Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Summary

I have always found focused funds very intriguing. To me, it seems like more giant versions of PMS’s per se since they also end up being concentrated less than 30 stock portfolios.

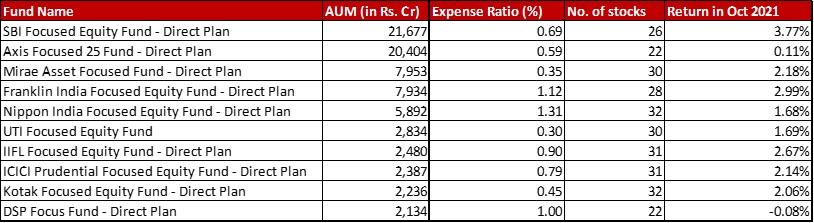

Most funds use varied benchmarks in this case. The one thing to note is that DSP and Axis have had the lowest returns in the month. In fact, this is the second consecutive month where DSP is the only one in red.

The one movement in terms of AUM that did happen was Mirae inching slightly above Franklin to get on to the number 3 spot. Although breaking into the top 2 might be a much longer battle.

As you can imagine, very little wriggle room in terms of no. of stocks leading to very less movement.

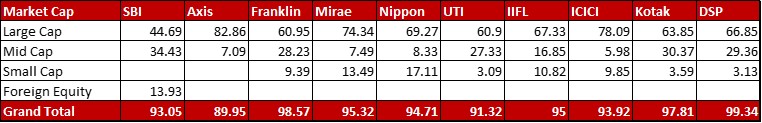

Market Cap Allocation

SBI remains the only fund in the category to have a chunk in Foreign Equity with three stocks – Alphabet, Netflix and Nvidia.

The biggest two funds are the only ones to have zero allocation to small cap in these concentrated portfolios. Franklin, IIFL and ICICI trimmed their allocations to small cap a bit while the other 5 have either stayed put or increased small cap allocations a bit.

Top 5 sectors

In this category, Axis is an outlier, betting their money far more on retailing stocks like Avenue Supermart and InfoEdge. Another marginal outlier is DSP with an almost equal play at Banks and Software stocks.

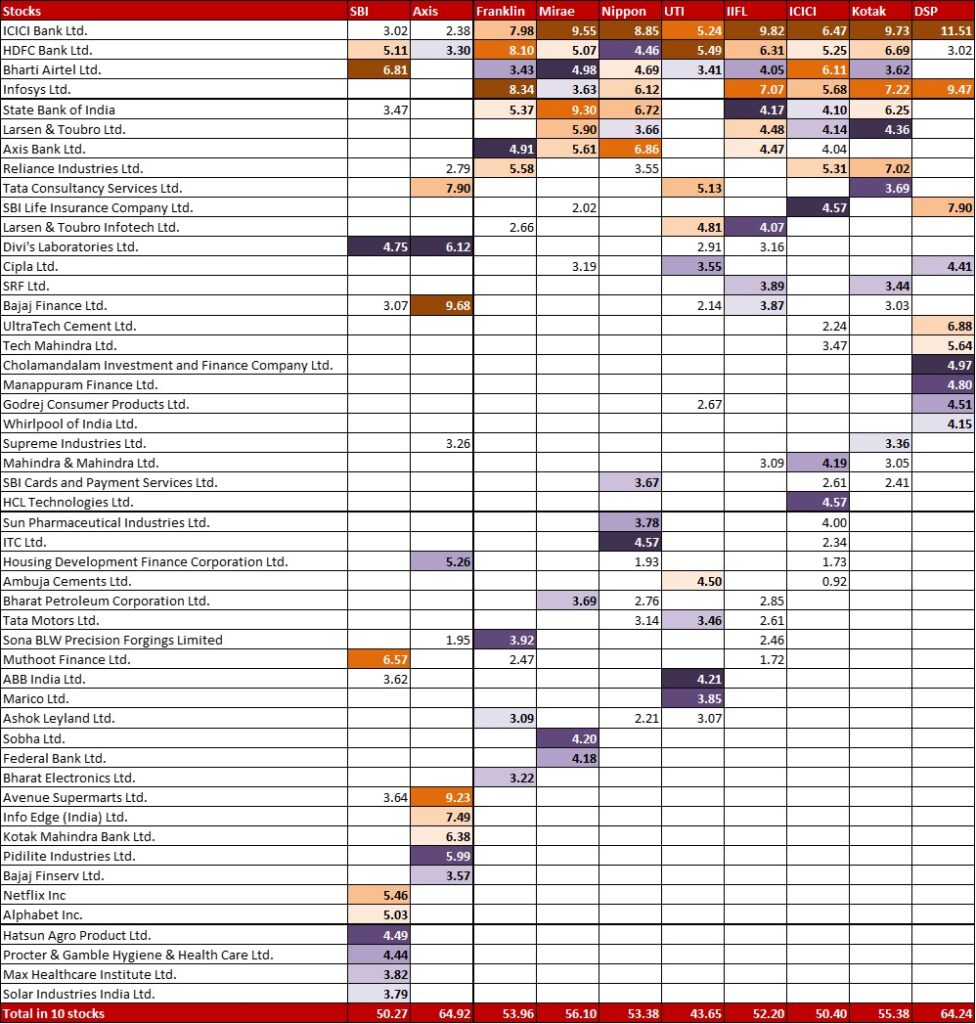

Top 10 stocks

Another category with ideas scattered all through. While the top 3 or 4 stocks will have a lot of funds buying into them, then as you can see conviction fizzles out across varied ideas.

Leave a Reply