Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Summary

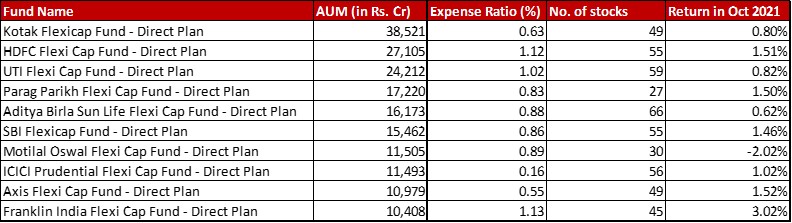

Flexi cap funds remain a highly varied category, be it in terms of market cap or the resultant returns. As for AUM wise ranking, there have been two movements. Parag Parikh is now the fourth largest, nudging past Aditya Birla Flexicap, whereas Axis has moved to 9th spot inching down Franklin India Bluechip. However, Kotak has such a strong lead on all the others that catching up to that giant looks difficult.

For most funds in the category, the benchmark is either S&P BSE 500 or the Nifty 500. Nifty 500 gave TRI gave a return of about 0.31{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The only fund which feel short, and that too by quite a hefty margin, was Motilal Oswal Flexi Cap fund.

UTI Flexi Cap and ICICI Prudential Flexi Cap both were on a bit of a shopping spree adding about 5 stocks to their portfolio.

Market Cap Allocation

There are pretty minor changes in the category. Parag Parikh has slightly increased it’s allocation to Foreign Equity and Mid Cap. Aditya Birla has reduced a bit of the large cap allocation to add on to the small cap allocation. Motilal Oswal has completely eliminated the miniscule 0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation it had to small cap.

ICICI Flexicap is the only one with a substantial increase in total exposure to equity, most of it in large cap. However, that’s also because the fund is new and is still building it’s portfolio. Hence, the increase from 73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 78{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

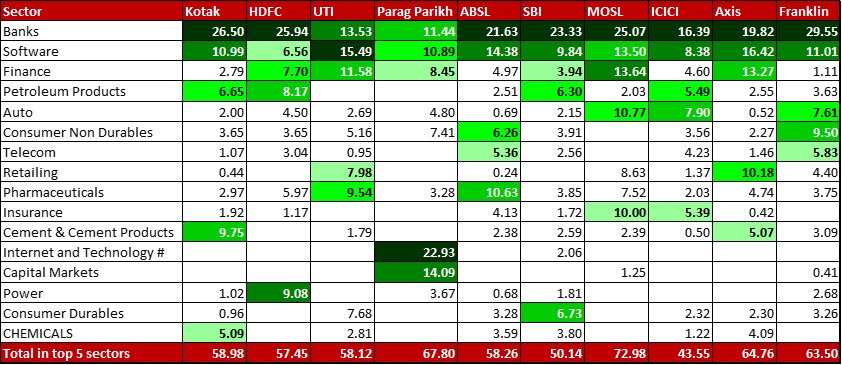

Top 5 sectors

You can see quite a bit of deviation from the same old bank holdings in Parag Parikh and even to some extent UTI Flexi cap funds.

For Parag Parikh the top sector is the US based tech stocks, namely Microsoft, Alphabet or Google and Facebook. The other interesting part is their second biggest sector, namely capital markets. This they do through 5 stocks. Of these, substantial allocation is to Indian Energy Exchange, CDSL and MCX. So, if the investment market does well, this fund benefits.

In HDFC, the second biggest sector continues to be Power which in my mind can be high risk. But then that’s just me. Enough investors believe that this is the point when power companies will see their fortunes turn.

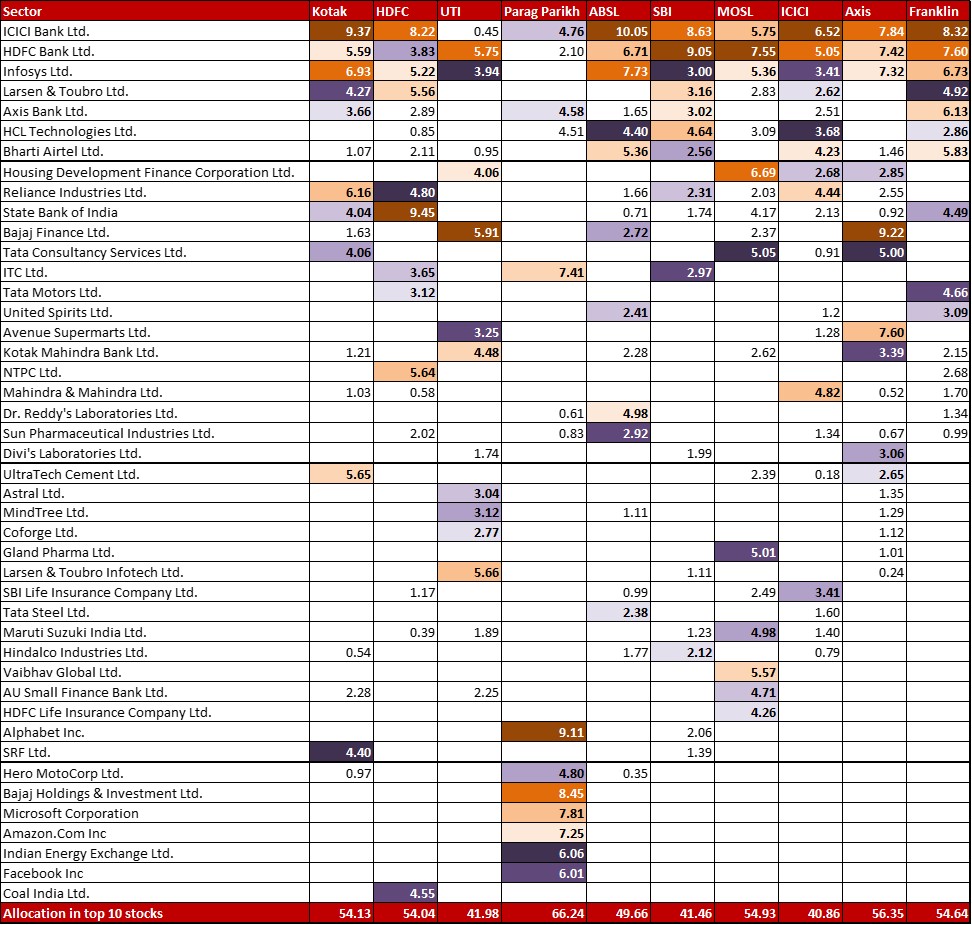

Top 10 stocks

Unlike market cap based categories, flexi cap as usual sees a more scattered version of the top 10 stocks.

This time it is still month 2 and as time goes by, I am hoping to be able to wrap my head around this data overload a little better to see more of the trends that can be brought out.

Till then, if you see any patterns in this colourful patchwork, feel free to comment below.

Leave a Reply