The best part about my job is the new instances and in a sense, brain teasers which often creep up. I have come to realize that the field of Personal Finance is forever dynamic. In fact, at times I even think that regulators keep tweaking rules just to keep the burgeoning financial services industry alive and kicking forever creating employment to ensure that they are there to untangle these knots for the investors.

Recently, a client came to us with his confusion on some debt fund investments made a few years back. This included a Franklin Templeton fund which not only came with side pockets but also with the main fund blocked and the remaining money trickling in slowly. As I set about understanding the intricacies, I realized this called for a post to discuss all about Debt Fund Side Pocketing. So here we go.

What is Side Pocketing in Debt Funds?

As discussed earlier in detail, debt funds comprise of a bunch of bonds, NCDs or other types of lending to governments or corporates. However, depending on the amount of risk taken (measured by the credit rating), at times one or a few of those assets might default.

As an example, suppose you have invested in Fund A which has 20 papers or debt assets. Now of these 20, one of them is a Company X bond at a (coupon) rate of 7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with a particular date to make its’ interest payment. But, the company falls into bad days and ends up with a credit rating downgrade.

Earlier, there was no distinction between such rotten apples and the good ones in a portfolio. With side pocketing, these defaulted assets become a sub portfolio or an attachment of sorts to the main portfolio. So, if you have invested in Fund A, where one of the assets has defaulted. Once the side pocket is created, the investor sees in his portfolio two folios of Fund A. One remains as Fund A which is the core portfolio. The side pocket is automatically created in each investors portfolio and is mostly called Fund A – Segregated Portfolio 1. Once a segregated portfolio is created, there can be no action on it from the investor end. So, even if you decide to redeem the fund, you are left with the segregated portfolio, like an amputated arm.

While the number of units remain the same in both portfolios, the pricing of the segregated portfolio depends on how much discounting the AMC is anticipating at the time of creation. If they feel that the entire amount needs to be written off (which often happens), then the portfolio is carried with an NAV of 0.

Gradually, as payment starts coming in from these defaulted assets, units are knocked off from the segregated portfolio. Once the amount is completely received and the same credited to investors, the segregated portfolio is knocked off. In some ways, it really feels like magic when it suddenly appears or vanishes without any transaction made from your end.

If all this sounds confusing, don’t worry. Let’s take a look at a real life example below.

Side Pocketing at work

Let’s take the example of Franklin India Short Term Fund. As per their December 2019 fund portfolio disclosure, they had two Vodafone Idea papers – 3.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to 10.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} Vodafone Idea Ltd (02-Sep-2023) and a 0.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to 8.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} Vodafone Idea Ltd (10-Jul-2020). This means that through the first paper, Vodafone Idea borrowed with a rate of interest 10.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} due to repay the principal amount on 2nd September, 2023. Similarly, for the second paper, Vodafone Idea borrowed from the market at a rate of 8.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} with principal repayment due on 20th July 2020. Already the credit rating was at BBB-.

On 16th Jan 2020, the Supreme Court rejected the telecom companies petition to review the calculation of AGR or Adjusted Gross Revenue dues. Essentially, that meant that Vodafone Idea was due to pay approximately Rs. 53,000 Crores, which as per their calculation was coming to Rs. 44,000 Crores (honestly with these mind boggling numbers doesn’t even seem like Rs. 9000 Crores would make much of a difference).

As this ruling came in, Franklin Templeton India took a pre-emptive action and completely wrote off these two investments. So, from 15th Jan to 16th Jan the NAV of Franklin India Short Term Income Fund fell from 4094.42 to 3907.82, a whopping 4.56{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! Further, on 24th Jan 2020 CRISIL downgraded the credit rating on the assets of Vodafone Idea from BBB- to BB which means below investment grade. This allowed Franklin Templeton to create two side pockets, one for each of the assets mentioned above.

