So, this is one of those things which you get excited about, start working on and then realise you have bitten off a crazy amount. Suddenly, you end up with much more work on your hands than you thought, with multiple levels of fretting whether you are getting it absolutely accurate.

But, somehow, even after poring over insane number of excel sheets, it has seemed so worth it. I have gleaned so much more about so many funds that I know anyone looking for any easy way to get deeper into some core equity fund categories will value it likewise.

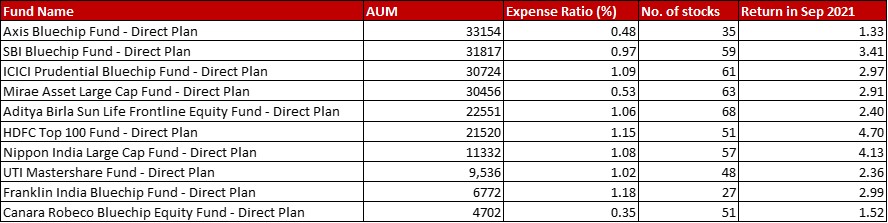

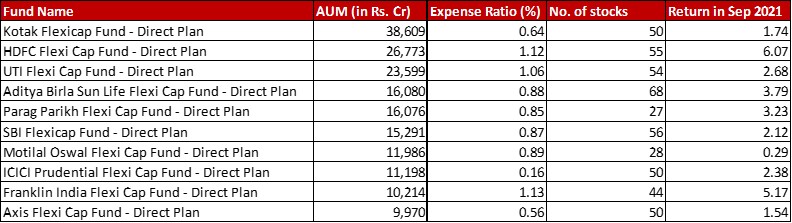

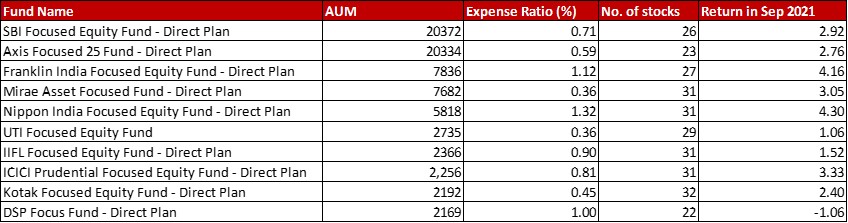

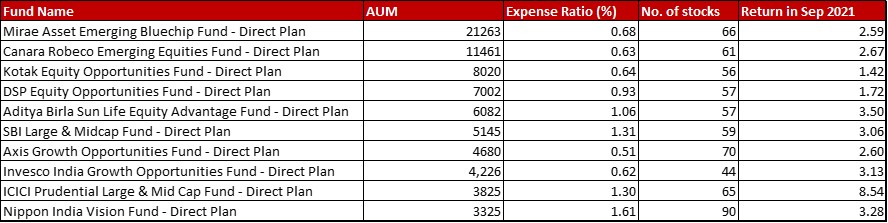

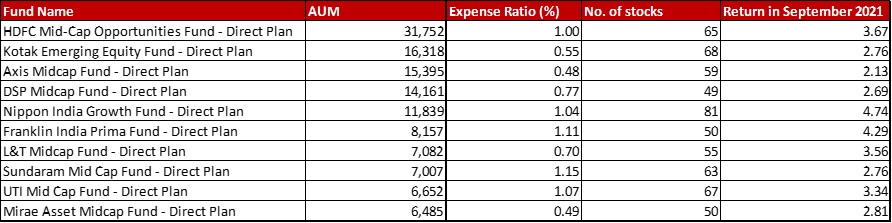

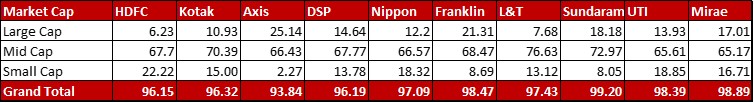

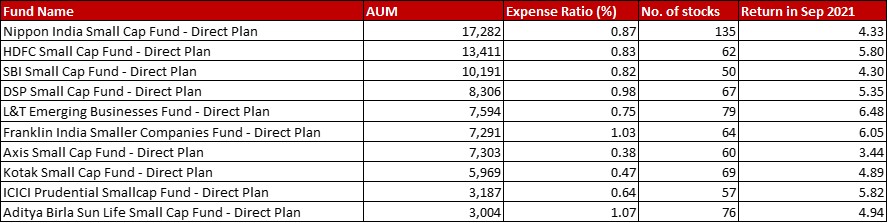

Although the AUMs are as on 30th September, 2021 (taken from the portfolio disclosures) the expense ratios mentioned are as on 1st October, 2021 (taken from the AMFI website).

