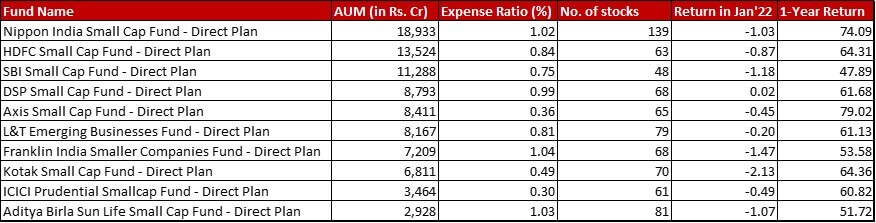

Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65% portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of -0.22% in January 2022 and a 1-year return of 61.25%

All data as on: 31st January, 2022

Summary

It’s such a disappointing report card this month with only DSP and L&T beating the benchmark last month. The good news is that in terms of 1-year return it is only L&T and Aditya Birla Sun Life which are lagging behind slightly.

The tug-of-war between Axis and L&T continues with Axis inching ahead this month.

In terms of expense ratio, only L&T has increased it by 0.08% which is almost a 10% hike.

Market Cap Allocation

The only main change is an approximately 3% reduction in small cap allocation and resultantly in the total equity exposure in Aditya Birla Sun Life Small Cap fund.

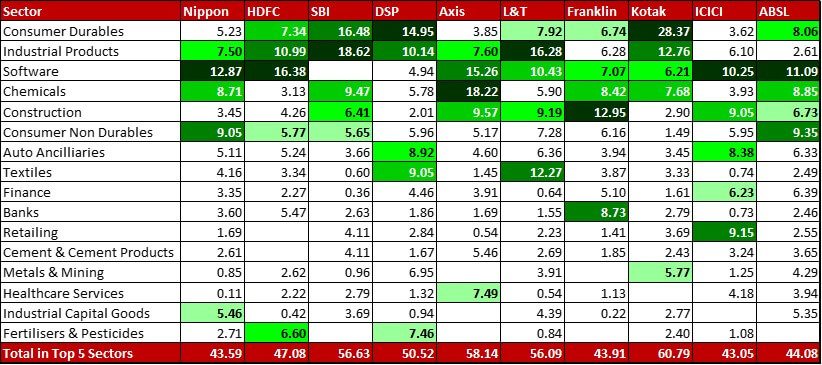

Top 5 sectors

In Nippon, with the addition of Adani Wilmar (0.40%) and Godrej Agrovet Consumer Non Durables goes on to get the top spot. Industrial Capital goods has also edged out Consumer Durables from the top 5 although not much has happened really to get to that change.

For HDFC, Consumer Non durables has edged out auto ancilliaries while Fertilisers and Pesticides has zoomed to the fourth highest sector with increase in existing positions of Chambal Fertilisers (+0.40) and Sharda Cropchem (+0.97). Increased allocation in Sharda Cropchem (+0.80%) also sees the sector get into the top 5 for DSP Small Cap.

In ICICI, there is a swap between Finance and Industrial products for the fifth and sixth place.

In Aditya Birla, Construction gets a fillip with a 0.69% new allocation to Sobha at the cost of Auto Ancilliaries with a complete 0.71% exit in Motherson Sumi Systems.

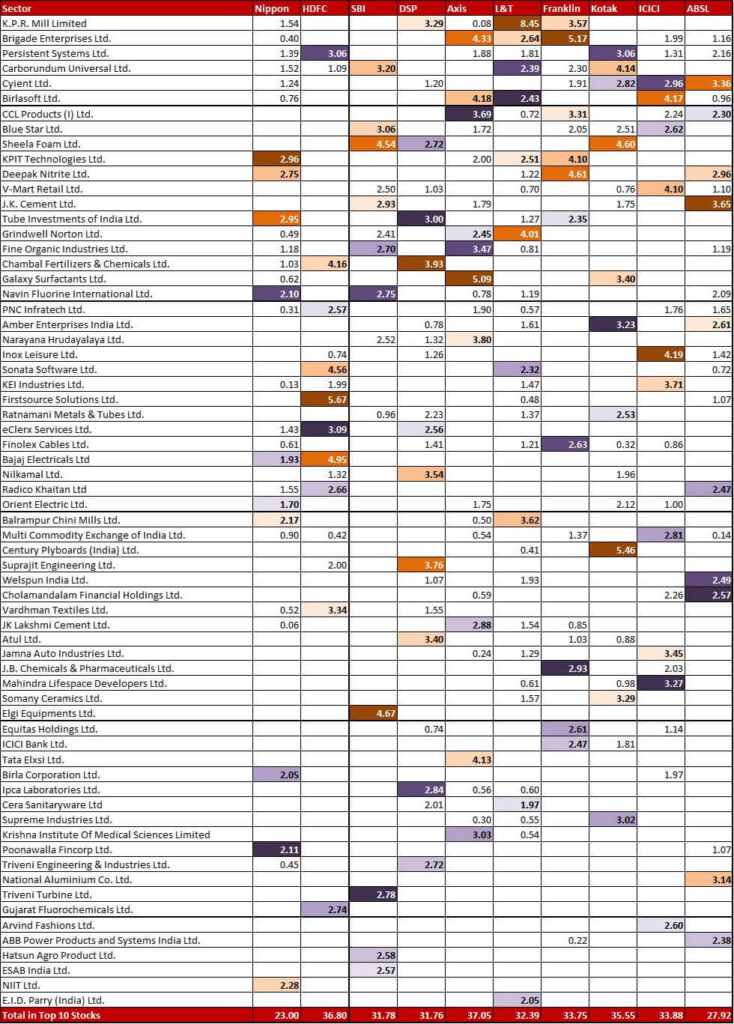

Top 10 stocks

In Small Cap, the odds of a significant change are very less as changes of 1% or more would pretty much shake the portfolio. But, I will still mention wherever there is a noteworthy juggle in the top 10 or a major entry or exit.

For Nippon, Deepa Nitrite goes from first to third spot with a 0.68% reduction in allocation. In the same sector Navin Flourine moves up from 13th to the 6th spot with a 0.47% increase in allocation.

In SBI, Hatsun Agro moves from 5th to 9th spot with a 0.62% reduction in allocation.

In Franklin, Brigade Enterprise and Deepak Nitrite have swapped the top two positions.

ICICI is banking heavily on all of us going back to watch movies in theatres. With a 0.62% increased allocation in Inox Leisure, the stock moved from number four to numero uno.

In Aditya Birla, Axis Bank has made a grand entry of 1.06%.

Check out the other categories and what the funds there were up to:

Leave a Reply