A few days back a friend who is a new mother, had a money conversation with me. This was after I started Elementum Money and before I was officially a CFP. It made me pretty happy for 2 reasons.

Firstly, I thought I finally have a convert! I have had multiple conversations with her about how we women need to know more about money, get more involved in its management, educate ourselves more and act accordingly. It would always fall on deaf ears as she would chirpily reply that she’s happy being poor (which was anyway not the case). It’s really good to see how a baby and some well-meant advice from fathers can turn a person’s perspective.

Secondly, while she ended up calling me a chatbot ( :-/) it felt good to be asked for money advice. I always wondered how I would garner experience on money matters and give enough confidence to myself and people around me that I could really be trusted with it. Turns out, Elementum Money is doing a great job for me in that respect. Since the time I have started writing, a lot of my friends have initiated money conversations and it has always been enriching.

THE MONEY QUESTION

Anyway, back to the case study. So, this friend of mine pinged me on Whatsapp and started by asking the current rates of Fixed Deposit. I checked with her for the tenure considering the rates vary for each tenure. As soon as she said that it was a lump sum amount with a tenure of around 18 years, I had to tell her to NOT put that money in an FD.

In a nutshell, she had received some cash gifts (let’s say around Rs. 70,000) for her baby girl which she wanted to use as seed money to accumulate for her higher education expenses. With a tenure as long as 18 years, putting that money in a Fixed Deposit would be financial suicide.

My suggestion to her was to put the money in a debt fund (earning approximately 7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} per annum) and then using a Systematic Withdrawal plan to start investing it in Small Cap Funds.

Keeping the money in a debt fund is convenient considering the Systematic Withdrawal Plan. Why the Systematic Withdrawal Plan to put the money as a SIP instead of a lump sum? Two reasons for that: One is, of course, the much-touted Cost Averaging whereby you end up getting the average cost of the Mutual Funds without going too high or too low. Secondly, I believe it induces a habit of regular investing. When you see 10 months of investing Rs. 7,000 or 20 months of investing Rs. 3,500 and the results it yields, the probability of continuing with that regular habit is far higher than if you lock in the Rs. 70,000 in one go. I can say this from personal experience.

However, even the SIP investments can and should change with tenure. 18 years is a long time and the investment cannot remain static in that period.

HOW TO INVEST

Let’s call my friends’ daughter, baby K. Baby K is born in 2017 and we are expecting her to need money for higher education at the age of 18 which would be around the year 2035.

From 2017 to 2027, being a considerably long period, they should invest the money in mid small cap funds (even if there are periods in the red). Between 2027 and 2029, they should watch out for a time when the market is at a high to transfer their funds to the less risky balance funds (equity oriented). In this they should continue till the year 2032-2033.

Last 2-3 years they would not want to have their corpus at the mercy of the vagaries of the market. This is when they should consider putting the entire corpus in a Fixed Deposit as all they are looking to do is conserve the wealth created so far. They could consider not making any fresh investments during this period.

TALLYING THE NUMBERS

How does this story look in numbers? Let’s consider 2 scenarios. I will consider both the scenarios without taking the minor fillip that the investment will get thanks to the short period of returns through the debt fund.

Rate of return: Mid Small cap: ~11.2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (tax-free)1

Balanced funds: ~9.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (tax-free)2

Fixed Deposit: ~4.2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (tax-free)3

Before I put down the 2 scenarios, it would be good to remember that if this lumpsum is locked into a Fixed Deposit for 18 years, the amount would have grown to less than Rs. 1.5 Lakh (1,46,797) at maturity.

