Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

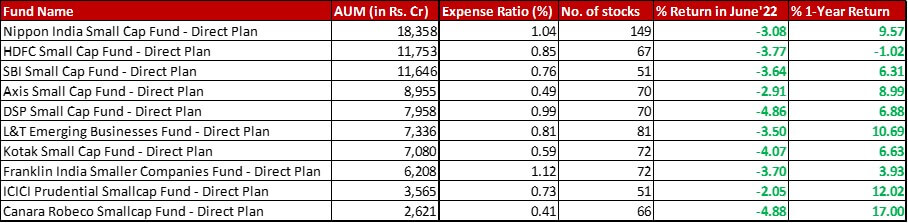

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Small Cap (251 and beyond by market cap size) stocks

Benchmark: Nifty Small Cap 250 TRI with a change of -6.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in June 2022 and a 1-year return of -3.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

All data as on: 30th June, 2022

Summary

The biggest development is the fact that Canara Robeco Small Cap is now in the tenth position, replacing Aditya Birla Sun Life Small Cap. The stellar performance in the last year might have had something to do with it.

Happily enough, all funds have outperformed the benchmark and some handsomely so, especially in the 1-year performance.

Kotak Small Cap has a big 10 bps increase in expense ratio, to settle in at 0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

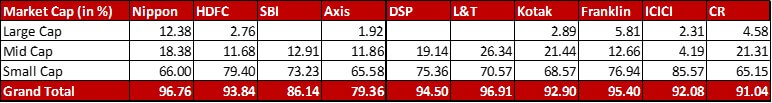

Market Cap Allocation

Bank of Baroda’s reclassification to Mid Cap means that now HDFC fund shows zero for Large Cap allocation.

With a few stock reclassifications from Small Cap to Mid Cap, these two market caps are now all mixed up for DSP with a movement of about 7{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} higher for Mid Cap and reduction for Small Cap.

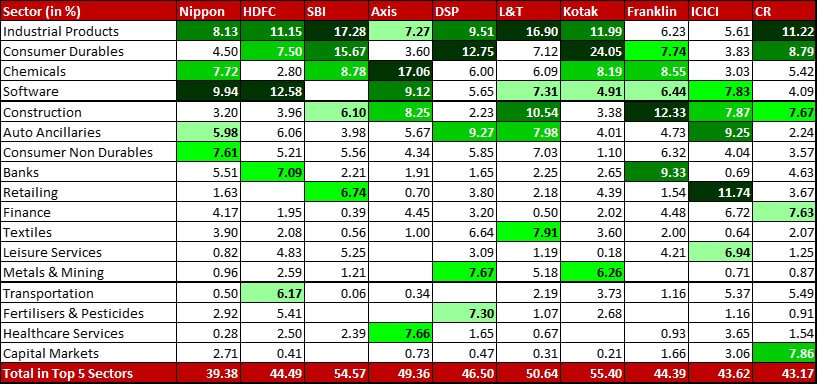

Top 5 sectors

Nippon sees an organic swap with Auto Ancilliaries replacing Banks for the fifth spot.

HDFC has cut down it’s allocation to Chambal Fertilisers by 1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} leading to Fertilisers & Pesticides dropping out of top 5 and being replaced by Transportation.

In L&T, an organic swap sees Auto Ancilliaries replacing Consumer Durables in the fifth spot.

Another organic swap has taken place in ICICI where Leisure Services has replaced Finance in the fifth spot.

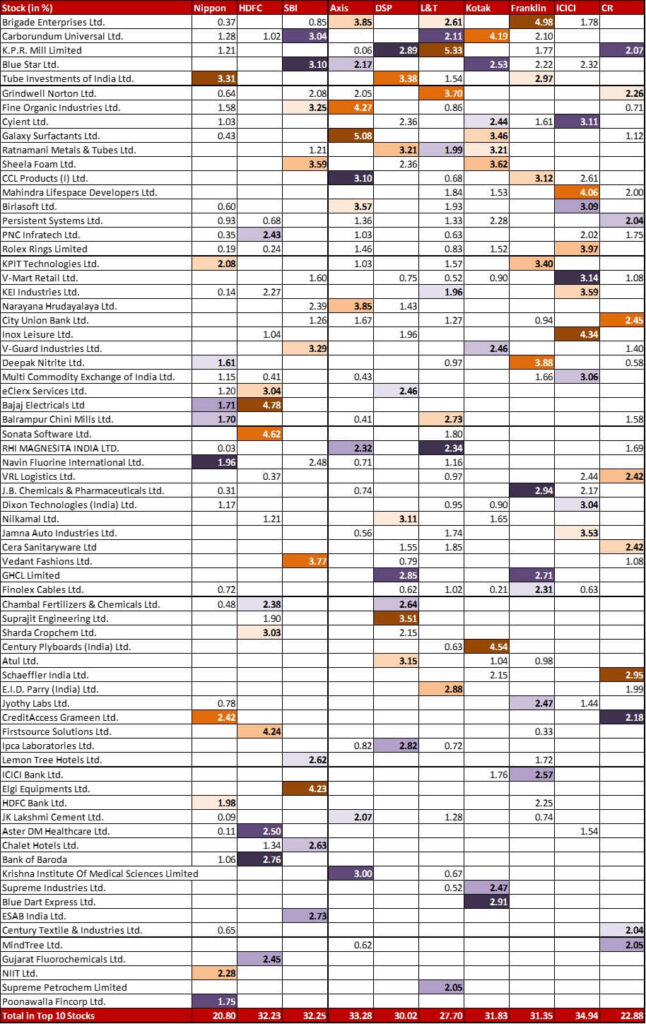

Top 10 Stocks & Movement

Nippon has two new entrants this month – Biocon (0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Seya Industries (0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

As mentioned earlier, HDFC has trimmed it’s position in Chambal Fertilisers to take it down to 2.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

SBI has reduced it’s J.K Cement allocation by 1.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to trim it down to 0.88{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There’s also a new 0.27{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Zydus Wellness.

While Axis has exited it’s tiny 0.01{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Bata India, it has a new 0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Aether Industries.

DSP has drastically cut down it’s allocation to Butterfly Gandhimathi Appliances by 1.55{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, bringing it to a shadow of it’s former self at 0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has also completely exited from the 0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Welspun India.

L&T continues to point it’s trimming shears at it’s biggest stock K.P.R. Mills, this time for a 1.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} chopping off to leave it at 5.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Franklin has a new 0.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in S.P. Apparels.

Check out the other categories and what the funds there were up to:

Leave a Reply