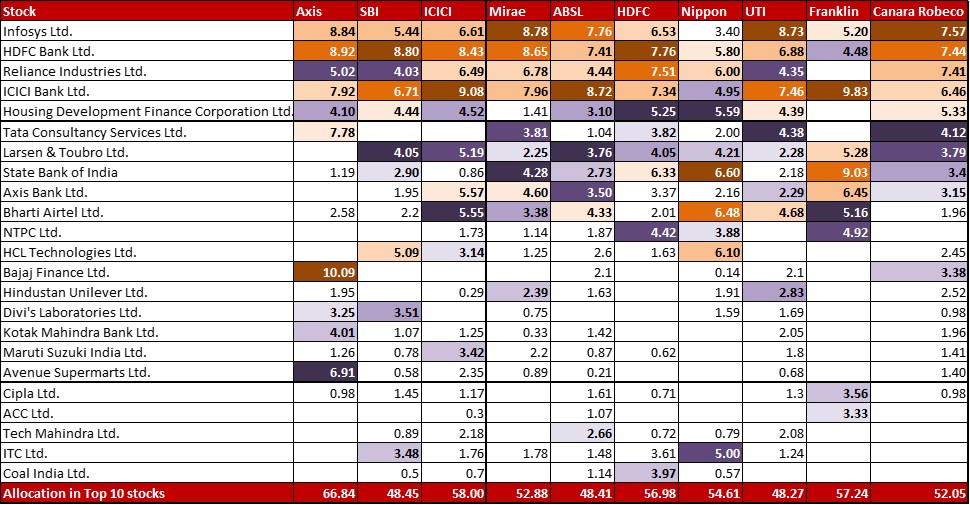

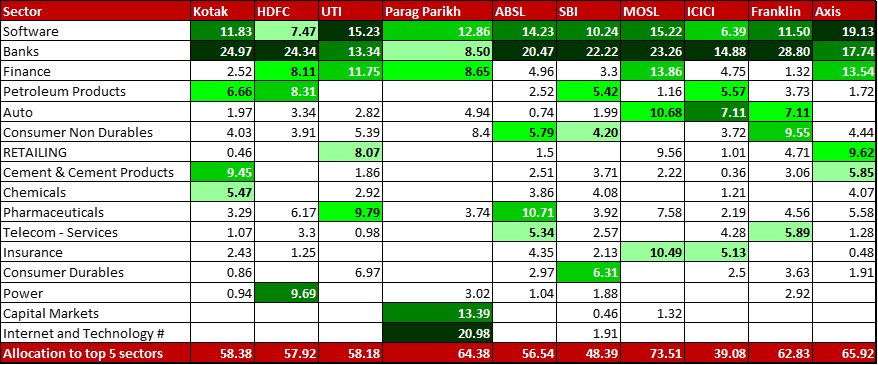

