One of the very popular acronyms in the Personal Finance blogosphere today is FIRE – standing for Financial Independence Retire Early. So, there are tons of people documenting their quest for and journey towards the said state of FIRE.

While I have mentioned this earlier, I have done so only to express my personal disdain for the concept of retiring early with the proclamation that it’s not for me. However, Financial Independence is a different matter altogether and a concept I wholeheartedly agree with and promote.

What is Financial Independence?

While the meaning of Financial Independence is unequivocal in the West, the term is commonly misunderstood in India.

The day I started earning is when I thought I had become financially independent considering I was no longer dependent on my parents for my financial independence. In the same light, in a country where a lot of women are stay-at-home moms, working women are often referred to as being financially independent.

However, today for anyone with even a slight interest in improving their financial life, financial independence implies having enough money for the essential expenses, without having to work for it. In that light, in India, retired people are the biggest class of financially independent folk (unless they are dependent on money from their children).

In India, my gut says that we are on the upswing of consumerism and willing to work long enough to be able to go after flashier things. US, on the other hand, has had consumerism for decades, and the cycle is reversing in favour of a lot of people pursuing Financial Independence at the cost of extreme frugality.

Benefits of Financial Independence

Financial Independence, to me, is a sign of a strong and healthy financial life. It is independent of the need to stop working. All it means is that in the event that you did not work a single day more in your life, you would still be able to take care of your essential expenses without having to depend on any one for financial support. How can any one not like the sound of that?

However, for the cynical, let me list down some pointed benefits of this:

Freedom from the paycheck to paycheck mentality

Financial Independence requires an entire mindset shift. Most of us salaried folk today are in a paycheck to paycheck mentality where towards the end of the month, we literally revert to the zero balance in our bank account and eagerly await the paycheck just to be able to pay essential expenses like loan repayments, housing, transportation cost etc. Financial Independence gets rid of what this habit.

Choice of how and when to work

Work is important and in some ways a major part of our identity. How many of us have had a brain wave of a business idea but squashed our entrepreneurial dream just in order to be able to pay the bill? Financial Independence ensures you no longer need to be strictly conventional with how you earn money and can choose exactly what you want to work on. It can even be your passion, that you might have otherwise earlier deemed financially unsustainable.

Less work stress

Most of us have just come out of yet another annual appraisal cycle where our professional work of an entire year is pegged to a number leading to measly bonus amounts and increments. How many of us have felt angry and even worried about future growth. Today, layoffs are also getting more and more frequent in the Indian economy. Financial Independence would mean, you work only because you want to and you like it at your work place. The stress that comes with keeping a job, and growing at it might no longer be applicable to you.

Better command over your time

“I wish I had worked more”, said no person ever on their deathbed. Financial Independence means you get much better control over your time. You always wanted to travel more? The world is your oyster. Want to spend more time with your family? Go right ahead.

The Two Routes to Financial Independence

There are 2 routes anyone can choose to take towards Financial Independence:

1. Through Passive Income

Passive Income is income generated without having to exchange time for it. Some common examples are stock dividend, rental income, royalty etc. I will cover this in more detail in a future post. Suffice it to say, if you build assets that generate enough passive income to take care of your essential expenses, you are financially independent.

2. Through a lumpsum portfolio

This is the concept of having invested a large lumpsum whereby the interest income or returns generated would be enough for the essential expenses for a year. In that manner, if you never really touched the principal amount, you would never run out of money.

Safe Withdrawal Rate

Safe Withdrawal Rate is an important concept for the second type of quest for financial independence. To come to a conclusion as to what percentage of the corpus can be safely withdrawn in the first year, without having to worry about running out of money, a lot of research has been conducted. The withdrawals in subsequent years are assumed to use the first year number as the base, adjusted for inflation.

One of the most important research conducted in this regard is the Trinity study in 1998 which concluded that 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is a safe proportion to withdraw in the first year, from a retirement portfolio that is invested in stocks and bonds. This is now often referred to as a 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} rule in short hand. So, people often say just multiply your first year expenses with 25 and voila! That’s your Financial Independence number.

How to Calculate your own Safe Withdrawal Rate and Financial Independence Number

What if 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is not the right Safe Withdrawal Rate for you? What if you want to play it very safe with your portfolio and still live with the fact that it will never exhaust? Too many questions are generally best resolved with an example 🙂

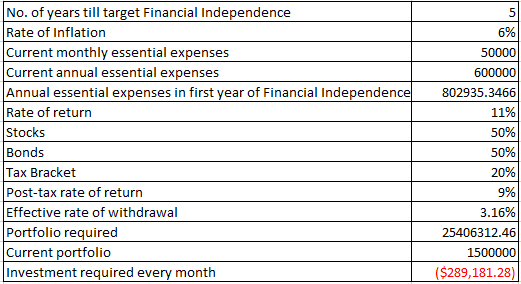

Assume you have come to the conclusion that you want to be Financially Independent in 5 years and currently, all you need is Rs. 50,000 every month, amounting to Rs. 6,00,000 for a year. Adjusting it at 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} inflation, you will need about Rs. 8,00,000 in the first year of Financial Independence. You will continue earning after that, but it will be less than Rs. 10 Lakh in a year, putting you in the 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} tax bracket.

You have a fairly aggressive asset allocation of 50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} stocks and 50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in deposits and can assume an average rate of return of 11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. To negate the tax hit, you take a post-tax return of 9{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (taking 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} on the entire stock corpus and your tax bracket on Deposit returns).

Taking all these factors into mind, the effective safe withdrawal rate that comes up is about 3.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which implies that you would need to have almost 32 times your annual expenses in your portfolio to never have the money run out which comes to about Rs. 2.54 Crores.

You also realize that you have an existing portfolio of Rs. 15 Lakh earmarked for this purpose already. In that case, you would still need to invest Rs. 2.89 Lakh every month at an assumed rate of return of 11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to be financially independent in the next 5 years.

Do your figures vary? Would you like to check different combinations to find what works for you best? Download the Financial Independence Calculator

Steps to Achieving Financial Independence

1 Know your target Financial Independence date

2 Calculate current essential expenses for a month/year

3 Calculate the inflation-adjusted first withdrawal required in the first year of Financial Independence

4 Assume an average rate of return as per your risk profile

5 Calculate the safe withdrawal rate

6 Calculate the total portfolio required

7 Calculate the savings you need to put in every month, after reducing for existing portfolio (Assumption: Same average rate of return as for the retirement portfolio)

What are your thought about Financial Independence? Do you have a date? Are you saving towards it? Let me know through the comments or email me at aparna@elementummoney.com

Leave a Reply