Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

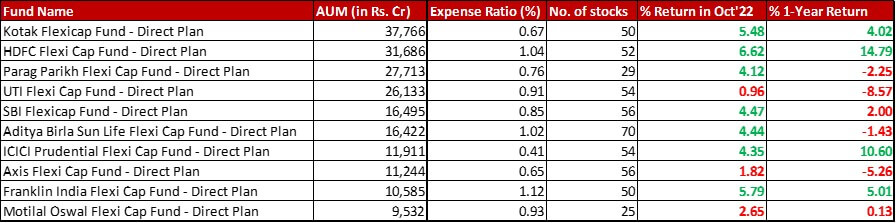

Benchmark: Nifty 500 TRI with a change of 4.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in October 2022 and a 1-year change of 3.54{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 31st October, 2022

Summary

There is no change in the AUM rankings and neither is there a substantial change in the expense ratio.

If I were forced to mention a fund for a change in the number of stocks, that would be Aditya Birla where the portfolio has increased by 3 to touch 70 holdings.

Last month’s spotlessly green report card for the month’s performance now this time has three laggards for diversity – UTI, Axis and Motilal Oswal. Apart from those three, Parag Parikh and SBI are two additional funds with a lower than benchmark 1-year performance.

Market Cap Allocation

The foreign equity allocation in Parag Parikh has further dropped by almost 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, to go down to 16.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

ICICI is acting a bit like a ping pong. Having reduced the Large Cap allocation by almost 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} last month, this month it is back to increasing it by a similar number which reflects in the total equity exposure going up. Franklin is another fund where the Large Cap allocation has increased by about 2.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} taking up the overall equity exposure.

Top 5 Sectors

There are very few changes in the sectoral allocation yet again.

In HDFC, Bharti Airtel allocation sees an increase of 0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} leading to Telecom nudging out Petroleum Products from the top 5 sectors.

Motilal Oswal yet again seems to be a mover and shaker this month. The fund has completely exited it’s 2.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in SBI Cards. Resultantly, the sectoral allocation to Finance has dropped to third highest, now behind Auto. There is also a 0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in the allocation to Ambuja Cements, with the sector now edging out Retail from the Top 5.

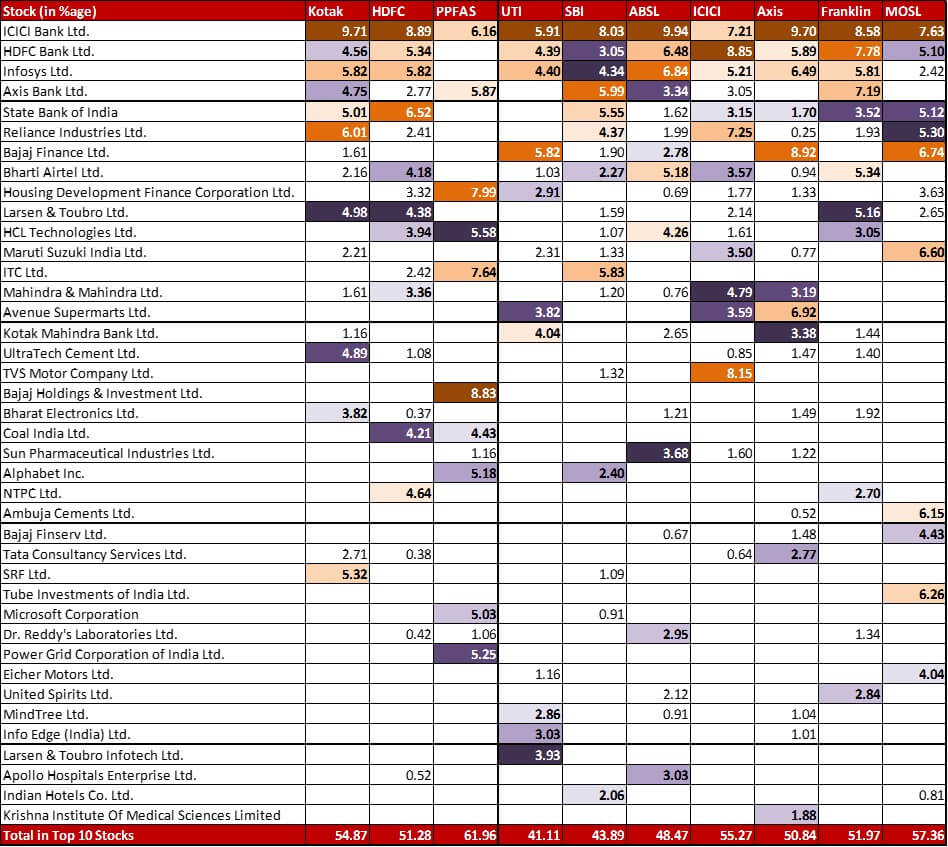

Top 10 Stocks & Movements

Kotak has added a 0.79{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} new position in Tata Chemicals.

It’s been a quieter month for HDFC. Two small exits – Ashok Leyland (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Max Healthcare after a mere two months (0.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Just one new addition of 0.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to Delhivery.

Parag Parikh has a substantially increased allocation (by 81 basis points) to Axis Bank (now at 5.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). However, this is less than the 23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} price increase the stock witnesses so some allocation might actually have been trimmed. There is a 0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction to it’s allocation in Facebook or Meta. There is a new addition of 0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in NMDC Steel.

SBI has some noteworthy changes. It has trimmed it’s position in HDFC Bank by a substantial 1.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to come down to 3.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Another stock which has got a bit of chopping is L&T down by 0.87{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to land at 1.59{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Axis Bank shows an increase of 0.93{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} on the back of it’s racing stock price. After the massive reduction last month, Cholamandlam Investment and Finance is out (0.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and so is Manappuram Finance (0.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are two new additions – Bajaj Finance (1.90{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Dehlivery (0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

While there is no noteworthy exit, Aditya Birla has four new stocks yet again – NMDC Steel (0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aarti Pharmalabs (0.14{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Interglobe Aviation (0.05), Tata Motors (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Two funds see a substantial increase in ICICI – Infosys by 0.92{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (to go up to 5.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and TVS Motors by 0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to steadily go up to 8.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Two stocks have been shown the door – Interglobe Aviation (0.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) after a short five month stay and Titan (0.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Even with some trims, Axis Bank sees a substantially increased allocation in the Franklin fund by 1.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (going up to 7.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) at the back of it’s price upswing. The fund has also added a 0.65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in IndusInd Bank.

Oh boy, Motilal Oswal yet again. Let me start with the strangest change I see. There is a new 5.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Reliance Industries, which saw a 5.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation completely being exited just last month. This is either the weirdest instance of indecision or an error maybe in the portfolios they publish. The fund has also trimmed it’s allocation in AU Small Finance Bank by 2.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 1.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HDFC Bank by 2.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (now at 5.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). There are two chunky exits – SBI Cards (2.68{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Kotak Mahindra Bank (1.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). Apart from Reliance, the fund has also added Pheonix Mills (1.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Large Cap Funds – October 2022

Multi Cap Funds – October 2022

Leave a Reply