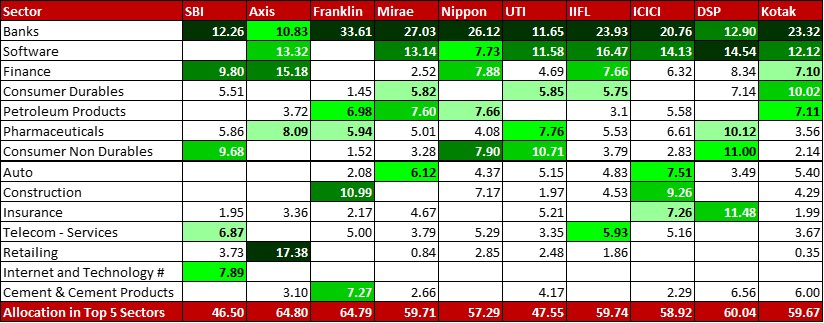

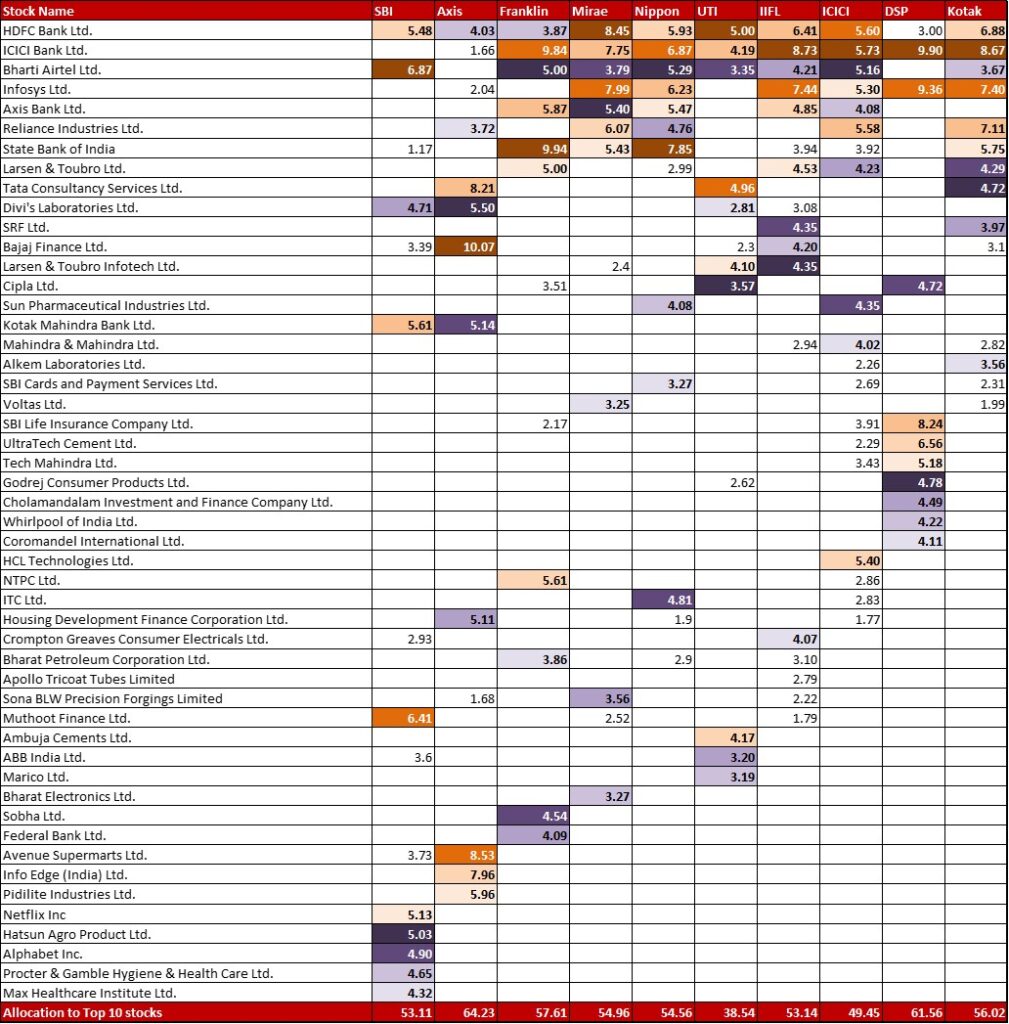

