Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

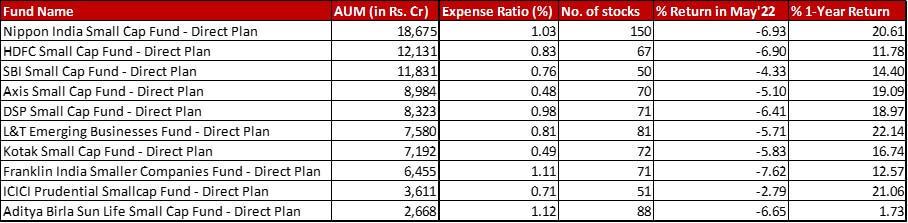

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of -8.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in May 2022 and a 1-year return of 9.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 31st May, 2022

Summary

Happily enough, all funds have dropped lesser than the benchmark in May 2022. Even in the one-year returns, apart from Aditya Birla, all other funds have given a handsomely higher return than the benchmark.

For Total Expense Ratio, two funds see noteworthy hikes – HDFC by 5 bps to 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and ICICI by 8 bps to 0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. While, Aditya Birla sees a 7 bps reduction bringing down the expense ratio to a still high number of 1.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

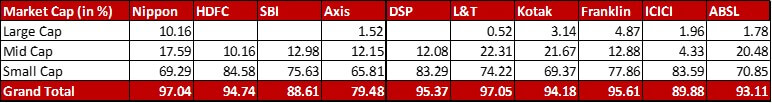

Market Cap Allocation

This month yet again, there are three funds in sub-90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} equity exposure category with Axis being even lower than 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Top 5 sectors

In Nippon, with a 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the HDFC Bank allocation, Banks have edged out Auto Ancilliaries in the top 5 sectors spot.

DSP, with a 0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Ratnamani Metals & Tubes, sees Metals & Mining as a sector replaces Textiles in the Top 5.

For ICICI, with a big new 1.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in SBI Cards & Payments, Finance replaces Leisure Services in the Top 5 Sectors.

Aditya Birla sees Consumer Durables moving up to the top spot thanks to quite a few changes – increased allocations in four of the stocks (biggest being Campus Activewear) and a new 0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Symphony. But, the biggest change really has been Deepak Nitrite being cut down a to a third of it’s last month’s weight (a reduction of 2.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) down to 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. That cutdown meant that even a new 0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Aether Industries was not enough to keep Chemicals in the top 5 sectors spot which it lost to Finance.

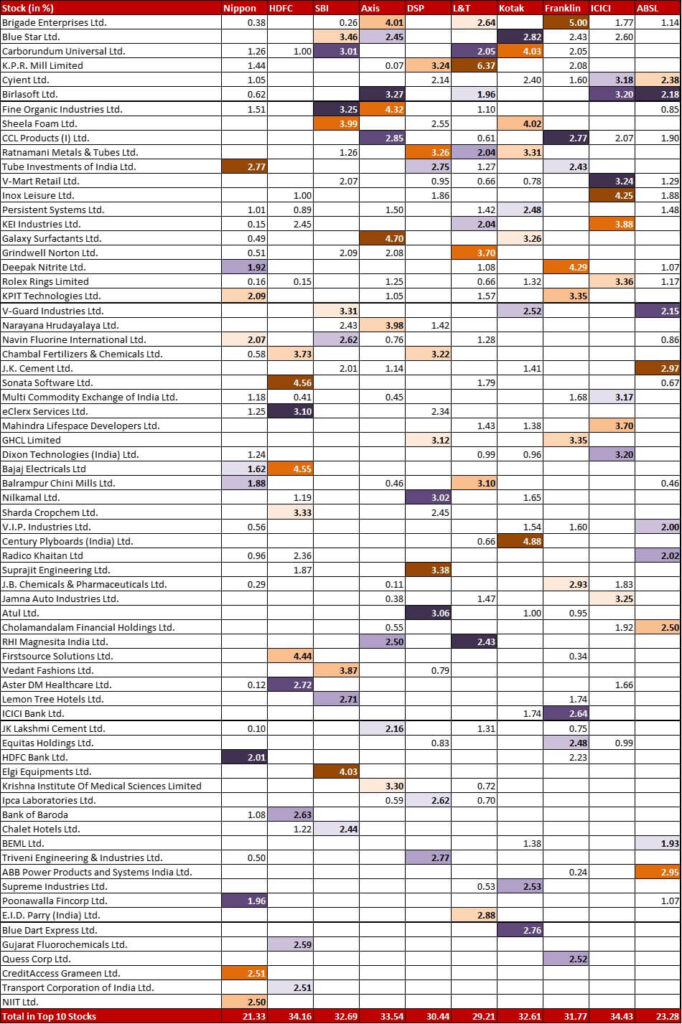

Top 10 Stocks & Movement

Nippon has used this month to further beef up it’s allocation to HDFC, taking it up by 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 2.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, it has completely exited it’s 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bharti Airtel.

HDFC has cut down it’s exposure to Vardhman Textiles by 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it down to 2.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI has increased it’s allocation to V-Guard by 1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to take it up to 3.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, which also makes it the fourth highest stock in the portfolio.

Axis has trimmed down it’s exposure to one-favourite Tata Elxsi by 0.84{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. which now stands at a humble 1.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

DSP has a new 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Paradeep Phosphates, a stock cropping up in quite a few funds.

Kotak has reduced it’s exposure to Amber Enterprises by 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, which brings it lower to 2.48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Franklin has reduced it’s allocation to K.P.R. Mills (a favoured stock in textiles) by 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} leading it down to 2.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. From December onwards (when the allocation was at a mighty 4.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), every month the stock has seen it’s position being trimmed in the portfolio.

As mentioned earlier, ICICI has taken a new 1.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in SBI Cards & Payments. It has also given much more heft to it’s position in Dixon Technologies, zooming it up from 0.58{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 3.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} an upward move of 2.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!

Quite a few changes in the Aditya Birla fund – Campus Activewear gets bumped up to more than 3x of it’s existing position going up to 1.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, with an increase of 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Also, this fund too has reduced it’s position in Amber Enterprises by 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, bringing it down to 1.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The biggest slash is to Deepak Nitrite, with the stock going to exactly a third of it’s position down to 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Ruchi Soya is another stock which has been really cut down in size to a tiny 0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Three interesting new positions worth mentioning – MTAR Technologies (0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Symphony (0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Federal Bank (0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply