Ah January! The time when we have the freshness and the drive to turn over a new leaf, most of us at least. Just yesterday I was having a fun conversation with my colleagues about new year resolutions. We were quite a few and well money or saving or investing or just being wiser about it did not really feature there. I can only hope it is one part of your resolve this year as we can all do with a bit of wisdom when it comes to money 🙂

As for good old me, I realized that, to be wiser with money, which is the aim of this blog, one stubborn area to tackle is taxation. Why stubborn? It has taken me years to understand and it is still one area of money where I get maximum reminders from my father and which also gets the maximum resistance from my brain.

WHY TAX PLANNING?

Over the years, I have noticed that I am not the only one resistant to the charms of Tax Planning. My boss in my first job, whom I learnt from in multiple respects, never used to plan taxes because she did not understand them. What is it about taxation, which gets so many people’s goat, especially women? I believe it has to do with the fact that we get our salary post tax deduction and we get complacent with it.

We would probably jump up to do our tax planning more meticulously if we got the money in our account and then it was deducted like an EMI. Ever noticed that we often pay more than an EMI in taxes every month with nothing to show for it, unlike an EMI which helps us buy a house or a car? Would we use an opportunity to reduce our EMI? Absolutely! Then why not use the government-gifted opportunity to reduce your taxation burden? It is YOUR money.

SIMPLIFYING YOUR TAX PLANNING

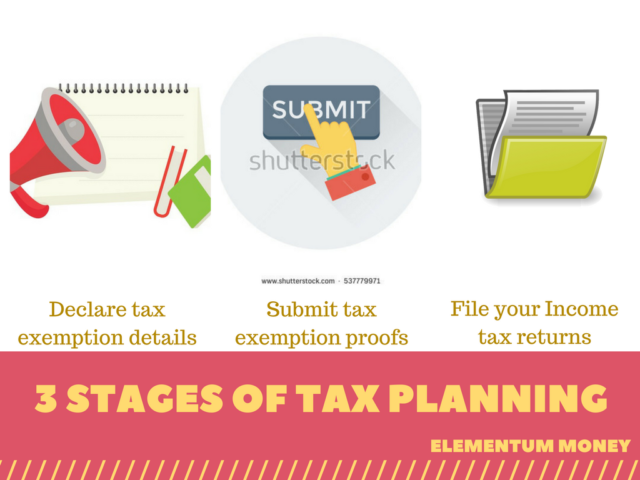

Tax as a word is good enough to make me run a mile in any direction. However gradually I have figured that there are 3 broad phases to tax planning:

- Put in all your tax exemption details at the beginning of the financial year for your company to deduct tax at a minimal monthly uniform pace

- Submit all proofs for the claims made for tax exemption earlier in the year. Most companies ask for it either by end of December or by end of January

- Filing income tax return of the previous financial year by July 31. Irrespective of what you might have heard from some people, it is a mandatory step which closes the loop on your tax cycle.

To me, steps 1 and 2 are two sides of the same coin. However, sometimes it is okay to fill in all the details in Step 1 at the time and then make necessary changes at the time of submitting the proofs.

Considering it is January, it is as good a time as any to talk about the various components through which you can build up on your tax exemption.

TAX EXEMPTION COMPONENTS

Tax exemption can be broadly split into 4 major components – HRA or House Rent Allowance, Section 80 which is mostly on the basis of investments and insurance, Medical reimbursements and LTA or Leave Travel Allowance.

HOUSE RENT ALLOWANCE

As the name suggests, if you are paying rent for your accommodation, there is a provision to use that for tax exemption. What makes HRA a little complicated is the exemption rule around it.

The exemption rule states that least of the following 3 will be exempt:

- HRA received

- 50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of income (basic salary + dearness allowance) in metros and 40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of income (basic salary + dearness allowance) in non-metros

- Actual rent paid minus 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of income (basic salary + dearness allowance)

Confused yet? I was too but after my CFP exams I have realized that numbers sometimes simplify things. So, let’s take an example here.

Suppose you are based in Mumbai the 3 main monthly figures in your salary slip look like this:

| Component | Paid |

| Basic | 20000 |

| Dearness allowance | 4000 |

| HRA | 10000 |

Let’s look at options 1 and 2 of calculating HRA exemption.

HRA received would mean Rs. 10,000 per month

50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (since you are based in Mumbai) of your income would mean ½ of (20000 + 4000) which would mean Rs. 12,000 per month

Coming to the rent you pay. If it is anywhere over Rs. 12,400 your exemption will be limited to Rs. 10,000. How? Subtract 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of your income (20000 + 4000) or Rs. 2,400 from your rent. The minimum of that, Rs. 10,000 (HRA received) or Rs. 12,000 (50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} income) will be considered which boils down to your HRA.

However, if you have managed to crack a super deal and are paying a rent of just Rs. 11,000 a month, your exemption will be lower still. Subtract the 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} income or Rs. 2,400 (as calculated above) and your exemption will then be Rs. 8,600.

Claiming exemption:

Most organisations require a rent receipt irrespective of the amount of rent paid. Some ask for all 12 reciepts while some need only a quarterly receipt.

It is only for an annual rent of above Rs. 1,00,000 (Rs. 8,333 monthly) that the rent agreement and the landlord’s PAN card copy is required as additional proof.

Even the minimal annual rent of Rs. 1,00,000 could mean a Rs. 30,000 reduction in taxes for people in the 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bracket.

MEDICAL REIMBURSEMENTS

Most of us get a Medical component in our salary, limited to Rs. 15,000 annually. On submission of actual receipts from pharmacies, doctor appointments or even pathology labs, this income can be exempt. If you fall in the 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} bracket, this can save Rs. 4,500.

LEAVE TRAVEL ALLOWANCE

Allowed twice in 4 years, the government actually subsidises your domestic travel. So, save those boarding passes or train ticket and claim your travel expense.

Mind you, it can only be one round trip in 2 years and ideally you should have taken leave for it (the L in LTA). Make all the hops you want, but the LTA covers only the shortest distance between point A and point B.

The exemption is the minimum of the LTA component in your salary and the proof of travel provided.

SECTION 80

This is a vast section and needs a separate post of its own to do justice to it. Keep watching this space for a follow-up post covering all possible ways to claim deduction under this section.

I hope this convinces you that Tax Planning is a knot that can be untangled. For any queries or doubts, drop a comment below or feel free to email me at aparna@elementummoney.com

Leave a Reply