Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks

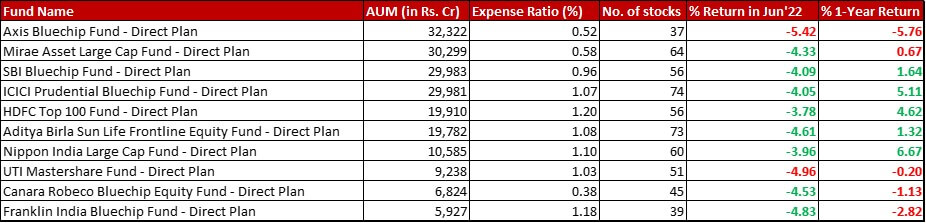

Benchmark: BSE 100 TRI or Nifty 100 TRI with latter changing by -4.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in June 2022 and giving a 1-year return of 1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 30th June, 2022

Summary

In terms of AUM ranking, HDFC Top 100 has just about inched up ahead of Aditya Birla Frontline Equity to make it to the top 5 funds by AUM.

Three funds have slight changes in expense ratios – Axis has increased by 4 bps to go up to 0.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, UTI Mastershare has reduced by 7 bps to come down to 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Canara Robeco has increased by 4 bps to go up to 0.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Axis seems to have had a bit of a trim bringing down it’s number of stocks from 41 to 37.

In terms of performance, only two funds underperformed the benchmark last month. Although for the one-year performance that number goes up to five.

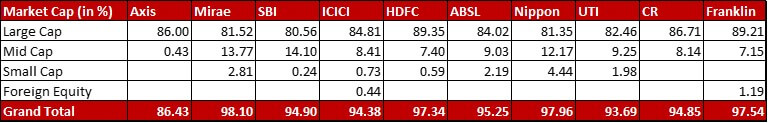

Market Cap Allocation

There is a bit of a shuffle between Large Cap and Mid Cap allocations in SBI, ABSL and UTI to the tune of 2-4{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. But, some of it can be attributed to the reclassification that we see.

Axis remains the only fund with a sub-90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} equity exposure.

Top 5 sectors

This month, Large Cap funds are doing what they are supposed to – being boring.

With a new 0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Mahindra & Mahindra and an almost 0.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the Maruti Suzuki allocation, Autos is the fifth largest sector for Canara Robeco, replacing Finance.

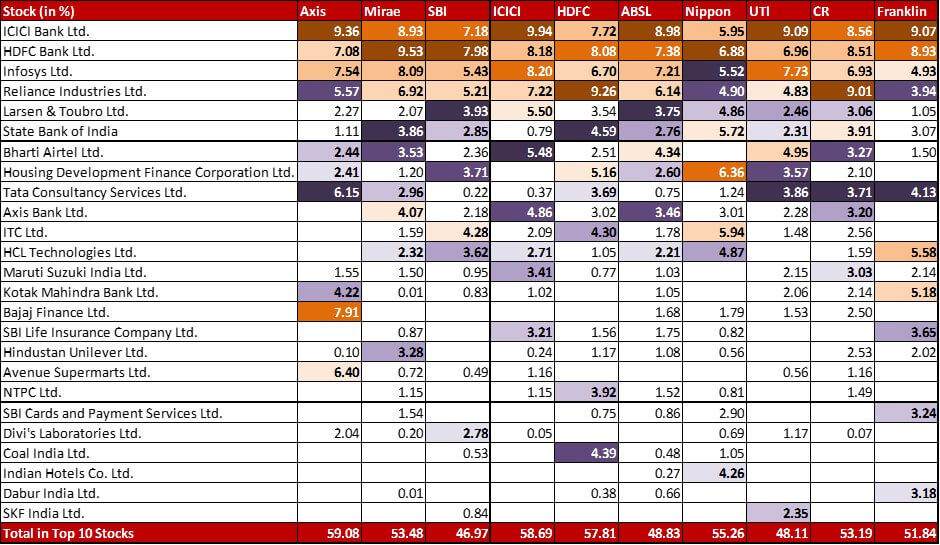

Top 10 stocks & Movements

Axis sees Maruti Suzuki holding increase to almost 3x, reaching 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund is tentatively reaching out to HUL again with a 0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} new allocation, having exited the stock in November 2021. The trimming means five tiny positions have been exited out of – Tata Motors (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), LIC (0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Tata Steel (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Hindalco (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Bharti Airtel (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

SBI has made two small exits – Nestle India (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Power Grid (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ICICI exited it’s 0.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Ashok Leyland. They also seem to be experimenting with some new stocks in the tail – Muthoot Finance (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Divi’s Laboratories (0.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Mannapuram Finance (0.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Gillette India (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

ABSL has exited a wee 0.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Wipro which was anyway there for a mere two months.

HDFC has one noticeable movement – exit from a 0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in NHPC.

Nippon can’t seem to make up it’s mind about DFL. The stock found a place in the portfolio from February to April in the range of going to 0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. May it spent on the bench and June, it’s back in the portfolio with a 0.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position. Three stocks find themselves out – ACC (0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) which had just made it’s way in April, Bharti Airtel (0.39{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and BEML (0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

After a three month hiatus, Mahindra & Mahindra is back in the Canara Robeco portfolio with a 0.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} new position.

Franklin has some noteworthy changes. L&T gets a trim of 1.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to land at 1.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Zomato has dropped by 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go to 0.95{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. On the other hand, HUL is beefed up by 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (to reach 2.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and TCS is up by 1.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (settling in at 4.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). It has also exited 0.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in United Spirits. This is another fund where LIC (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). finds itself there only in the post-listing and out this month. There’s also a brand new 0.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Coforge.

Check out the other categories and what the funds there were up to:

Leave a Reply