Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is as per fund management.

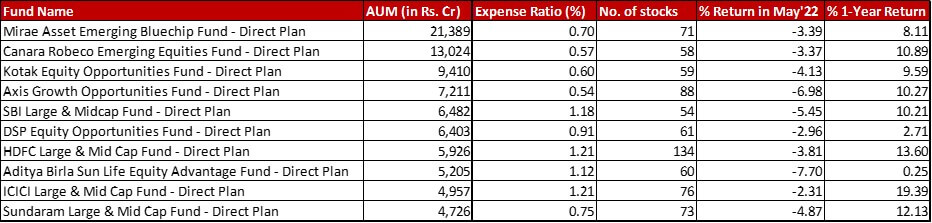

Benchmark: Nifty LargeMid Cap 250 TRI with a change of -4.42{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in May 2022 and a one-year return of 8.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 31st May, 2022

Summary

This is personally one of my favourite fund categories. I have often been caught saying like an ad salesperson – stability of large cap, growth potential of mid caps.

But, when you look at the AUMs, you will see it’s not much of a favourite of investors apart from Mirae. In fact, it really is Mirae Emerging Bluechip which first got the AMC much popularity. Even now investors with high value SIP refuse to let go of it, concentration risk in the portfolio be damned.

Four of the ten funds have under performed to drop by even more – Axis, SBI, Aditya Birla and Sundaram. In the one-year performance, things are still looking good for the category with only Mirae, DSP and Aditya Birla missing the mark.

In terms of AUM, ICICI has inched up one spot above Sundaram.

Nothing noteworthy in terms of expense ratio, unless you count a 6 bps reduction in ICICI to still land at a very high 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Market Cap Allocation

There is a further 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Large Cap for Axis, with a 2.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Mid cap allocation. Within two months Large cap has seen an almost 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase taking it closer to the mandate level of 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI has taken a clear call to sit on more cash, reducing its’ equity allocation by almost 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it down to sub-90. The reduction is seen in trimming across domestic Large, Mid and Small caps whereas Foreign Equity is mostly consistent.

Aditya Birla has increased it’s allocation to Large Cap by almost 3.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while reducing that to Mid caps by almost 4.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and a slight shave in Small cap also.

ICICI has increased it’s mid cap allocation by almost 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which has hiked up it’s equity allocation as well.

Top 5 sectors

In Mirae, organically, Petroleum Products has been edged out by Insurance for the fifth sectoral spot.

In DSP, Auto is now the fourth highest sector edging out Consumer Non Durables from the top 5 sectoral spots. This is thanks a new inclusion of Maruti Suzuki (1.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and increase in Ashok Leyland by 0.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The funny thing about Maruti Suzuki is that just in March the 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation was exited while a month later there is a bigger allocation to the same stock.

HDFC, sees mostly an organic shuffle between Auto and Consumer Non Durables, although Auto does have a new entrant in Eicher Motors with 0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

As for Aditya Birla, with a more than 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Reliance Industries allocation Petroleum products has gone ahead to third highest sector, edging out Chemicals which has also seen slight reduction in all four of it’s constituents (Atul Ltd, SRF, Aarti industries, Anupam Rasayan).

Within Sundaram, there is just an organic swap in the opposite direction of what happened last month. This time, Finance got in whereas Pharma got out. This could be a regular dance in this fund.