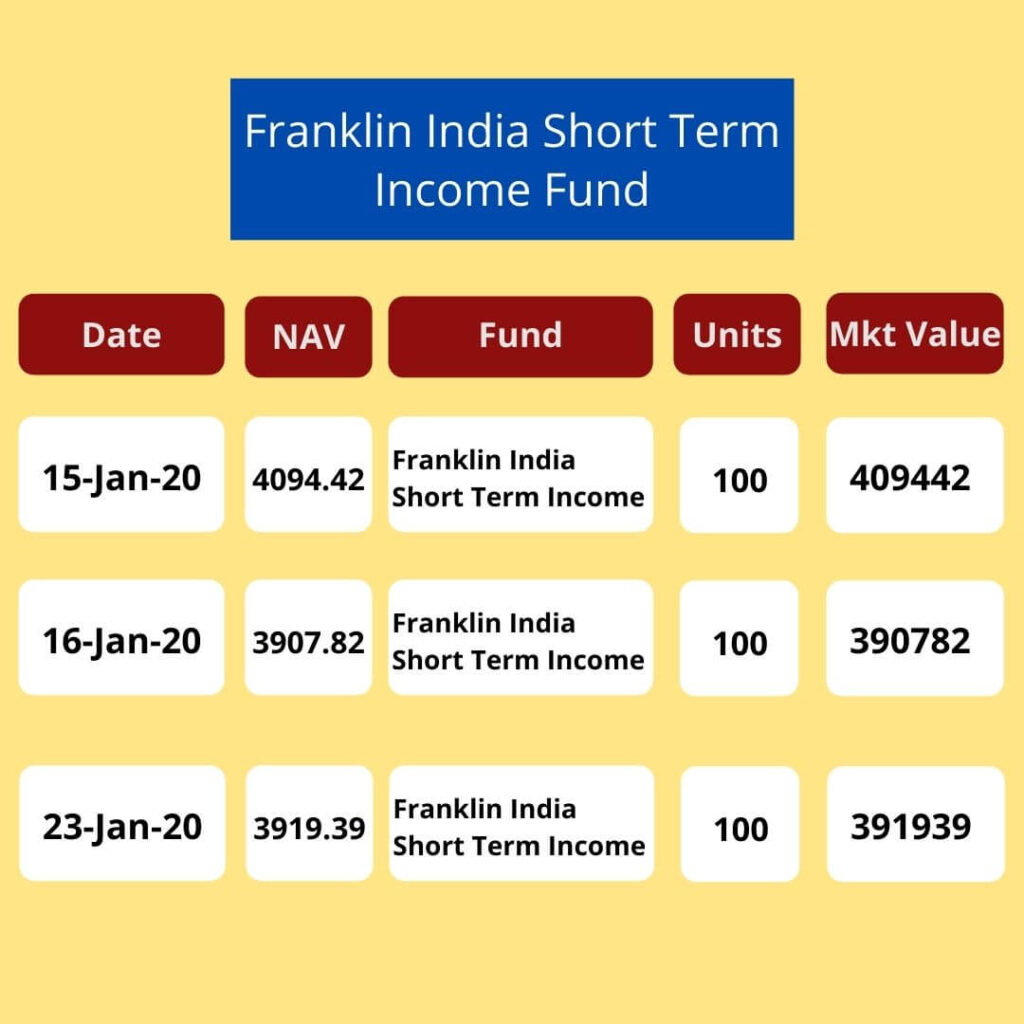

So, if an investor had 100 units in this fund, this is how the fund value would have moved a week prior to the side pocketing:

