To say that we are living in strange times would be an understatement. While coronavirus rages on, markets of almost any asset have also continued to spring up surprises. Life and investing both seem so unpredictable that it can lead to inaction and confusion. However, when nothing else works, sometimes distilled human wisdom through research can provide us with some clues.

One such distilled wisdom used by investors for decades now is asset allocation. The concept first germinated with award-winning Harry Markovitz’s Modern Portfolio Theory way back in 1952, However, the idea of maximising returns in your optimal level of risk still remains appealing.

Asset allocation even today is the one action-based practice we should undertake at regular intervals. To get a more detailed idea about the process, read my earlier post detailing all about asset allocation.

However, there are a few things that you do need to keep in mind even as you decide to become a pro asset allocator per se.

Asset Allocation is a hedge against risk

The world is not a black and white place. In a similar vein, just doing asset allocation does not mean that with the twists and turns of the economy your portfolio will not move.

However, it’s job is to reduce risk. Ideally, risk can be seen as synonymous with volatility. So, in a nutshell asset allocation leads to a less bumpy ride while not foregoing all of the astronomical returns promised by the investment options that are more of a blood pressure gauge.

2. Every dog has his day

Like me, you must have internalised the idea by now that investing including this whole asset allocation piece is a long term game. In the long run, while we might know a rule of thumb as to what to expect from every asset class, we can never get that timing right.

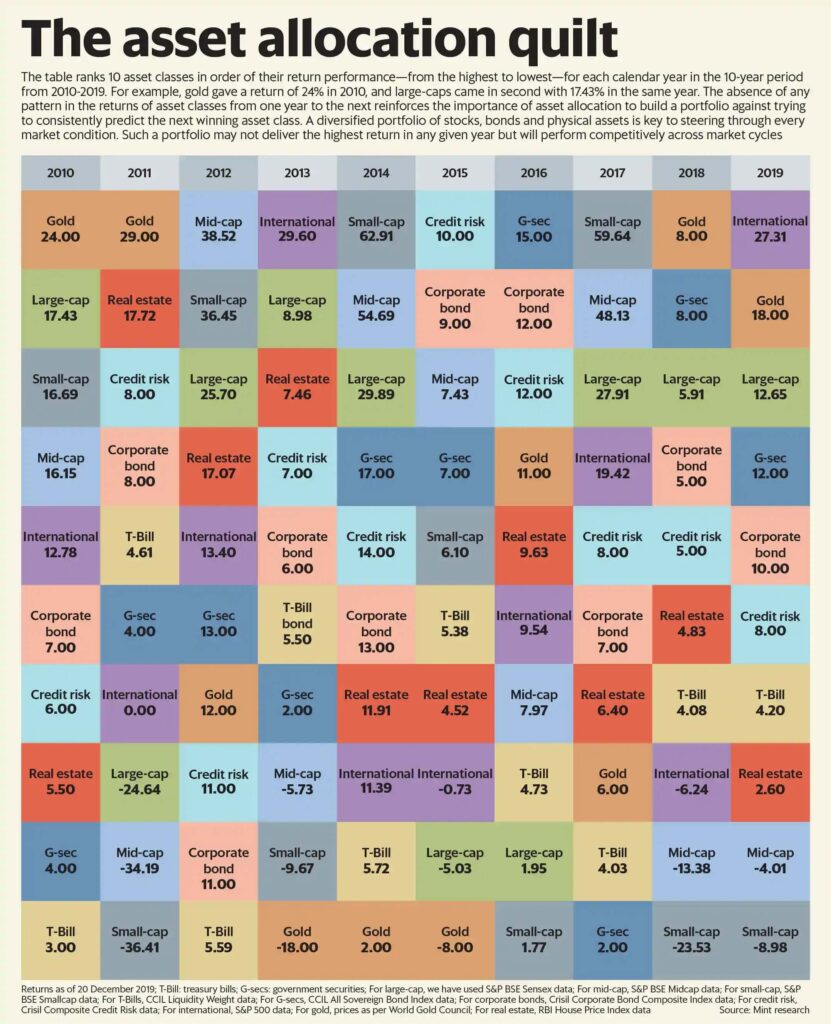

Check out this chart above that Mint collated in late-2019. It is a wonderful visual cue telling us that having our investing fingers in multiple pies is a much needed balm to assuage the dips that high-risk assets are bound to make from time to time.

3. Defining portfolio allocation is only half the job done

With asset allocation comes along it’s sidekick – rebalancing and it’s only together that they really start making sense for your portfolio.

As discussed above, all assets move in cycles performing at varied times. The great thing about doing your portfolio in this manner is that without getting too deep into the economy or getting predictive about the markets you can still end up seeming intuitive.

So, at regular intervals of a substantial period like one year, you check to see how your allocation has moved. If for instance, from 60-40 in equity and debt, it has moved to 65-35 you could take one of two routes. You could either add amounts or book gains in equity and add those amounts to debt to bring the ratio back to 60-40. Either way, you are then buying into an asset that hasn’t performed as well and taking some profits out of an asset that has probably seen some of its time in the sun.

4. Don’t overthink within the asset class

We have all seen the kind of media glamour that star fund managers and momentary outperformance generates. However, when you see the long term trend of funds within a category, you will realise there is barely any difference.

More so, a lot of them often end up underperforming the benchmark. Especially, in the case of Large Caps where the universe is a mere 100 stocks, there is a strong case to be made for a passive or an index fund making the core of your portfolio.

However, even in this case, do not look at it as a one-time decision. When you check your portfolio for rebalancing, do a quick check to see if the fund is staying true to it’s initial promise.

5. Technology can help

Sometimes going strong on the path of asset allocation requires us to not give in to emotion. Confused? Let me explain.

When we are in a bull run, there is euphoria everywhere that we see and booking gains or increasing allocation to asset classes other than equity almost feels like an opportunity cost of missing out on further rally. Similarly when the economy is in a depressed state and nothing seems to be going right, allocating more to equities seems like walking into doom.

However, technology can be very supportive in this case.. You can take the help of a robo advisory which will then help give the right cues to keep you on the path.

If you are looking to follow asset allocation in a number-based scientific manner then Glideinvest is a good option. Glide Invest is a SEBI Registered Investment Advisor (RIA). It is backed by the Motilal Oswal Group, synonymous with equity investing and wealth creation for millions of Indians over the last 30 years. Glide Invest is backed by the Motilal Oswal group, a name synonymous with equity investing and wealth creation for millions of Indian investors.

On the Glide Invest platform, you can take the risk survey to understand your risk profile, specify your goal, for which you will get your personalised investment plan, and start implementing it. Glide Invest recommends the appropriate asset allocation, investment in direct mutual funds, and handholds you till you achieve your financial goals. All you need to do is to download the Glide Invest App and get started.

Head to the App Store or to the Play Store to download the app today.

*This is a sponsored post with views about asset allocation completely endorsed by the author concluding with fact-based information for Glide Invest

Leave a Reply