One of the first IPOs I remember being truly excited was the Café Coffee Day listing in 2015. I was still new and naïve into Personal Finance but was intrigued by Peter Lynch’s philosophy of the wisdom of investing in stocks of brands personally seen and used. But, as I did a cursory check on numbers, I realised that the company was yet to turn profitable having chosen to prioritise growth. I know I know, Amazon had it’s first annual profit in 2003 while it was listed in 1997! While that is the story fuelling the growth of enough and more unicorns in the country, every company is not Amazon especially something like a CCD where so much of their cost was to do with real estate and man power.

To cut a long rant short, I chose to skip Café Coffee Day and was happier for it. But, coming back to the subject, IPOs have a tendency to leave investors faint with excitement and smelling profits from a distance. Especially, against all odds, 2020 turned out to be an exciting enough year with $9.2 billion raised in IPO funding. This year so far, 2021, has already proven to be the highest IPO funding in 13 years with $2.2 billion. This post aims to decode the details behind this enigma.

What is an IPO?

An IPO or an Initial Public Offering in simple terms is when a company goes public by hiving a part of it’s ownership to public shareholding. It’s like the debut of a star on the stock exchange which could either become a Shah Rukh Khan with a string of blockbuster quarters or a one-time wonder.

Essentially, the process allows them to list on the stock exchange and for miniscule parts to be owned by retail investors like you and me as well as institutional market players like mutual funds.

An important point to remember is that this is the only money that the company actually generates. So, when the stock prices move up or down the company’s valuation is affected on paper yes. But, technically they get the money raised in the initial entry to the market. That’s why an IPO is also referred to as a primary market whereby the company is selling directly to end investors. On the other hand, when we trade in already listed shares it is called the secondary market as the asset is only shifting hands from one investor to the other.

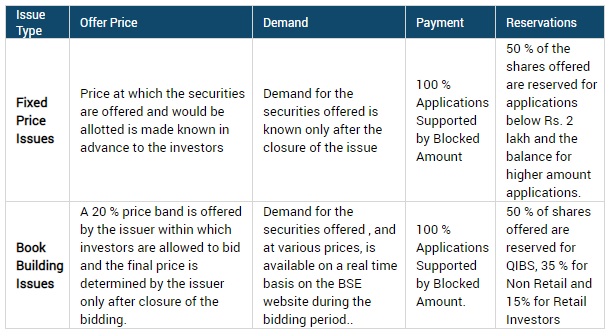

There are two types of IPO processes – Book Building and Fixed Price. Whenever you hear the phrase price band being used with respect to an IPO, know that it is a book building type which also happens to be the more commonly used variant. The BSE website does a good job of clearing out the distinction between these two types:

How to invest in an IPO?

One of the things I find most annoying about the whole process is the complexity. When you consider a regular equity transaction, today those are quite easy. You login to your demat account and place your order. If it is a fairly liquid stock and your order isn’t too big you know you will get it.

In IPO though, there is hype, excitement, anxiety and build-up. Although for a lot of investors that is part of the fun of the process. Assuming you are someone who already trades in equity which means you will have an online demat plus trading account, below is a short description of how you go about applying for an IPO.

Application Process

This is the step where you fill in all the details through your demat account or sometimes through the banking facility of the attached savings bank account to it. The form will ask you to fill in details like lot size, bid number etc.

Since IPOs are allotted in lots of specified number of shares, the lot size determines the multiples that you can bid in. Suppose you apply for the IPO of Stock X which is possible only in lot sizes of 15 shares each. When you fill in 3 lots, you are essentially applying for 45 shares.

As for the bidding, most IPOs come in a price range whereby the lower number is the floor price while the higher number is the cap price.

The most important point to note however is the concept of ASBA or Application Supported by Blocked Amount. Essentially, you need to ensure there are enough funds required to back your proposed application. So, if you bid for 100 shares at a cap price of 500 ruppees, you need to have that Rs. 50,000 in your attached account. In fact, the bank blocks that amount by putting a lien on it. So, the money is there in your account with a name tag for the IPO if it materialises.

Allotment of shares

You might have seen news reports where popular stocks have had bumper subscriptions often even more than 100x like the case of Burger King and Mrs. Bectors. That means for the number of shares that the company is willing to release for public shareholding, the demand is far more than supply. Hence, the two forces of economics apply.

Shareholders are allotted shares on the basis of a draw of lots which means that the number of lots an investor gets is pretty much up in the air. On the day that the stock gets listed, a lot of them end up getting listed even higher than the upper band price thanks to the price discovery mechanism of the exchanges in the time between 9:15 and 9:50. This quora thread does a good job of explaining how the listing price varies from the initial price band.

Somehow this reminds me eerily of the days of applying to different colleges, rushing to the notice board and checking out the cut-off lists. I never could stomach the anxiety and am happier avoiding it in investing too.

Should you invest in IPOs?

I come across enough and more investors who get excited at the mere mention of these three letter I – P – O. Personally I am not a fan. Since I have to be at my professional muted self on the job, I thought this is as good a platform as possible to enlist just why I think it’s better for retail investors to stay away from this shiny new thing phenomenon.

1. Warren Buffet doesn’t recommend it either

For anyone who wonders why listen to this woman yap about investing, let me start with the Oracle of Omaha and his views. Check out this video, especially from the 1 minute mark.

