A few months back, SEBI realised the alarming pace of Indian investor money being invested in foreign equity. So, as on Feb 1st 2022, it mandated that the mutual fund industry could not breach the $7 Billion limit and the same was set at $1 Billion for each fund house.

Subsequently, all fund houses stopped accepting fresh inflows into their foreign funds, and gradually cut off any live SIPs as well. The domestic+foreign hybrid funds, stopped additional purchases leading to the foreign equity allocation dilution over time.

Twist in the Tale

Now with fallen equity valuations, developed market equities more so, and the constant hankering of investors, SEBI has relented just so slightly. Read the verbatim allowance as made by SEBI:

“Mutual fund schemes may resume subscriptions and make investments in overseas funds/securities up to the headroom available without breaching the overseas investment limits as of end-of-day of February 1, 2022, at the mutual fund level”

-SEBI ammendment to rules for Mutual funds to invest in overseas equities

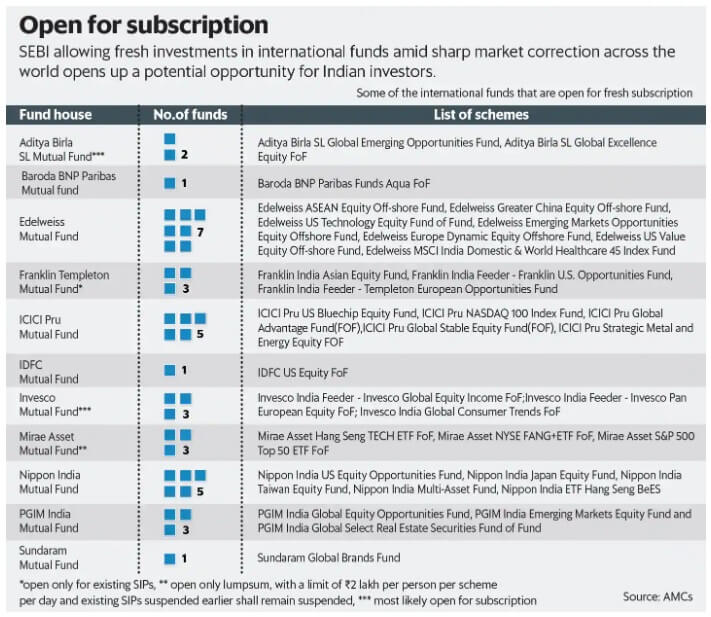

So, for funds with big redemptions, there is now wiggle room. Edelweiss seems to have been one of the first AMCs to act as it’s the one name mentioned across articles about resuming inflows into it’s 7 foreign funds.

But fund houses are following other permutations and combinations, too. For instance, Franklin Templeton has opened up only for existing SIPs. Mirae is allowing only upto Rs. 2 Lakh per investor per day. AMCs like Motilal Oswal with barely any redemptions, are choosing to err on the side of caution.

As for the flag bearer of foreign+domestic hybrid funds, Parag Parikh announced that their inflows continue unabated. However, the stance of not investing in foreign equity also stays.

In the coverage of this topic, I really liked the way Mint collated information of most AMCs and the funds where they are allowing inflows along with the T&Cs. Take a look.

Final take: Considering the low correlation between developed markets and Indian markets, a 10-15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to foreign equity is a good idea. If you still have that gap in your portfolio, use this opportunity to plug it.

Leave a Reply