As promised I wanted to write about the different types of life insurance policies offered in India. Once I started researching I simultaneously also understood why the penetration of life insurance is so poor in India – the options are mind bogglingly confusing. In this universe of various options, separating the hay from the chaff can be particularly taxing (pun not intended).

One thing that helps is clarity of the objective – life insurance is a product where you make regular payments over a certain period to cover for the uncertainty of life so that in case of an unfortunate death your dependents do not suffer financially.

That being said let’s take a look at the 5 broad types of insurance policies available in India:

TRADITIONAL PLANS

- TERM INSURANCE POLICIES

The ORIGINAL life insurance policy where you pay premiums through a term till your earning age to cover for the risk of death. This to me is the one insurance policy that makes maximum sense.

There are innovations at different levels that have been made in the product.

- Riders: Think of your term insurance policy as vanilla ice cream or maybe a frozen yoghurt. Riders are then toppings that make the purchase much better. Some of the most common riders include:

- Critical Illness rider: Policy holder is entitled to receive financial benefits in case s/he is diagnosed with one of a list of pre-defined critical illneses

- Disability benefit: Policy holder is entitled to receive financial benefits in case s/he is diagnosed with one of a list of pre-defined disabilities

- Accidental death benefit: Policy holder is entitled to a higher amount of insurance cover in case of an accidental death. The logic is that it would also entail a longer stay in the hospital, hence need for a bigger cover.

- Waiver of premium: Policy holder is not required to pay premium for the future term in case of occurence a pre-defined set of instances or mishaps

- Monthly income plan: Some life insurance companies also provide the option of getting the life insurance in monthly installments rather than a lumpsum. While it’s a handy feature, it might still be a good idea to do a quick check if a similar lumpsum life insurance cover was to be taken, is there a wide gap in the premium amounts?

- WHOLE INSURANCE POLICY

This can also be called the unlimited term Life Insurance policy. While a term insurance policy typically covers you for a defined term, say till 60 years of age, a whole insurance policy covers you till eternity. Whenever you die, your beneficiary gets the insurance corpus.

I have a fundamental issue with this policy. Most of us expect to stop working and accumulate a corpus by the time of retirement as well as pay off our loans and not have any dependents. In that case, a whole life policy essentially becomes redundant after retirement.

INSURANCE + SAVINGS PLANS

- ENDOWMENT PLANS

These plans typically work on the psychology of – “if I have not used it, why should I pay for it?”. In a nutshell, you pay a 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (of the desired life insurance amount) premium for the insurance period and either get death benefits in case of demise or the entire benefit + accrued bonus at the time of policy maturity. Compare this to the 0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} premium for a regular term insurance policy. For a simple 1 crore insurance policy, how many of us can pay 10 Lakh every year? We end up losing sight of the objective of insurance which is to protect financial interests of loved ones in case of a tragedy.

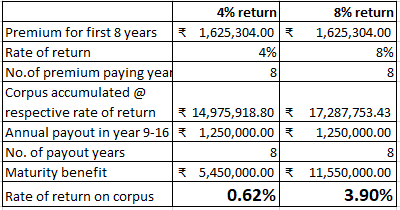

I also checked out a sample illustration for an endowment policy offered by HDFC Bank where you pay premium for 8 years and get payout for the next 8. We all know when surrendering a life insurance policy, we are anyway getting the short end of the stick. So, I will stick to the survival benefits.

I typed in that 30-year old Rakesh wanted a 15-year endowment policy with death benefit of Rs. 1 Crore. However, the illustration that was given was for a death benefit of about Rs. 1.58 Crore.

Consider this: Rakesh pays Rs. 16.25 Lakh (including Rs. 35,765 as taxes and other levies) for the first 8 years as premium. The illustration shows 2 calculations – at 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} return and at 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} return. The sum that Rakesh gets from years 8 – 16 remains constant at Rs. 12.5 Lakh. However the maturity bonus is Rs. 54.5 Lakh at 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and Rs. 1.155 Crore at 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. At first instance I am sure you might be wowed. But, let’s break these numbers down a bit.

Essentially if you used this premium amount (Rs. 16.25 Lakh) every year and got a 4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} return on it (post-tax returns of FD also fit the bill) you will accumulate almost 1.5 Cr. It’s almost like keeping that corpus as cash in your house (definitely not advisable considering the Modi government’s attack on cash) and taking these payouts.

Even at an 8{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} return on the premium amount (Rs. 16.25 Lakh) in 8 years, the corpus accumulated would be almost Rs. 1.73 Crore. Enough banks today will give you a post-tax interest rate of 3.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Does this still sound like a good deal?

See the original HDFC Life document here (Illustration_hdfc life) and the calculation here (Endowment illustration).

- MONEY-BACK POLICY

This is very much like an endowment policy with the difference that payouts are at regular intervals. So, in a 20-year term, you would end up getting 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of your sum assured in years 5, 10, 15 and the rest in year 20 along with any accumulated bonus. The rate of return is and the rate of premium is as poor as any endowment policy.

INSURANCE + INVESTMENT PLAN

-

- ULIP

ULIP stands for Unit Linked policy. Essentially it is a life insurance policy with an insurance component and an investment component (which gives market-linked returns). While they were known to give lower returns and very little component of insurance, a 2010 IRDA overhaul of the category has improved the situation, albeit slightly. There is no research to say that ULIPs perform better than regular Mutual Funds. However, most of them do have higher costs with different heads like premium allocation charge, policy administration charge, fund management charge, mortality charges and surrender charges which not even be communicated up-front. Also, the main purpose of insurance to provide a cover remains undermined with this type of policy as barely any of us are going to pay lakhs for a basic 1 Crore cover. Read a simple yet controversial comparison between ULIP and Mutual fund in this Morningstar article

Over the recent period, I have realized that personal finance is simple if we stick to the basics. When it comes to money there will be enough people out to fool us with a sly number play and complicated products with confusing jargon. If we choose to stick to what we know, understand and require the chances of sorting out and not being overwhelmed by our financial life is far higher.

Do let me know your opinion through the comments or email me at aparna@elementummoney.com

Other posts in the #LIMonday Series:

Why do you need Life Insurance

Leave a Reply