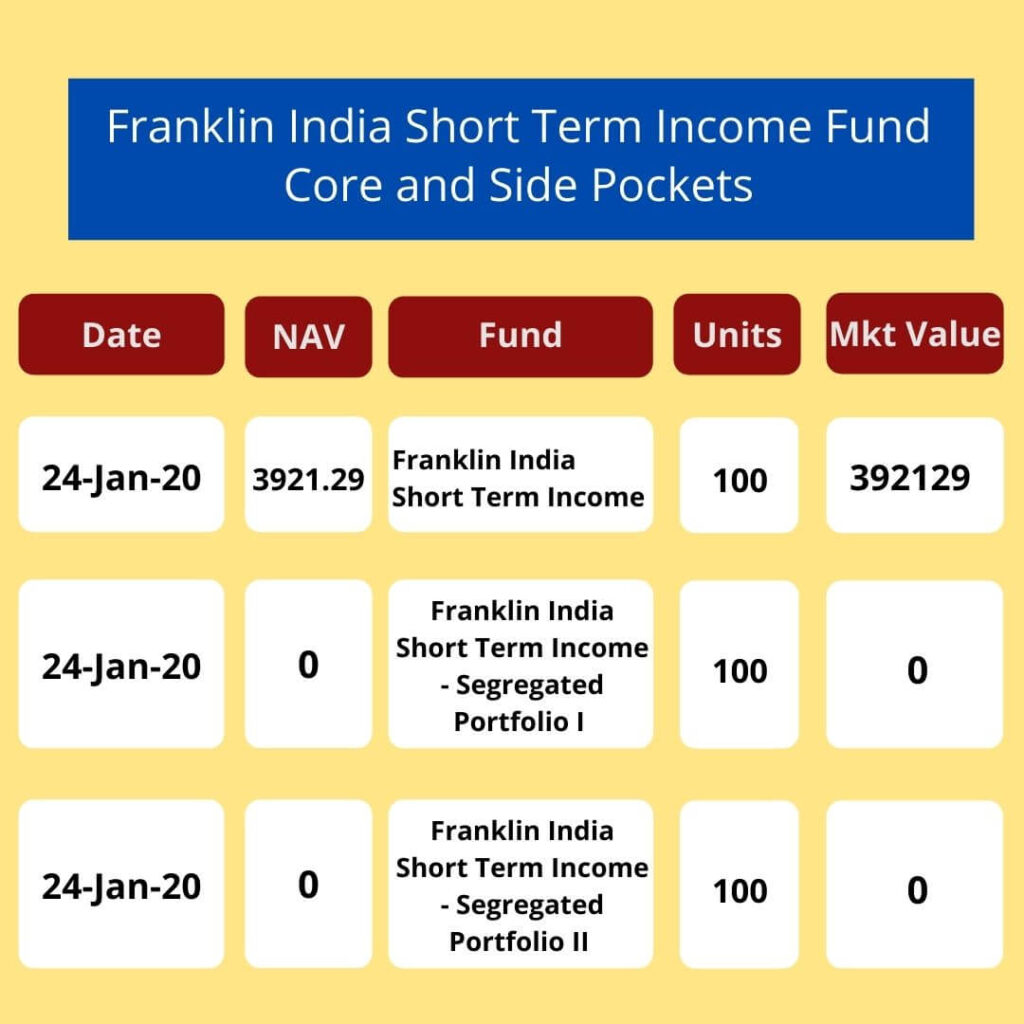

After the two side pockets were created on 24th Jan, the portfolio would now look like this:

