I was watching the Soccer World Cup match yesterday and realized the excitement that running towards a goal brings with it. That led to the realization of just why goal based investing is such a powerful idea!

If you keep hunting for the best returns as the main reason behind investing, you could either burn your fingers or burn out your enthusiasm. Goal-based investing where all your efforts towards investing are to achieve a particular goal, on the other hand, is more sustainable and beneficial. The idea of tieing your money to your dreams seems really instinctive to me and when you can see it coming to life in front of you, it will be that much more rewarding.

So, how do you go about goal-based investing? Pretty much like aperture in photography, goal-based investing has 3 variables:

- Time horizon

- Required Amount

- Asset allocation

Time Horizon

This is one of the most important parameters having a bearing on the other two aspects of goal-based investing. Knowing exactly when you would need the funds for your goal is crucial to planning for it. Of course, the earlier you are able to save for it, easier it is to be able to achieve the goal.

Within your list of goals, you should look to bifurcate them into 3 categories on the basis of time horizon – short-term (2-3 years), medium term (3-7 years) and long-term (7+ years). Read on to the asset allocation to know why the categorization matters.

Required Amount

This is a question which has quite a few people stumped, especially if it is a really long-term goal, like a kids’ wedding. But, there are smart instinctive ways around this.

For instance, your child is 1 right now and you imagine that the kid would get married at a minimum age of 25. Being able to completely fund your child’s marriage is a major goal for you, but you just don’t know how much money you will need 24 years down the line!

The right way to go about it is to estimate how much you would want to spend on such a wedding today. Suppose, you decide that if you were to organize that wedding today, it would cost you Rs. 15 Lakh. Assume a figure to factor in annual inflation in the costs. While the Consumer Inflation generally hovers around 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, for weddings it is safe to assume at least 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

When you look at an impact of 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} annual inflation compounded on a base of Rs. 10 Lakh, you will end up needing a sum of Rs. 63.4 Lakh!

Asset allocation

Asset allocation is decided on the basis of a number of factors including the risk appetite of a person, time horizon and possible amount to invest. Every individual should choose an asset allocation unique to them, their situation and the goal at hand.

The time horizon based category of the goal will define the direction of your asset allocation:

Short term

Look to invest in more of liquid assets like Fixed Deposit or the Money Market/Liquid Mutual Funds.

Medium Term

Bifurcate your investments into a short equity cycle or limit it to debt followed by liquid assets in the last 2-3 years.

Long Term

Ensure you harness the power of equities and the superior returns that they can provide over a longer period of time before switching the funds to liquid assets in the last 2-3 years.

Case Study

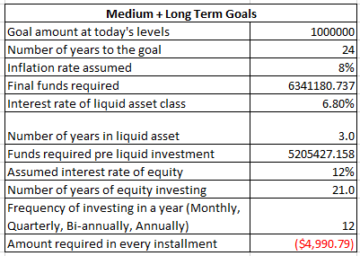

Continuing with the previous example of planning for your child’s wedding in 24 years. You can also check out the previous case study of saving and investing for your child’s education.

You decide you want to put in the funds in an ultra-conservative vehicle like Fixed Deposit for the last 3 years when you also stop adding any more funds to it and assume you will get a rate of 6.8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (such high rates like the current 7.4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} may or may not make it to the future). Note: All calculations being made are without taking tax implications into consideration.

In this scenario, you would need Rs. 52 Lakh to put into a liquid asset for the last 3 years. Sounds like a mountain of a task?

Wait till you see the magic of compounding. If you decide to invest every month with even a conservative estimation of the return rate of 12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (Small caps often give above 15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886})), you need to put in just Rs. 5000 every month.

Download the Goal-Based Investing Calculator to plan for your financial goals

As you might have read it earlier, the mountain will be progressively easier to hike through, as the time horizon gets longer thanks to the eighth wonder of compounding. So, you know what you need to do. List all your goals, categorize them, plan and start investing right away!

Are you already planning in this way for any of your goals? Was the calculator helpful? Let me know in the comments below or email me at aparna@elementummoney.com

Leave a Reply