Hear that? Buffett and Munger have both not invested in an IPO since a few shares in Ford Motors in 1955! Although, there has been a recent exception to this rule when Buffett’s Berkshire Hathway invested in the IPO of Snowflake a few months back. That still comes to 1 IPO in 65 years for the world’s best-known professional investor. What does that say for novices like us?

2. Sentiment Premium

Most IPOs enter the market when there is euphoria and the sentiment is on an upswing. As I said above, this finally is the money that the company actually gets. So, timing becomes supremely important here.

Not just that, most companies amp up their marketing muscle just before listing especially in case of consumer facing businesses. So apart from a regulatory advertisement probably in a pink paper, you are also bound to see splashy hoardings in most major cities and probably a burst of digital advertising also.

All these things feed into the final pricing which finds it’s way to the stock exchange listing.

3. Listing day gains booking

Mint did a wonderful analysis showing the offloading of IPO stocks done on listing day itself. Check out this graphic to show the percentage of non lock-in shares sold off and gains booked. The lock-in shares are also offloaded pretty quickly since a lot of Institutional investors have been holding on to the stock in it’s pre-IPO form through all possible listing delays. The clock is ticking for them.

Especially where the stocks do not seem to have long term sustainable metrics, most institutional investors are happy to offload them while retail investors who have bought into the hype could very well remain stuck with it.

4. No track record

When you choose a stock for the long run, apart from business numbers ideally you also do a check on the past performance of the stock. For instance, for a lot of FMCG stocks the PE remains perpetually inflated. But since you know that is the track record for them and they anyway end up giving stable returns, you can go ahead and invest in it. Even when there has been a past dip for a stock being considered, you can go back in time to check what made them come back to track.

With IPOs, it is a completely new, raw deal. What you get will often depend on the ratio of the strong fundamentals versus buying into the hype and euphoria.

5. “IPOs are the lowest price for a stock” is a myth

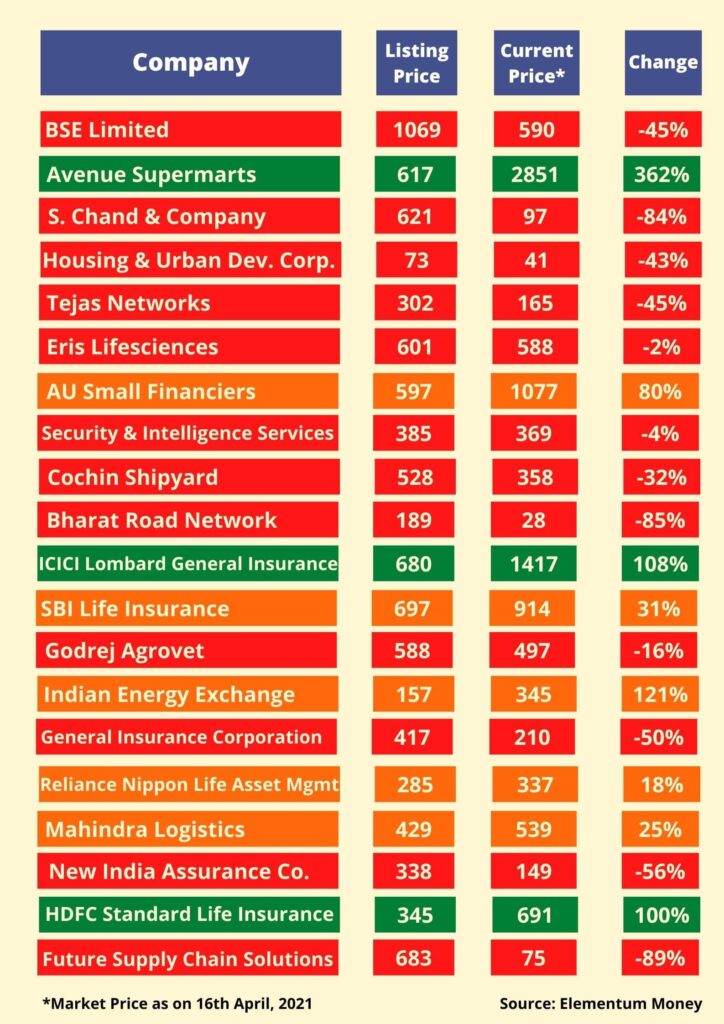

There are a lot of investors who believe that IPOs are a bargain deal after which the stock only keeps getting a higher premium. Nothing can be further from the truth. For some back check, I did a short analysis of the top 20 IPO issues (by size) from the last bull run of 2017. Check out the list below.

In green are those stocks which had their lowest ever closing on listing day (apart from ICICI Lombard which fell by 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} on one of the days). The ones marked in orange are the stocks that today have a market price higher than what they listed at, but in the interim dropped in a range of 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} – 55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Finally, I saw red for the stocks that despite the roaring bull run of 2020 are still trailing their listing price and some by a very hefty margin!

So, how advisable is it to run after IPOs? Personally I have always believed in the KISS philosophy of Personal Finance, Keep It Simple, Silly. Which is why I might come across as judgemental but I often strike down popular practices like day trading off my charts for the poor return on investment (of time, effort and mind space). In my mind, IPOs are also one of those things that ends up being struck off.

Are you a serial IPO applicant? Or like me you prefer watching from the sideline. Let me know in the comments below.

Leave a Reply