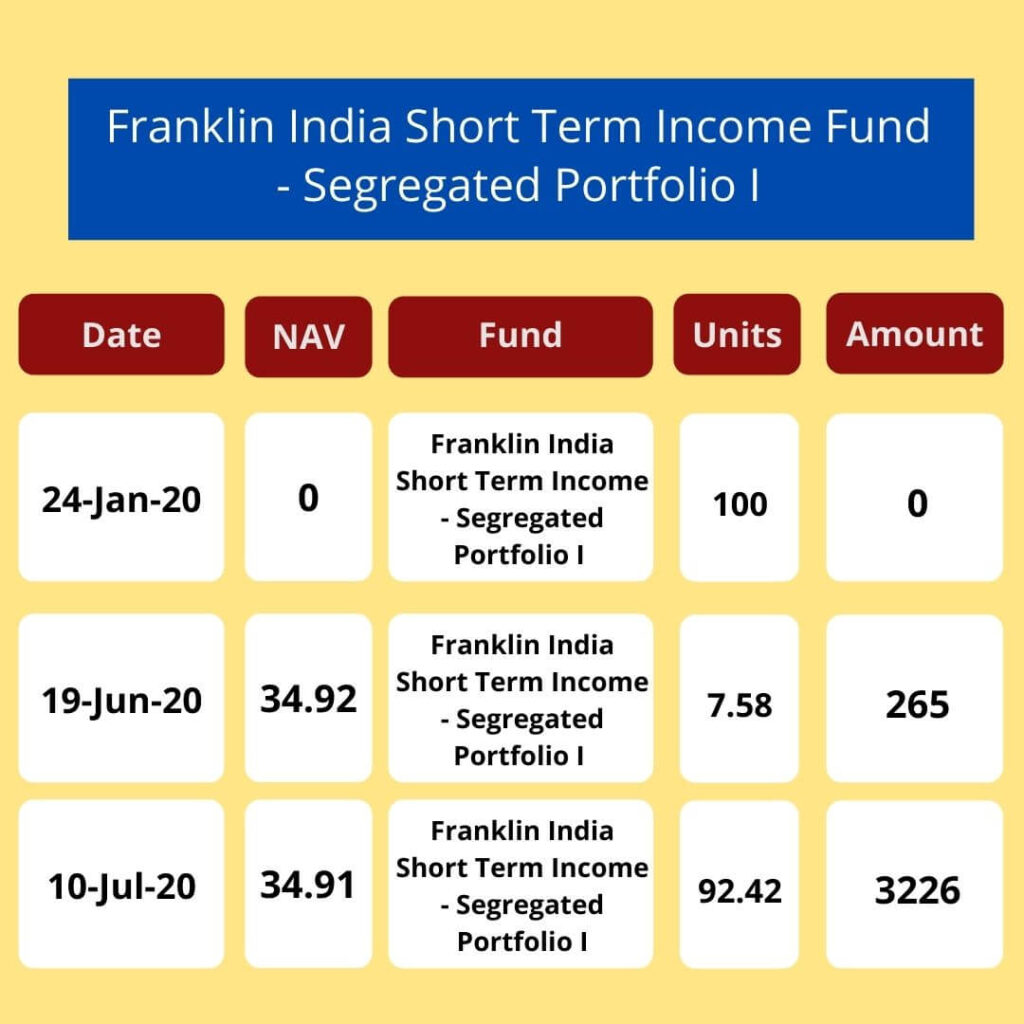

Since Franklin completely wrote off these two investments, they started at ground zero. As you may have noticed, for the first side pocket, the principal payment was due on 10th July 2020. On 19th June, 2020 Franklin India received some interest which they credited to the investors and knocked off about 7.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of the segregated portfolio I. Then on 10th July, 2020 they got the entire principal payment and knocked it off entirely. This is how it looked with the latter two entries directly credited to investor accounts.

Interestingly, if this paper had been fully valued at the time of side pocket creation, at a 0.7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of the portfolio, the NAV would have come to 27.4490 while in the end the investors ended up getting it back at approximately 34.9.

