Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 35% portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35% allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30% is as per fund management.

Benchmark: Nifty LargeMid Cap 250 TRI with a change of 2.85% in November 2022 and a one-year return of 9.94%.

All data as on: 30th November, 2022

Summary

There is no change in AUM rankings this month.

Two funds have a slightly noticeable reduction in expense ratio – HDFC Large & Mid Cap by 4 basis points to go down to 1.14% and Sundaram by 3 basis points landing down at 0.70%.

Aditya Birla has reduced it’s number of stocks by 3 to come down to 61 but no other noteworthy development for the other funds.

Here too, it’s a red dominated report card with only three funds (Mirae, HDFC and DSP) managing to beat the benchmark in November 2022. In the one year performance, only HDFC maintains this distinction over the benchmark and is joined by three other different funds (Kotak, SBI and ICICI).

Market Cap Allocation

None of the funds have a substantial enough change of more than 2% in any market cap category that could warrant a mention.

However, within the four market cap categories (including small and foreign equity), Axis sees it’s total equity exposure go up by 2.62% up to 99.81% with very little cash on the portfolio.

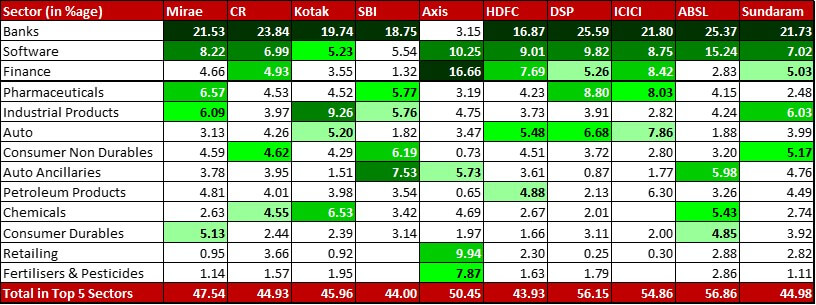

Top 5 Sectors

In Canara Robeco, the ping pong between Pharma and Chemicals continues with the latter making up the Top 5 Sectors this month.

Kotak has more than doubled it’s allocation in Hero Motocorp taking it up to 1.10% leading to Auto sector dethroning Construction from the Top 5 Sectors.

Sundaram has exited two auto ancilliaries stocks – Motherson Sumi Systems (0.18%) and MRF (0.17%) while there is a 0.24% increase in the allocation to United Breweries. Resultantly, Auto Ancilliaries has been replaced by Consumer Non-Durables in the Top 5 Sectors.