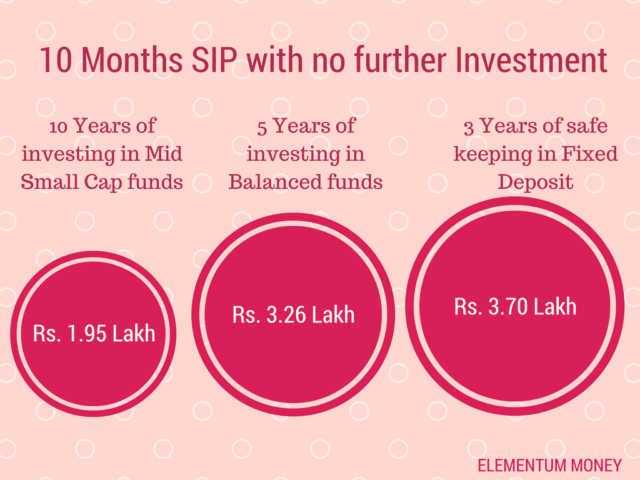

Scenario 1: My friend decides to spread out the lump sum into 10 monthly investments of Rs. 7,000 in Small Cap Fund with no further investments. The money is allowed to grow there for a total of 10 years. After 10 years, the Rs. 70,000 can be expected to have grown to almost Rs. 1.95 Lakh (1,94,535). Then the corpus is moved out to a Balanced fund for 5 years where it grows to almost Rs. 3.26 Lakh. In the final safekeeping period in Fixed Deposits the amount has finally ballooned to Rs. 3.7 Lakh.

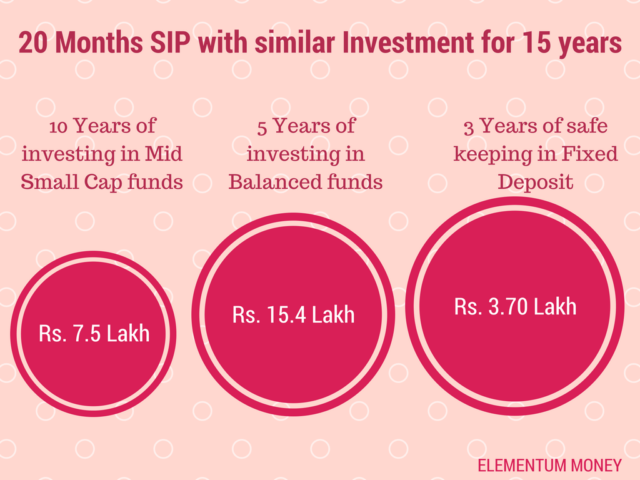

Scenario 2: Assuming my friend spreads out the initial lump sum into 20 months for it to become a SIP of Rs. 3,500 per month and continues with this investing discipline for the next 15 years (before transferring the funds to the FD).

The monthly investment of Rs. 3,500 is made for 10 years in the Small Cap Fund followed by 5 years in a Balanced Fund (Equity Oriented). Last 3 years with no new investment, the amount is put away safely in a Fixed Deposit.

After a decade of investing in mid small cap funds, they would have built a corpus of little over Rs. 7.5 Lakh (7,51,447). On transferring this amount to balanced funds, and continuing with the regular investments, at the end of 5 years, the corpus would have grown to almost Rs. 15.4 Lakh (15,39,943). Finally, even in the 3 years of safe-keeping period the corpus would grow to a final figure of Rs. 17.42 Lakh (17,42,240).

As you can see, in the long-term equity investments are your friend. In case of any doubt or clarification or opinion, do feel free to write in the comments below or email me at aparna@elementummoney.com

Notes:

- Rate of Return for Mid Small Cap calculated by taking the annualised return in the period April 2007 – March 2017 for the following 4 Indices: Nifty Mid Small Cap 400 (14.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Nifty Full Small Cap 100 (9.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), S&P BSE Mid Small Cap (12.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and S&P BSE Small Cap (8.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

- Rate of Return for Balanced Fund assumed to be a mix of 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} equity and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} debt. Returns for debt taken at 7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} per annum. Rate of return for equity calculated by taking an average of annualised return in the period April 2007 – March 2017 for 2 broad-based indices – BSE 500 (10.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Nifty 500 (11.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886})

- Rate of interest for Fixed Deposit assumed to be 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Tax paying individual assumed to be in the 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} tax bracket which diminishes the post tax return to 4.2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Leave a Reply