Crypto currencies have been in freefall for the last few months as is obvious from the mass layoffs. But, things really came to a head with the recent suspension of all transactions by Vauld crypto exchange. This Singapore-based crypto exchange cited financial troubles leading to many investors so-called “investments” hanging in the balance (I say “investments” because I am yet to be convinced about crypto being an asset class).

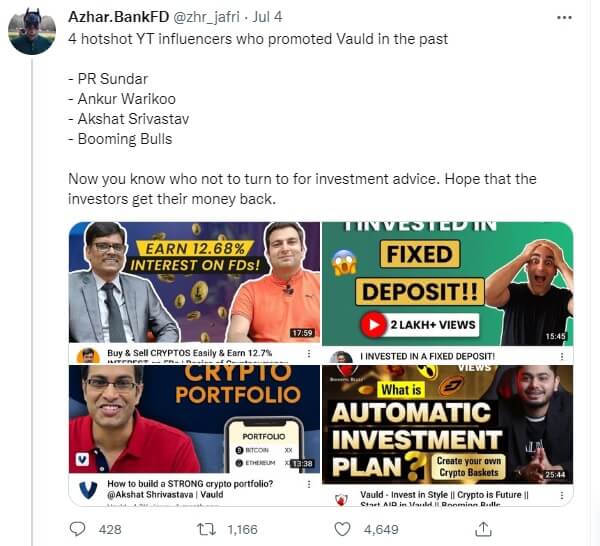

This event has turned the heat on finfluencers who stuck out their neck (for some easy money) claiming “Fixed-Deposits” with 12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} interest rate through Vauld were safe and smart. Essentially, this tweet really started that furore.

Of the four finfluencers mentioned here, only Ankur Warikoo has had the decency to apologise. The other three, till this point have shrugged off the responsibility saying their videos are not to be construed as “investment advice”. Honestly, that’s worse than showing a cool Marlboro man smoking a cigarette with a small illegible warning somewhere in a corner – “Smoking can be injurious to health”. Especially when such social media celebrities spend years building trust of millions of followers, brushing your hands off this responsibility seems pretty glib.

Finance is a specialised field which when done correctly entails much more rigour than displayed by finfluencers. Not just these guys on the top of the pyramid, but there are enough and more Telegram channels as well doling out stock tips to make you rich. Australia is among one of the first countries to recognise the problem with this situation. The Australian Securities and Investments Commission (ASIC) has now released a guidance for social media influencers that needs to be followed while promoting financial products.

To be fair, there have been such instances of the money getting stuck for a bit in other traditional instruments as well. The top few which come to mind are the Yes Bank deposits, PMC bank deposits and Franklin Templeton six debt schemes. However, a few vital differences spring to mind. One, no celebrity backed ads promising security or long winded videos of “Yehi hai right choice, baby” were made by trusted online personalities. Two, there are better checks as well as more established authorities to put things back on track. For instance, Yes Bank is now functioning as a regular bank again while Franklin has repaid all of the money back. With the Vauld FD, nobody knows since it’s not even a regulated asset class.

Let me end this issue with just two short disclaimers for investors as lessons from a bear market. One, heeding to free advice could be injurious to your financial health. Two, return is directly proportional to risk. If you are investing in “fixed” returns of 12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in an environment of 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} or even 4.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} repo rate, then you are also saying yes to the probability of losing entire money altogether. Finally, it is caveat emptor – let the buyer beware.

Leave a Reply