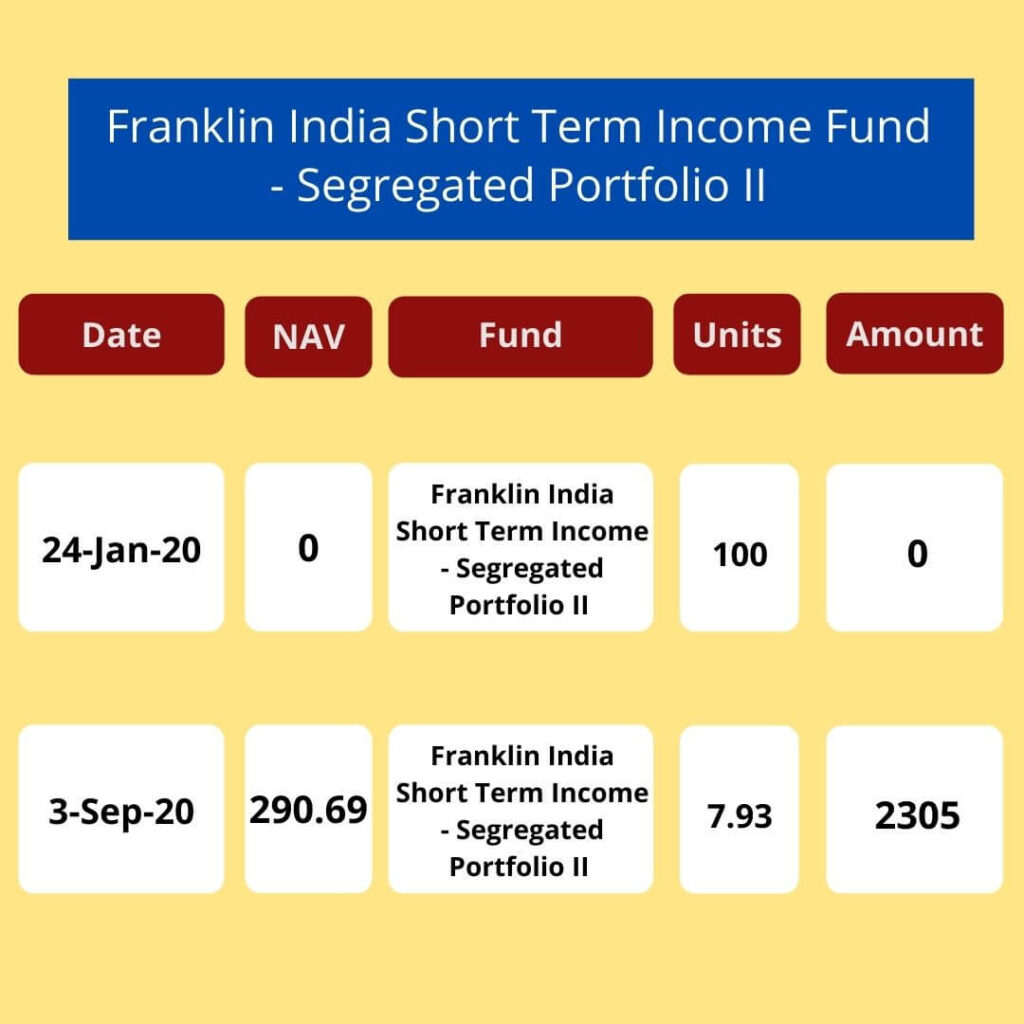

As for the second segregated portfolio, the fund received an interim payment which they distributed to investors on 3rd September, 2020. This is how that got accounted for:

Here again, at a 3.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation, originally the NAV for this side pocket would come to 141.9504 but with the penalty, the NAV has ballooned to 290.6868. However, in this case the due date for the principal repayment is at a distant date of 3rd September 2023. So, to get the entire amount it could be a long wait.

Of course, this fund along with five others has had a much more colorful journey beyond this also. In March, they side pocketed a Yes Bank paper which had a 2.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in the portfolio into the third side pocket.

And then on April 23, 2020 they all fell down. Six debt schemes of Franklin India downed their shutters completely – no one could come in or go out. Gradually, the money is still trickling in as investors wait to see their blocked money (invested in supposedly safer debt funds) come back to them. But, please note, the Franklin incident of winding up 6 schemes was a one-time event and has nothing to do with the concept of side pocketing.

Benefits of Side Pocketing

Although there was some resistance from SEBI initially, after the IL&FS crisis and the ensuing domino effect of other defaults they realized this might just be another good practice to take from the West.

