As Indians, our love for the glitter of this precious metal is well documented. Even with the evolution and maturity of the financial markets leading to better financial assets, our love for real estate and gold is intact. At times of such crisis, most of us see the eye popping returns that the asset has given (an unbelievable yet true 45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the last one year) and then become trigger happy to join the gold brigade. However, before you attempt jumping Scrooge-like into any such pile, I would suggest listening to the words of a gold cynic like me.

This post comes with a few more numbers and graphs than usual. But, even then with the promise of Elementum Money, they are broken down to the basics and are fairly easy to visualise and understand.

1. Buying gold jewellery is an investment

In India, the most popular investing route for gold is through jewellery. However, two factors make the idea of jewellery being an investment completely moot. One, considering the form factor, a lot of gold is wasted which means that you pay for higher quantities than what you end up with. This is fine in the case of vegetables where we are happy to pay for the peel while not consuming it. In gold, that’s quite a cost.

Second, jewellery comes with the making charges attached to it. Yet again a cost which we forget when we think of the investment in gold.

Third and more importantly, the emotional attachment to gold jewellery, especially wedding jewellery is so high that you would really not part with it which is an essential factor of investing. Unless you realise the inflated value of an asset, is it really an investment?

On a broader level, with physical gold the barriers to investing are higher. The storage cost, be it the emotional insecurity if it’s at home or the monetary cost if it’s in a bank locker is a big one. Apart from that, most of us are novices who will really never know if we have been duped about the gold purity.

Today, there are three forms of paper gold that can be considered.

Gold sovereign bonds

This is a government backed investment with an 8-year lock-in period and a 2.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taxable interest per annum. The only gold lining here is that capital gains at maturity are tax-free. In my view, the liquidity challenge of this one is not worth the trouble. Also, in case you want to book any gains, you can’t do that either. So, it is highly probable that the maturity happens at a down cycle when a lot of your gains have been eroded.

Gold ETFs

Then there are gold ETFs (Exchange Traded Funds) which are backed by physical gold and you can buy units through a demat account. These ETFs closely mirror domestic gold prices and even though they do not allow SIP you can manually purchase units at regular intervals. Some AMCs also give the option of exchanging ETF for physical gold with some limitations on the investment period and value.

Gold mutual funds

Third, there are also gold mutual funds but most of them have given a pretty lacklustre performance when compared to the benchmark of domestic gold prices. Even with the convenience of not needing a demat account and the benefit of possible SIP, I wouldn’t recommend these.

2. Gold is directly correlated with inflation

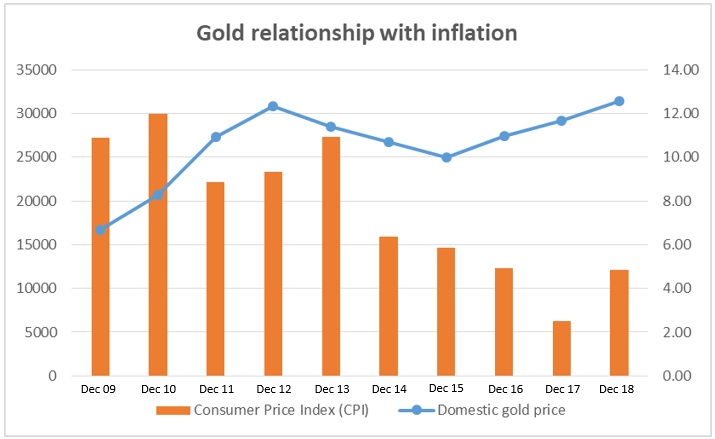

One of the reasons I have often heard quoted for investing in gold is the “hedge against inflation argument”. The idea is that when inflation zooms up, so do gold prices making it directly correlated to inflation. Check out the graph below which tracks India’s inflation rate or the Consumer Price Index at the end of each year along with the corresponding domestic gold price.

While this is only a 10-year period from 2009-2018, I think the relationship is fairly clear. Instead of being directly correlated to inflation, gold prices are a precursor to high inflation by one or sometimes even 2 years. So, if you are a long time investor, yes you could somewhat hedge inflation with it. But, if you end up running to the shelter of gold when the economy is already witnessing heated inflation, then you have already missed the bus and are probably on the downward twirl of the golden roller coaster.

