Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

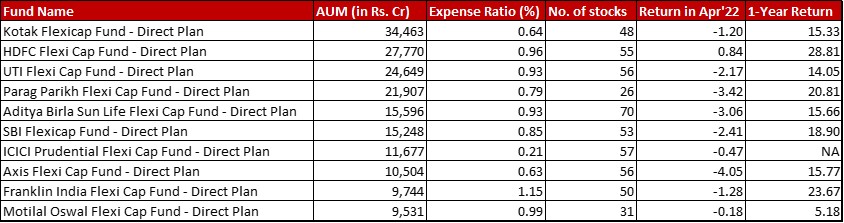

Fund category definition: Funds with no restriction on market cap allocation or number of stocks

Benchmark: Nifty 500 TRI with a change of -0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in April 2022 and a 1-year return of 19.37{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 29th April, 2022

Summary

There is no change in the AUM ranking this month.

As for the returns for the month, only HDFC, ICICI and Motilal Oswal have beaten the benchmark. Even the golden boy of the category, Parag Parikh got rogered this month with the tech meltdown in the US (about 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is made up for by 4 US stocks). In case of the 1 year returns, HDFC, Parag Parikh and Franklin are the only ones to have beaten Nifty 500 TRI.

There are two substantial expense ratio changes – ICICI has moved up from the unrealistic 0.13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to the still unreal 0.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Axis has increased it’s TER from 0.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 0.63{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which is more than a 15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase.

Market Cap Allocation

There is an almost 3.5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in foreign equity in Parag Parikh. This could be due to two factors – the price slash in some of the stocks like Alphabet Inc (about 18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) as well as the RBI limitation on further foreign equity investment.

Axis follows it’s trend of increasing cash allocation here as well with an almost 2-odd {76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in equity exposure.

Motilal Oswal has reduced it’s Large Cap exposure by more than 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, redistributing it to Mid and Small caps.

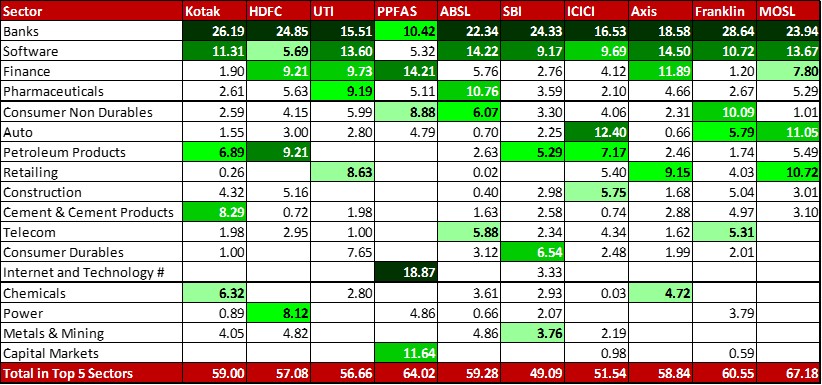

Top 5 sectors

Parag Parikh seems to have swapped the HDFC twins, bank (used to be 5.18{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) for the NBFC (new allocation of 5.98{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}). This almost doubles it’s allocation in Finance from 7.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 14.21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}, taking it from 5th to the 2nd highest sector.

With somewhat of an organic shuffle, instead of Consumer Durables sector Metals and Mining is now the fifth biggest in SBI.

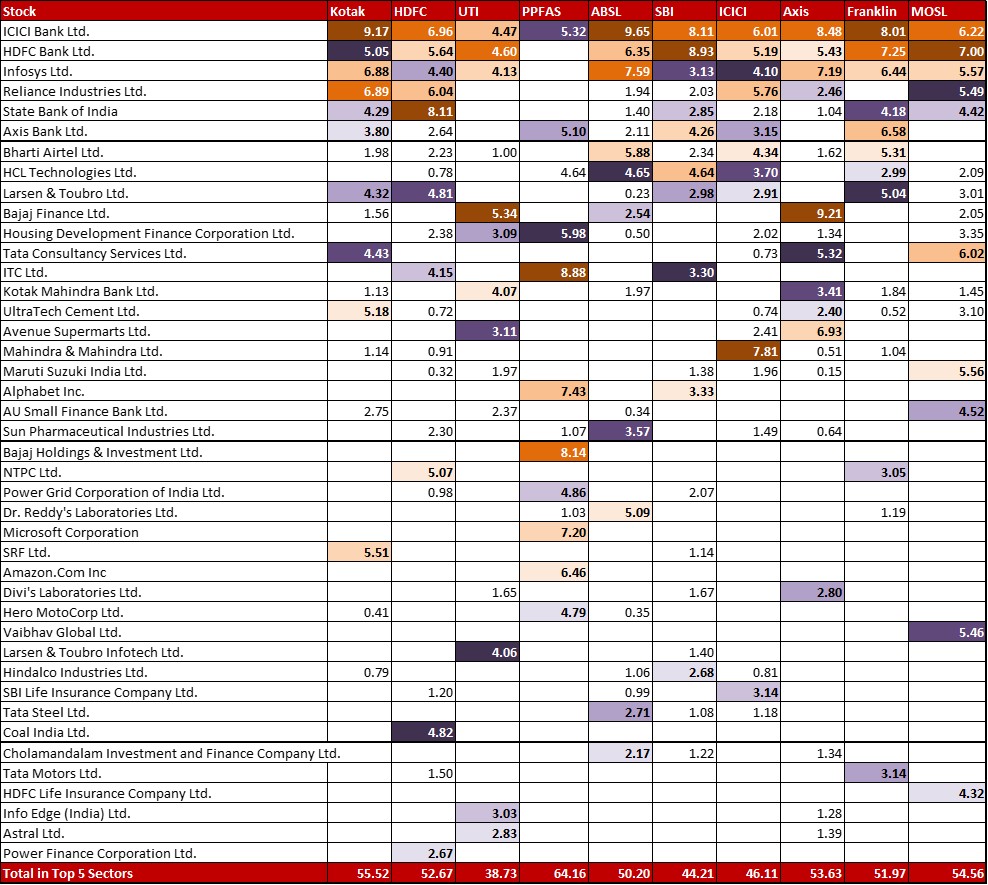

Top 10 Stocks & Movements

To some extent, the Infosys story repeats here. We can see reductions in most of the funds including Kotak (1.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), HDFC (1.00{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), UTI (0.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aditya Birla (1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), ICICI (0.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Axis (1.28{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Franklin (1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Motilal Oswal (1.09{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

HDFC also has a new significant position of 0.72{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Ultratech Cement.

UTI has reduced it’s allocation to L&T Infotech by 1.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Parag parikh sees two changes apart from the HDFC twin swap mentioned above. Alphabet Inc allocation is down by 1.45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while Amazon.com allocation is trimmed by 0.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

ICICI has almost doubled up on it’s allocation in Motherson Sumi Wiring taking it from 0.76{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Mahindra & Mahindra also sees a substantial uptick of 0.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} fortifying it’s numero uno position.

Two big ins and outs in Axis. L&T Infotech out with the 1.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position while Reliance makes an entry with a substantial 2.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position.

In Franklin, there is a 2.03{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} drop in HDFC Limited bringing it’s allocation down to 3.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Two stocks see a substantial boost – Vaibhav Global (1.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Reliance Industries (1.25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Check out the other categories and what the funds there were up to:

Leave a Reply