 19,643 to be exact).

You have a monthly in-hand salary/income of Rs. 50,000. From that, you pay Rs. 15,000 as monthly rent and Rs. 3,000 as gym subscription which is automatically debited from your account. In this case, Rs. 38,000 (Rs. 18,000 + Rs. 20,000 of the personal Loan EMI) would be your fixed obligation every month on an income of Rs. 50,000.

However, this makes it a 76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} FOIR (38/50). The relationship manager on the loan account might come back to you with 2 options of either reducing the loan amount to approx. Rs. 5.2 Lakh (Rs. 5,20,000) or increasing the loan repayment tenure to somewhere between 42 and 48 months which would reduce the EMI to the range of Rs. 15,507 to Rs. 17,276.

- Employment/Business history: When you are just starting out, with little employment or age of the business, the bank gets no confidence that you would be able to repay the loan. Generally, they look for at least one year of stable employment/business to approve a loan.

Good Debt vs. Bad Debt

Debt is generally taken to get a lump sum of money in hand and pay it back in relatively tiny installments. However, it is not as simple as that either, right? What this definition doesn’t take into account is the massive interest component in the loan repayment.

Consider this – you borrow Rs. 10 Lakh (Rs. 1,000,000) for a brand new car at 9.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} interest rate for 5 years. Your EMI is a mere Rs. 21,000.

Over the period of the loan repayment, you end up paying a massive Rs. 2.6 Lakh as interest over and above your Rs. 10 Lakh principal. On the other hand, your car would have lost most of its value in those 5 years.

The concept of good loan and bad loan simply means that whenever possible, use loans to fund assets which will grow in value over time. This ensures that while you are paying a higher cost to borrow those funds, it is to build an asset of much higher value over time. Hence, a Home Loan is probably the best loan out there.

Points to Consider Before Applying for a Loan

- Loan amount: Now that you know how much each penny could actually end up costing you, try and reduce the loan amount that you need to borrow.

It can be a tricky call to decide whether to dip into an investment or not. However, goal planning can help there as it earmarks funds for specific purposes making this decision easier.

2. The rate of interest: While credit score plays a role, in India, it has still not made the rate of interest that flexible. Do your research to check for multiple bank rates and quote them while checking with other banks.

Does a 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} even make a difference? In the car loan example above, you stand to save Rs. 30,000 over the repayment period of 5 years. It is for you to decide whether the effort to research and negotiate or going to another bank, is worth the cost.

3. Repayment period: The longer you repay a loan, the higher interest amount you end up paying. Yes, the EMI will be higher but the total interest amount that you pay in that period will be far lower!

In the above car loan example, let’s compare the same loan amount of Rs. 10 Lakh and 9.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} interest rate. When the repayment period is 5 years, the EMI is Rs. 21,000 while the total interest payment ends up ballooning to Rs. 2.6 Lakhs. At the same time, with a 3 year repayment period, the EMI inflates to Rs. 32,000, bringing down the total interest paid to 1.53 Lakhs!

So, for the decided loan amount, if you can pay it sooner, ALWAYS choose that option.

4. EMI as a percentage of monthly income: The numbers do not always tell the true story, especially when you do not track your expenses. Confused? When you are in the habit of tracking your expenses, you know what to expect and how much you usually end up spending month-to-month. The probability of surprises springing up will be far lesser.

Before applying for a loan, use an EMI calculator (do a google search and you will find lots of them).

Take some margin around the expenses you expect and apply for a loan for which you can repay the EMI comfortably. Trust me, you do not want to turn bitter towards this debt that you are taking of your own will. Click To Tweet

5. Processing fees: The part which most of us miss – the processing fees! Did you know most banks charge quite an amount just to process a loan application? There is a huge machinery which works behind this simple process and this fee goes towards keeping that in place.

A lot of home loan providers keep this at an amount of 0.5 – 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of the principal amount – so if you are applying for Rs. 50 Lakh, do the math (yes, I give homework).

Shop around and negotiate hard on this. This is probably the one aspect where some banks might actually budge.

Pre-Payment and Foreclosure

While most of what I have talked about till now covers the stages of till you actually get the loan, it is important to understand that you are NOT obligated to pay as per the monthly schedule, right till the end.

There are possibilities of part payment and foreclosure. In fact, most home loans are closed in India within 10 years (don’t have a source because I heard it while working in a home loan team).

Part payment means you can reduce your loan amount in bigger chunks (with all of it contributing to the principal) than your usual EMI. So, if you have a home loan where the outstanding principal amount is Rs. 30,00,000 and you get a bonus of Rs. 3,00,000 you CAN use it to repay 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of your home loan.

While for a home loan, most banks have done away with the charge for such processes, for most other loans, there is a cost to pay for repayment like a 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} on the principal amount that you repay.

So, there you have it. This covers the basic aspects that you need to understand about Loans in general. Watch this space for an upcoming separate guide on Home Loans.

Take your first step today. Sign up for the Elementum Money Weekly Newsletter to download the Financial Feminist checklist. Also, get nuggets of financial wisdom with our 3 posts every week, directly to your inbox. Have more questions, feel free to send any of them my way at aparna@elementummoney.com.

Leave a Reply