3. Gold performs better than equity

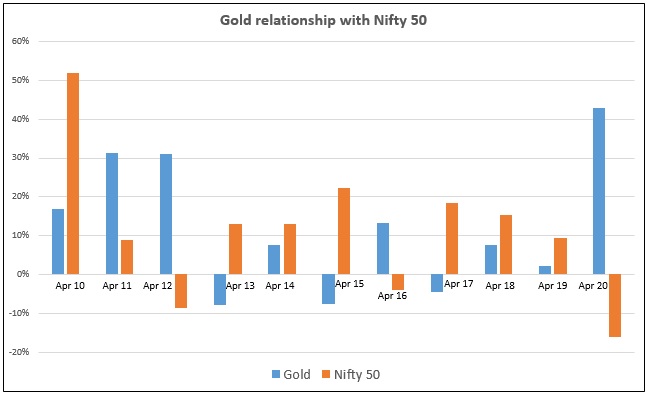

There are years where equity fails miserably and gold gives phenomenal returns. Unfortunately, this occasional trend often gets generalised to mean that gold can perform better than equity. If you look at a few years in isolation, most importantly in hindsight, yes it’s true. For instance, when you look at the below chart, it shows the one year-returns as on April for the last 11 years for gold as well as Nifty 50. At one glance, you could very well come to the conclusion that in each year that Nifty 50 has given a negative return, gold has risen to the occasion.

But as they say with statistics, you can use the numbers to show exactly what you want. Note here that we are looking at a time when Nifty has already tanked and gold has zoomed up. This is also the point when the hyperbole around this asset takes full charge even though most of the rally might be behind us.

| 3 year returns as on | Gold | Nifty 50 |

| Apr-12 | 26.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 14.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-13 | 16.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 3.96{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-14 | 9.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 5.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-15 | -2.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 15.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-16 | 4.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 9.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-17 | -0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 11.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-18 | 5.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 9.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-19 | 1.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 14.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

| Apr-20 | 16.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} | 1.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} |

For a better perspective, check out the table above. This shows the 3-year returns as on April of the year mentioned for Gold as well as Nifty 50. As you can see, most years they seem to be in competition as to who can elbow the other out of the competition.

But, more importantly note that if anything gold is far more volatile than equities. The 3-year returns have a range of 13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for equities whereas it is an eye-popping 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for gold! So, remember that if you go in with dreams of 26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, you could well be stuck in a deep rut for years.

4. Gold does not give negative returns

One of the favoured arguments by gold aficionados is that gold never loses value since it is backed by a physical asset and is the world’s oldest store of money. While I agree that the value can never go down to zero unlike some debt and equity assets, the idea of not losing value is not true for gold. Just look at the table above to notice 3-year negative returns in April 2012 and in April 2017. Not just that, in a 5-year period from 2012-2017 gold delivered a return of -1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! Unlike equities which also have had such returns but with more movement allowing to book gains, the price of gold was quite flat in this period.

5. Gold does not give any returns

I like to believe I am a person with balanced views. So, let’s talk about the good parts of gold. I have often believed that long-term returns of gold generally lie in the range of 2.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}-3{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} p.a. which basically makes it useless. However, even disregarding the recent crazy surge, in April 2019 also the annual returns for a 10-year period were to the tune of approximately 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} per annum. To me, gold is not the shiny hail mary of investing that it is often made out to be. If anything it can often be like a sulky child with long tantrums followed by bursts of brilliance.

So, what should an investor do?

I know you are now thinking, Oh wise Aparna, now tell us the appropriate route to investing in gold.

Firstly, I think Gold ETFs are the most appropriate route to go about. While I don’t much care for the idea of exchanging it for physical gold, I think they mirror the prices really well and the liquidity means that they will help in the other action of an efficient investor which I will come to.

Two, gold is only a diversifying agent in your portfolio. So, it should have no more than 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} weight there.

Three, but most importantly rebalance. Every six months or every one year, check for it’s relative weight in your portfolio and take action to revert it to 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. With the benefit for indexation in the long term of 3+ years, such rebalancing will not attract much tax either.

Four, would I buy much of gold right now? No. I think the euphoria around it has led to unrealistic prices and ideally I would buy it at a time when equities get unreasonable. Currently, I think buying equities will work better considering the low valuations we are witnessing.

What are your views of gold? Do you still feel that it’s the best investment and far safer than equities? Let me know your thoughts in the comments below.

Sources for data:

Gold prices – Gold Price India

Historical CPI numbers – Macro Trends

Nifty 50 numbers – Official NSE website

Leave a Reply