1. Existing investors are protected

The practice of side pocketing enables existing investors to be protected in two ways. Suppose there is news of a credit event and big investors pre-emptively hit the redeem button. A fund would then be forced to sell off more liquid assets (sometimes not at the best price) bringing the entire NAV down for investors who choose to stay invested.

Similarly, when a defaulted asset seems to be on the verge of a payment or closer to it’s principal repayment date, there could be a few investors keenly watching from the sidelines and rushing in to get through.

With side pocketing, even if investors choose to exit they still remain saddled with the segregated portfolios and get the proceeds that trickle back from the defaulted asset. In some ways, it’s like your karma as an investor gets squared off in the same fund!

2. Allows AMCs to take more risk

India’s debt market is still at a nascent stage. In developed economies, junk bonds run a thriving market of their own. With this possibility of side pocketing, AMCs can now be a little better empowered knowing that higher risk assets will not take the entire portfolio down.

Personally though, I look at debt as a defensive allocation. If I wanted to take risk I would do so in equity which is a more liquid market and one that I feel more confident in. I would rather stick to my Sovereigns and AAAs (not that they are a guarantee these days looking at how IL&FS and DHFL fared).

3. Reflection of an AMCs track record

This to me is a big unspoken benefit of side pocketing. I think this practice puts it in very clear terms as to the funds which have had credit hiccups. In my head, those AMCs which have had a side pocket come with their scars and make me wary of trusting their debt teams with my money. The good thing is as of now there are enough and more AMCs with a clean chit and you could use the side pocketing history as a rule of thumb for yourself when picking any debt fund for investment.

However, side pockets are an option and not a mandate from SEBI. So, it is possible that the same credit event (or downgrade of one company’s credit rating) could lead to side pocketing in one fund, and no side pocketing in the other even if they have exposure to the same company.

Taxation on Side Pocketing

Now to the contentious part – taxation. Anyway, taxation is complicated for debt funds but for reference here’s what it entails.

When invested for less than three years, the gains are connoted as Short Term Capital Gains which attract tax as per your income tax bracket. So, if you are in the highest tax slab (Rs. 10 lakh and above taxable income) then any gains you earn in less than one year will incure a tax of approximately 32-33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (including cess).

As for Long Term Capital Gains, or gains earned after investing more than 3 years, that’s where it gets slightly tricky. In comes the concept of indexation and post that benefit, the gains are taxed at a flat 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Indexation essentially compensates for the impact of inflation and helps consider only gains more than inflation. For an example of how this works out, you can check out this earlier detailed post on capital gains tax.

For the segregated portfolios, the acquisition cost is considered to be the NAV at the time of side pocket creation. In case, like the Franklin Templeton example mentioned above where the asset is completely written off the acquisition cost is zero. Then any gains that come in are considered as capital gains.

So, take a look at the Segregated Portfolio I mentioned in the example above. The entire amount that came back to the investors of Rs. 3491 will be considered as gains. As for short term or long term, it will depend on the initial date of investment. So, if the investment was any time before 19th June 2017, both the amounts will be Long Term Capital Gains. Suppose the investment was made between 19th June and 10th July 2017, then the first one would be short term and the second one would be long term capital gains. Finally, for any investment post 10th July 2017, both those redemptions would be short term capital gains and taxed accordingly.

If your advisor is not able to give a detailed idea or explanation, then just ask the AMC and they will provide you with a detailed statement for any accounting queries that you may have.

I know Side Pocketing in Debt Funds is a slightly complicated topic to tackle. But, in a way it is a god send for investors in products where an asset ends up getting stuck in default. It brings alive the lyrics of Hotel California – “You can check-out any time you like, But you can never leave!”

If you still have any doubts or confusion or some query stuck in your head, feel free to put them in the comments or drop me an email on aparna@elementummoney.com

Leave a Reply