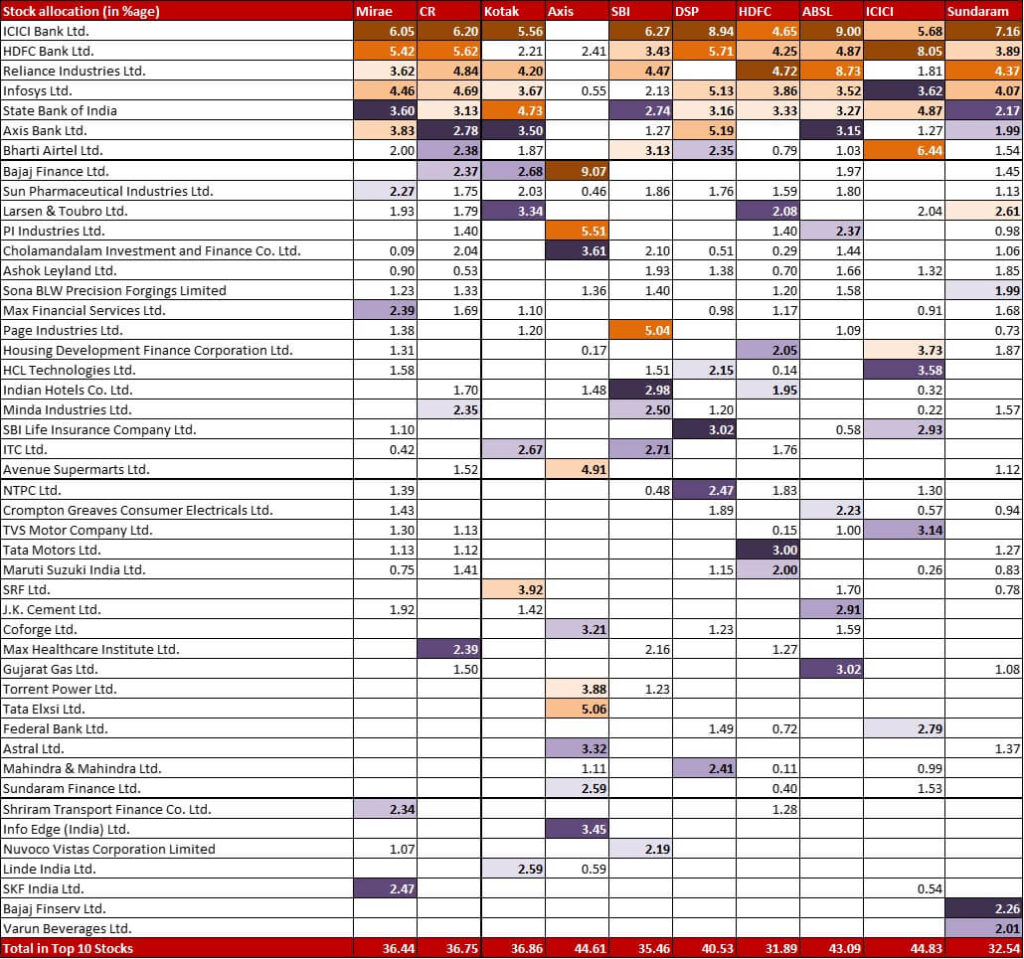

Top 10 stocks

In Canara Robeco Divi’s Lab sees a big 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} slash down to a miniscule 0.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} whereas Tata Steel seems to be almost as good as out with a 0.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cut down bringing it down to 0.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In Kotak, there is a 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in the allocation to Jindal Steel & Power.

Axis has taken a 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in the new insurance stock on the block – LIC. It has also almost doubled it’s allocation to HDFC Bank from 1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.41{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Avenue Supermarts also goes up by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 4.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI has three substantial noteworthy exits – the US stock Cognizant Technology Solutions (1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Brigade Enterprises (0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and NATCO Pharma (0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There is also a very surprising new entrant, the down and beaten American stock Netflix with a big 1.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

As I mentioned earlier, DSP has followed a strange pattern with respect to Maruti. It exited a 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in March and in May the stock is back with a bigger 1.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position. The fund has also trimmed Kansai Nerolac by quite a bit (0.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) to bring it down to a mere 0.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

For HDFC, the only noteworthy occurrence is the inclusion of new logistic stock Delhivery with a 1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation.

Yet again Aditya Birla has a whole host of changes. Personally, as an investor it makes me very uncomfortable and makes the fund seem very indecisive. As mentioned earlier, Reliance is up by about 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 8.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), and so is HDFC Bank (now at 4.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). ICICI Bank has also increased by 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cementing it’s place as the biggest stock in the portfolio. There are four substantial trims as well – Voltas by 2.69{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (settling at 1.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), NATCO Pharma by 1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (bringing it down to a negligible 0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Steel by 1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (reducing it by almost half to 0.97{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Then there are the exits – IndusInd Bank (1.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tata Motors (1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Info Edge (1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Jindal Steel & Power (1.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). The last one, mind you, was in the portfolio for a grand total of 1 month. The list of new entrants is no less lengthy – Godrej Consumer Products (1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bharti Airtel (1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Titan (1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and TVS Motor (1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

In Sundaram, just one change worth mentioning. After an exile of 4 months post exiting a 0.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Dec-2021, HUL makes a re-entry in the fund with a 1.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position.

Check out the other categories and what the funds there were up to:

Leave a Reply