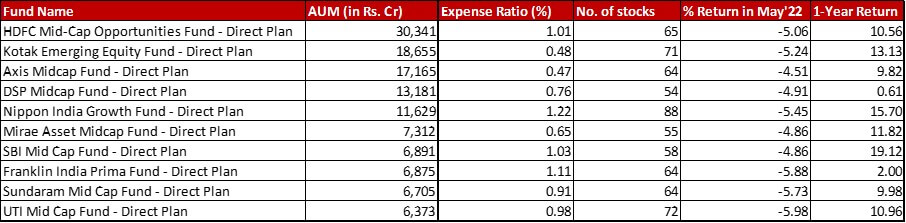

Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

Benchmark: Nifty Mid Cap 150 TRI with a change of -5.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in May 2022 and a 1-year return of 10.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 31st May, 2022

Summary

When we look at the month’s performance, it’s split in the middle with five funds doing better and five doing worse in different degrees. The five that under performed include Kotak, Nippon, Franklin, Sundaram and UTI. The list is one short when the one-year performance is looked at with funds being Axis, DSP, Franklin and Sundaram.

Nippon seems to have shopped a bit increasing the number of stocks by five.

Nothing else is worth mentioning be it in AUM or expense ratio.

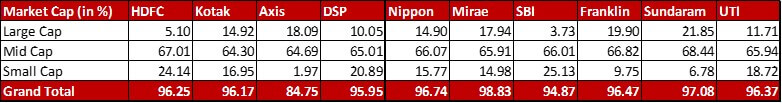

Market Cap Allocation

DSP has cut it’s small cap exposure by about 1.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and resultantly also it’s total equity exposure to be sitting on slightly more cash.

Nippon has increased it’s Large cap exposure by almost 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Mirae has increased it’s small cap allocation by about 1.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, also increasing it’s equity exposure.

SBI has increased it’s mid cap exposure by about 1.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

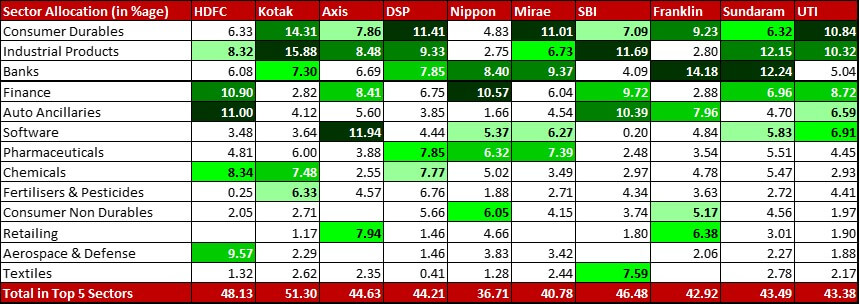

Top 5 sectors

In Kotak, Pharma has organically edged out Fertilisers and Pesticides from the top 5 sectors.

That is the only noteworthy change in the sectoral allocation. The rest of them might be a shuffle within the existing top 5 sectors.

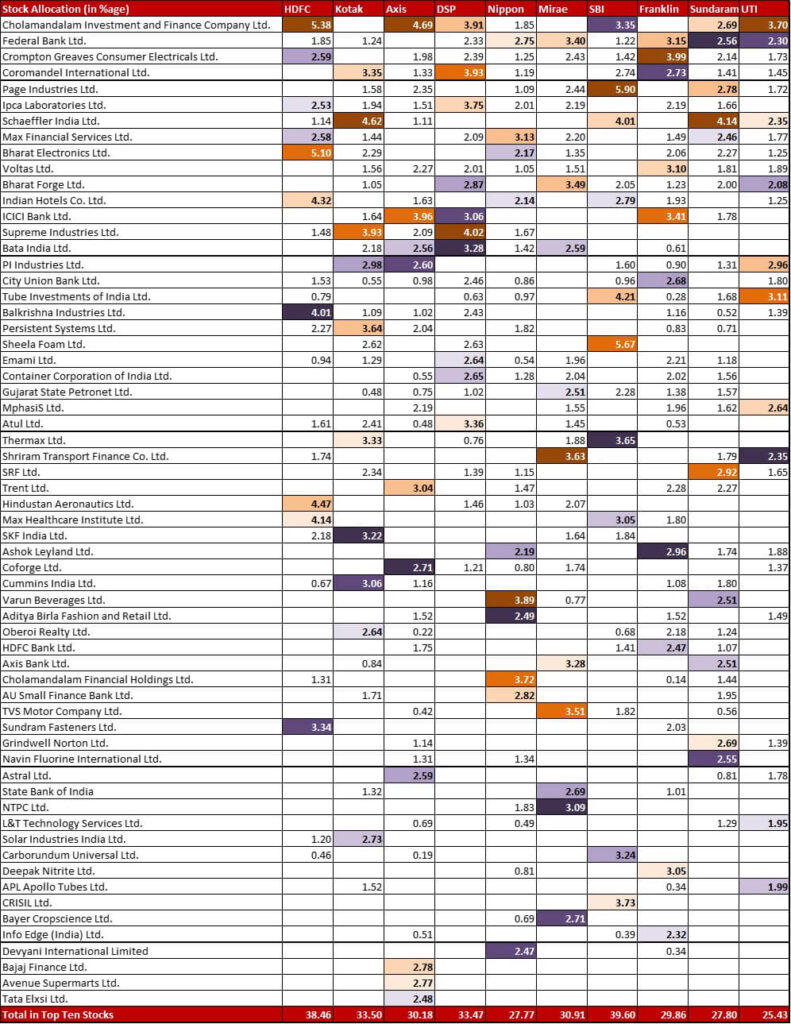

Top 10 Stocks & Movement

HDFC has further increased its’ allocation to Hindustan Aeronautics this month by 0.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it up to 4.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, making it the third largest stock position. They also have a new 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Zee Entertainment.

Nippon is yet again one of the newsmakers with many changes to report. Three position have been trimmed substantially – Jindal Steel & Power by 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (down to 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Varun beverages by 0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (down to 3.89{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and SRF Ltd. by 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (down to 1.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Three positions have been substantially beefed up – Mahindra & Mahindra that came in just last month is up by 1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (to touch 1.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Navin Fluorine is up by 0.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (reaching 1.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Cholamandlam Investment & Finance is up by 0.82{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (to come up to 1.85{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Infosys which had entered the fund in March itself finds itself out from it’s 1.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position. On the other hand, there are two new entrants – Tech Mahindra (1.47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Ambuja Cements (0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Mirae sees a trim in Jindal Steel & Power by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in all probability organic thanks to the 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} price fall the share witnessed in May. They have also cut down their allocation in Varun Beverages by 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to bring it down to 0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There are two new substantial entrants – Delhivery (1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Laurus Labs (0.78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI has just one change – exit from a 1.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Aditya Birla Sun Life AMC.

Unlike last time, Franklin has just one change worth mentioning – a 0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trim in Oberoi Realty to bring it down to 2.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Sundaram has reduced it’s allocation to Honeywell by 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to make it a shadow of it’s former self at 0.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Check out the other categories and what the funds there were up to:

Leave a Reply