For years and years, Life Insurance in India has been synonymous with “LIC policy”. While it still remains the largest player in the market, there are multiple other private players today to give us more options and well complicate the scene as well. However, some myths and some mindset blocks as well as a lack of a basic understanding about the product persists in India.

Today, for #LIMonday, I thought of talking through 9 fundamental myths that still surround Life Insurance in India. Considering this is a long post, I am not putting in numbers in this post and I will talk about any number specific details in follow-up posts of #LIMonday.

LIFE INSURANCE IS AN INVESTMENT

One of the myths that makes me irritable. Life Insurance is NOT an investment. When you google “insurance definition”, the answer thrown up is – an arrangement by which a company or the state undertakes to provide a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a specified premium. How does that spell out investment or growth of money? In real terms, insurance is not supposed to benefit the holder but simply compensate them in case of a loss. This loss could be life (like in the case of life insurance) or good health or damage to property. As for the numbers, don’t get me started. I will cover the types of life insurance policies available in India in a later #LIMonday post which will make the distinction clear between a pure play term insurance policy and all other types of cover + investment policies.

LIFE INSURANCE IS EXPENSIVE

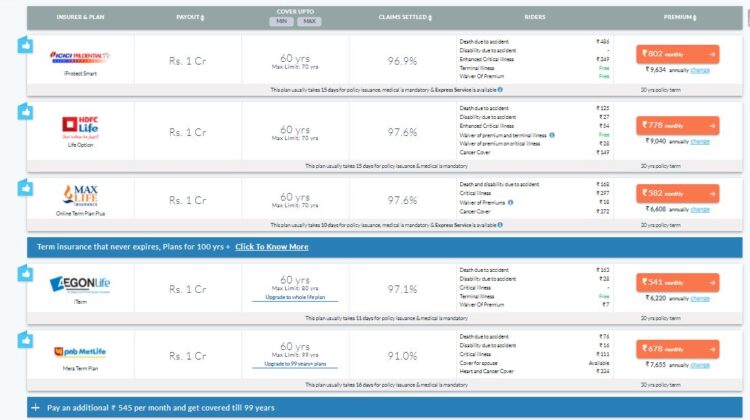

A myth I have held on to for quite some time. But just now a quick check on Policy bazaar showed just how wrong this myth is. For a 30-year old non-smoking female, to buy a life insurance of Rs. 1 Crore till the age of 60 years, the premiums ranged from Rs. 541 per month to Rs. 802 per month from 14 providers (snapshot of the offers below). Compare this to what we all spend in just one dinner out with friends.

LIFE INSURANCE IS APPLICABLE TO EVERYONE AT ANY AGE OR LIFE STAGE, EARLIER THE BETTER

If you look up on the internet you will find enough people making both sides of the arguments. However, I believe if you do not have any dependents, or any debt and enough money for any terminal costs like a funeral there is no reason for an insurance at that stage in life. Sure, premiums are cheaper that time. But maybe the years of unnecessary premium can be better used to pay slightly higher premiums at the stage when you actually need a life insurance. Just ask yourself if your death could mean financial stress for any of your loved ones. If the answer is yes, then you should consider life insurance right away.

LIFE INSURANCE IS VALUABLE ONLY FOR THE TAX EXEMPTION ON THE PREMIUM

Tax exemption on the insurance premium is a big plus in favour of life insurance. However, is it the only one? Definitely not. Also deciding how much insurance cover to buy as per the premium to be used for tax exemption is definitely not logical.

I WOULD RATHER INVEST MY MONEY IN GROWTH INSTRUMENTS

Life insurance is a necessity, not an after thought. It protects us in case of an unseen tragedy. Putting money in growth instruments is important but what if the unforeseen death occurs before your investments bear fruit? Also most such investments are not too liquid (they take time to be converted to cash) and for immediate needs in case of such a tragedy, life insurance is a must.

Homemakers also need life insurance

HOME MAKERS DON’T NEED LIFE INSURANCE

Think of any home maker in your life – mother, wife, sister or friend. Now imagine a day in their life and the huge number of tasks that they manage to achieve like taking care of household chores and looking after children. In case of an unforeseen death of a homemaker, a lot of tasks undertaken by her will need to be outsourced implying extra cost. Clearly, homemakers provide economic value in daily life which needs to be protected through life insurance.

LIFE INSURANCE IS ONLY A SALARY REPLACEMENT

Life insurance is supposed to cover multiple needs like – living expenses, funeral expenses, outstanding debt and any future financial goals. Using a plain jane formula like 10x your annual salary is not a good idea. It is only after studying for CFP (Certified Financial Planner) I realised that proper calculation of life insurance can be tedious but well worth it. I will talk in detail with examples on the most logical way of calculating an appropriate life insurance cover, in a future #LIMonday post.

EMPLOYER LIFE INSURANCE TAKES CARE OF ALL MY NEEDS

How many of us even know how much the group life insurance cover (provided by the employer) is? 10 Lakh? 50 Lakh? How many of our needs are covered by that insurance? Also, what happens in case you move jobs? Purchasing a job-agnostic life insurance has many benefits to it, not trapping you to a particular job being one of them.

BUYING INSURANCE IS A ONE-TIME PROCESS

How much money we need in our lives depends on a lot of parameters and is barely constant. An annual review is ideal to measure if the existing life insurance cover is still adequate. If we take annual review in our jobs seriously, however tedious, why should our lives be any less important?

This is some food for thought that I had in my head for Life Insurance in India. Agree or disagree I would love to hear your views about it. Share it in a comment or feel free to email me at aparna@elementummoney.com

Other posts in the #LIMonday Series:

Why do you need Life Insurance

Learn the right way to calculate your Life Insurance Needs

Leave a Reply