Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with maximum 30 stocks in their portfolio

Benchmark: Nifty 500 TRI with change of -0.48% in January 2022 and a one-year return of 33.44%

Data as on: 31st January, 2021

Summary

I have always found focused funds very intriguing. To me, it seems like more giant versions of PMS’s per se since they also end up being concentrated less than 30 stock portfolios.

With the new primary benchmark system, like Flexi Cap, this category also follows Nifty 500 TRI. Not a very pretty report card, considering only 4 out of the top 10 were able to beat the benchmark and register a positive movement. In fact the first two, Axis and SBI have quite a distance to travel back. Although, when it comes to one year performance, it’s only Axis and Aditya Birla which have an under performance as compared to the benchmark.

In my analysis, there is the addition of Aditya Birla Sun Life in the focussed category because that is one fund I had missed out thanks to the faulty nomenclature followed by Valueresearch. But now I hope to check with the AMFI list for better accuracy.

Another change in terms of AUM ranking is that ICICI has for now, overtaken IIFL.

Market Cap Allocation

SBI has reduced it’s allocation to mid cap stocks (leading to an overall drop to equity exposure below 90%) whereas Axis has had a slight increase in Large Cap stocks.

Nippon has reduced it’s allocation in Large Cap leading to a simultaneous similar increase in Small Cap.

Top 5 sectors

SBI has seen quite a bit of shuffle in terms of sectors. The foreign inter and technology sector is out of the top 5 because of a complete exit of 3.71% position in Nvidia!

As for Franklin Auto replaces software in the top 5 sectors with an increased position in Maruti and a new 1.33% allocation in Ashok Leyland.

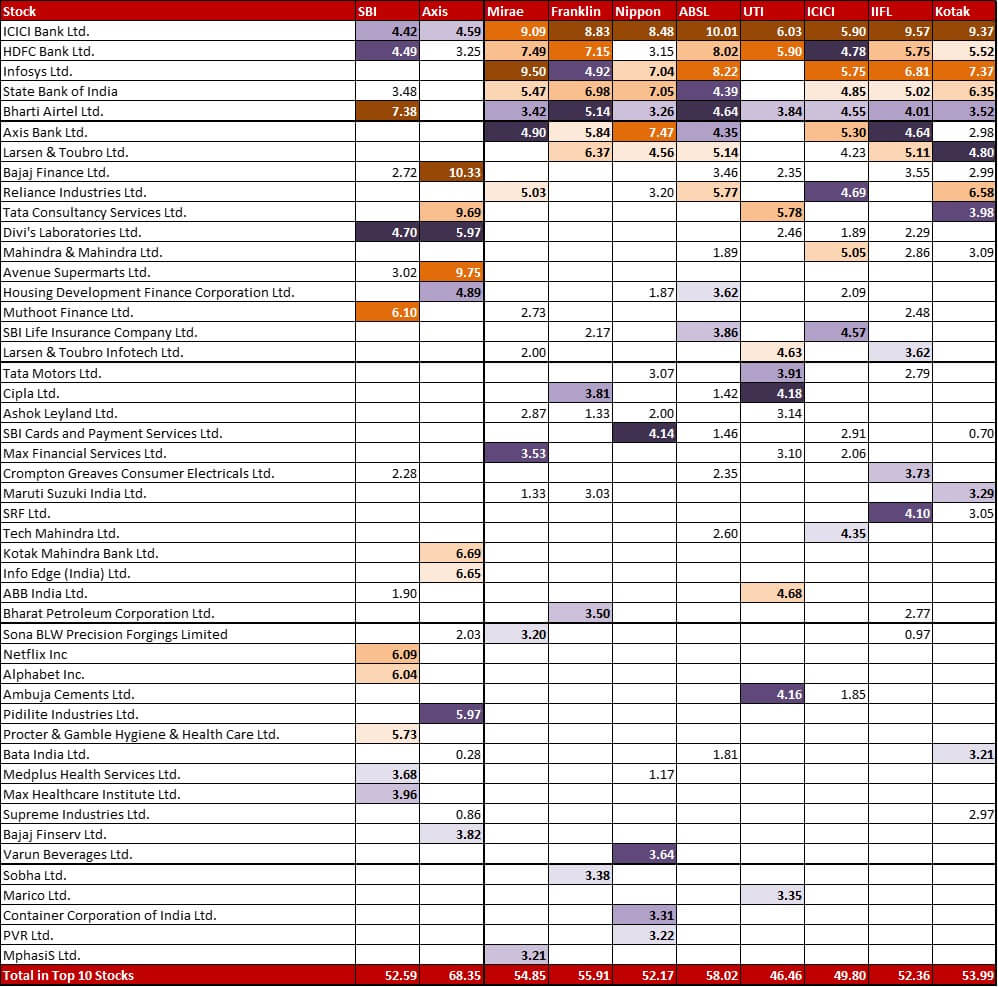

Top 10 stocks

For SBI, Netflix has moved from number 5 to the second biggest stock with a 1.30% increase in allocation. Whereas Max healthcare goes down from sixth to the ninth spot with a 0.71% reduction. ABB India is another stock to see a big trimming of -1.27%. As mentioned above though, the biggest change is a complete exit of 3.71% from Nvidia.

Axis has beefed up it’s banking allocation with fairly chunky increases in Kotak Mahindra and ICICI Bank. In this fund too, the AMC has completely exited a 1.16% position in Zomato.

A fairly significant exit in Franklin is the nearly 1% from Apollo Hospitals while the other complete exit is the 0.61% position in NTPC.

In UTI, the ICICI Bank allocation has increased by nearly 1% for the stock to move from number four to numero uno. Although the biggest shift is a 1.34% reduction in Mindtree allocation.

In IIFL, the fund has slashed down the allocation in Sona BLW by 1.70% to almost a third of it’s earlier allocation! Zomato wasn’t spared either with a 1.35% reduction leaving it to a mere 0.33% allocation.

In ICICI, HCL Tech sees a reduction by 1.15% taking it from number 2 right out of the top 10 stocks. The fund has also completely exited it’s 1.36% allocation in NTPC and instead taken a 1.89% fresh allocation in Divi’s Laboratories.

In Kotak, there is a reduction in SBI Cards & Payments and a similar increase in Axis Bank, both in the whereabouts of 1.50%.

Check out the other categories and what the funds there were up to:

Leave a Reply