Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

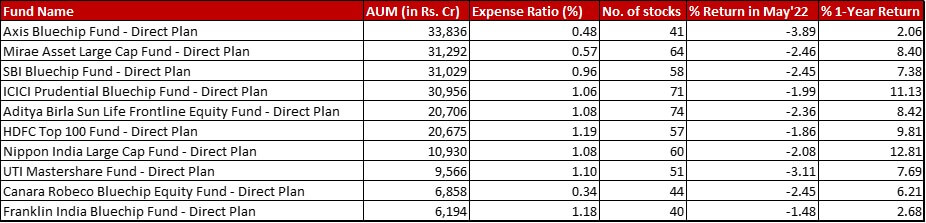

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by -3.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in May 2022 and giving a 1-year return of 7.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 31st May, 2022

Summary

The category has quite a decent scorecard this month with only Axis falling more than the benchmark. When it comes to the one-year return though, the list widens to include SBI, Canara Robeco and Franklin in it’s fold beyond the Axis fund.

In terms of expense ratio, Mirae has reduced it by a slight 5 bps bringing it down to 0.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Market Cap Allocation

Axis has further increased it’s cash allocation, reducing the Large Caps by almost 3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and sitting on more than 12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} cash.

Franklin has knocked off it’s 1.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to foreign equity and replaced it with a tiny 0.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} Small Cap allocation. This leaves only ICICI in the category with a foreign equity imprint, albeit a miniscule 0.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Top 5 Sectors

In Axis, there is a small swap between Pharma and Petroleum products with the former being edged out.

Mirae also sees an organic swap between Consumer Durables and Consumer Non Durables, the latter making the cut this month.

For HDFC, Divi’s Lab sees an exit of it’s 0.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position and reduction in quite a few stocks like a 0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Sun Pharma. Hence, pharma is edged out by Consumer Non durables with HUL also seeing an increase by 0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Nippon sees quite a bit of a shuffle, mostly organically. Petroleum products and leisure services are out of top 5 making way for consumer non durables and auto.

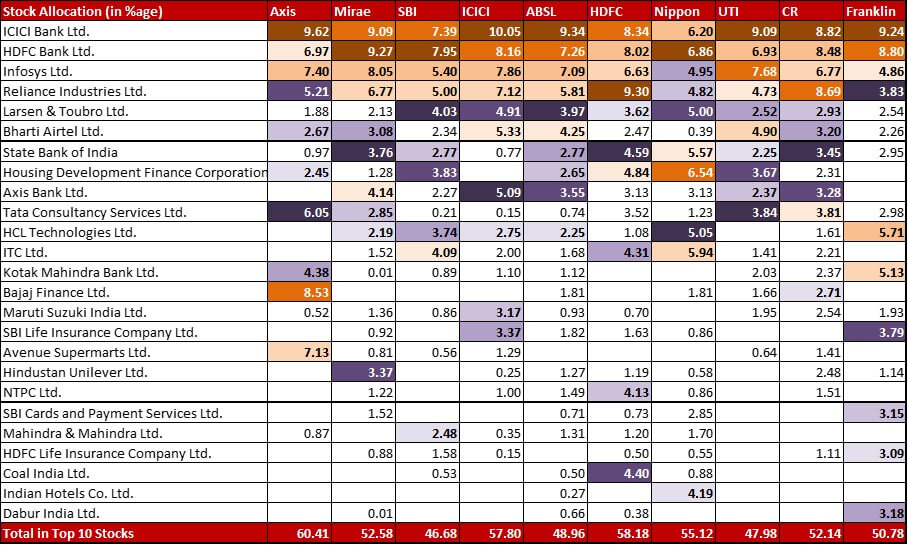

Top 10 Stocks & Movements

In SBI, the 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position of Tech Mahindra sees a complete exit.

In ICICI, HDFC Bank has been beefed up by about 2.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. HDFC Limited sees a complete exit of it’s 1.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} after having been slashed by more than half last month already.

In HDFC, the main substantial change is a 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in HDFC bank.

Nippon has almost tripled its exposure to Bajaj Finance moving it up from 0.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} t0 1.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (an upswing of 1.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). ITC also gets beefed up by 0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 5.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Reliance, on the other hand, got a shave of 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to get to 4.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. As for Bharti Airtel, since November 2021, the allocation has been getting reduced in the fund to now finally remain at a wafer-thin 0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

In Canara Robeco, the newsmakers are three stocks which have all seen a trimming to their name – Bajaj Finance cut down by 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to come to 2.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Tata Steel and Divi’s Laboratories both have been brought down to ground from their last month’s positions of 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each. Divi’s has been cut down to 0.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Tata Steel is at an even smaller 0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

There are quite a few noteworthy changes in Franklin. A 0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Reliance Industries to go up to 3.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Substantial reductions in L&T (down by 1.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 2.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Bhart Airtel (down by 1.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to reach 2.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Info Edge (down by 1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to touch a much smaller 0.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are also two big exits of 0.99{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each – Axis Bank and ACC Cement. On the other hand, the fund has taken a new 1.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Tata Motors.

Check out the other categories and what the funds there were up to:

Leave a Reply