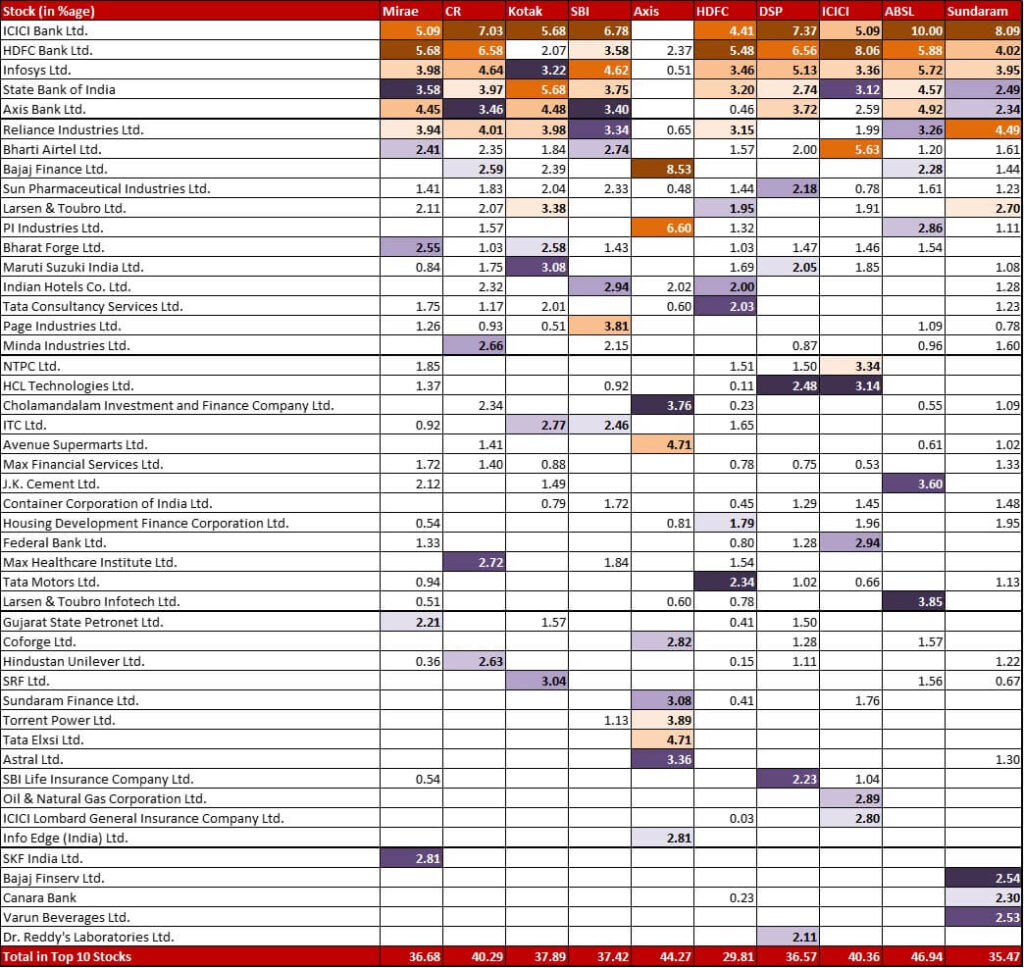

Top 10 Stocks & Movement

Apart from the MindTree and L&T Infotech switch, Mirae has two new positions – Delhivery (0.52%) and Biocon (0.34%). It has also exited Motherson Sumi Wiring India (0.17%) and ICICI Lombard General Insurance (0.10%).

Canara Robeco has two new additions – Bluedart Express (0.38%) and Schaeffler India (0.36%).

Kotak has added an allocation to Exide Industries (0.24%).

SBI has a few noteworthy changes. It has increased it’s position in Infosys by 1.04% to go up to 4.62%. The fund has also increased it’s allocation to Invesco QQQ Trust Series 1, which is it’s instrument to invest in Nasdaq 100 by 0.88% to reach 2.34%. There are three new positions – newly-listed Archean Chemical Industries (1.40%), Voltas (0.91%) and IOCL (0.20%). The fund has made the balancing act with three simultaneous exits – Cipla (1.49%), NTPC (0.40%) and ONGC (0.31%).

Axis has beefed up PI Industries by 0.85% (taking it up to 6.60%) while doubling down on Zomato (now at 1.57%).

Apart from the MindTree and L&T Infotech switch, HDFC has two new additions – PB Fintech (0.48%) and Chemplast Sanmar (0.10%).

DSP has three new positions – HUL (1.11%), Tata Motors (1.02%) and Power Finance Corporation (0.58%). As a balancing act, the fund exited Hindalco (0.52%) and Ambuja Cements (0.12%).

ICICI has added a small allocation to SBI Cards (0.28%). On the other hand, it’s exited Aditya Birla Capital (0.19%) and General Insurance Corporation (0.13%).

Aditya Birla continues to have another month of multiple changes. Keeping the MindTree and L&T Infotech switch over aside, the fund has beefed up HDFC Bank by 1.31% (up to 5.88%), Infosys by 1.16% (now at 5.72%) and Axis Bank by 0.83% (taking it to 4.92%). The fund has also trimmed it’s allocations in Divi’s Labs by 0.92% (now at 0.88%) and Cholamandalam Investment and Finance by 0.89% (landing at 0.55%). The fund has two new positions – Go Fashion (0.55%) and Apollo Tyres (0.51%). There is a string of four exits as well – PVR (0.61%), SBI Life Insurance (0.59%), Tarsons Products (0.47%) and LIC (0.33%).

Sundaram has two new additions – IndusInd Bank (1.08%) and Voltas (0.30%). It has also exited two stocks – Motherson Sumi Systems (0.18%) and MRF (0.17%).

Check out the other categories and what the funds there were up to:

Large Cap Funds – November 2022

Flexi Cap Funds – November 2022

Leave a Reply