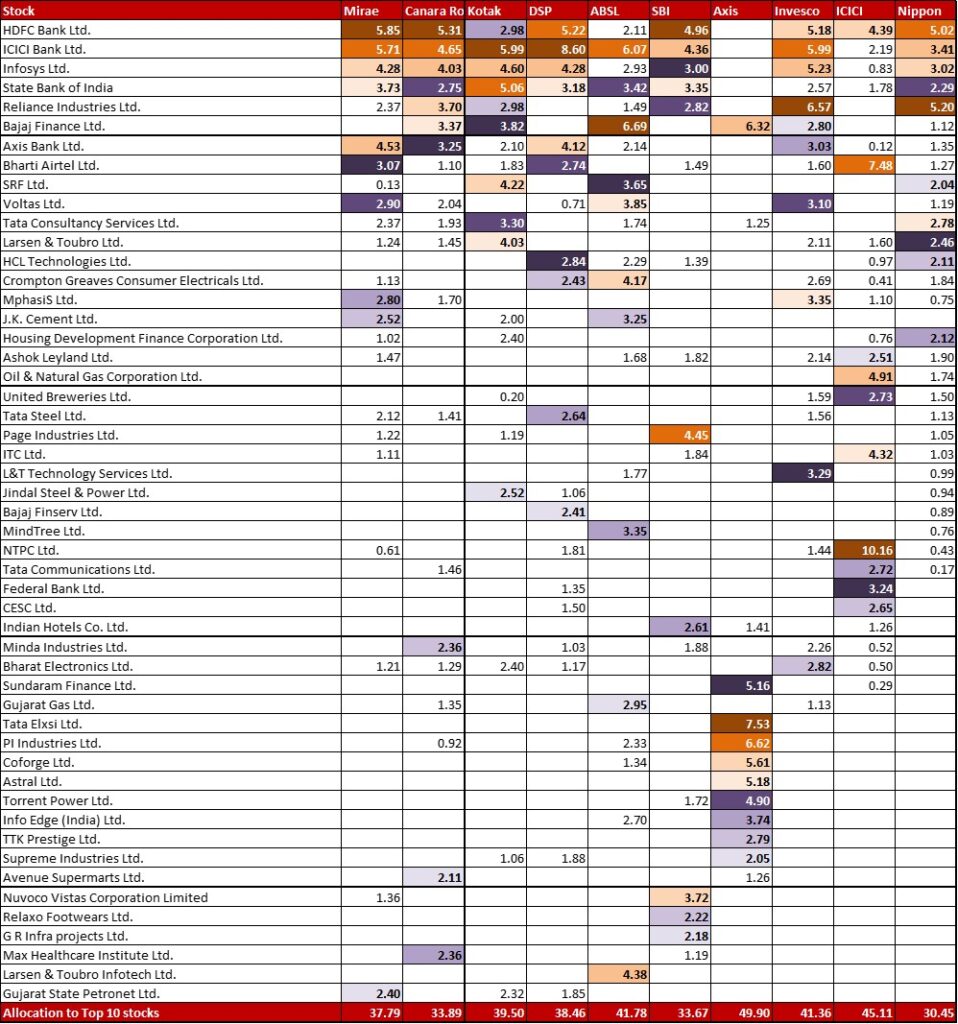

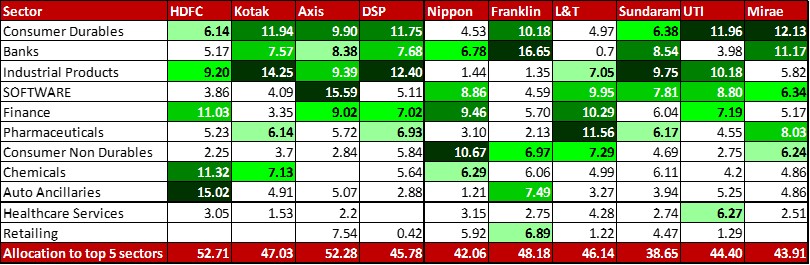

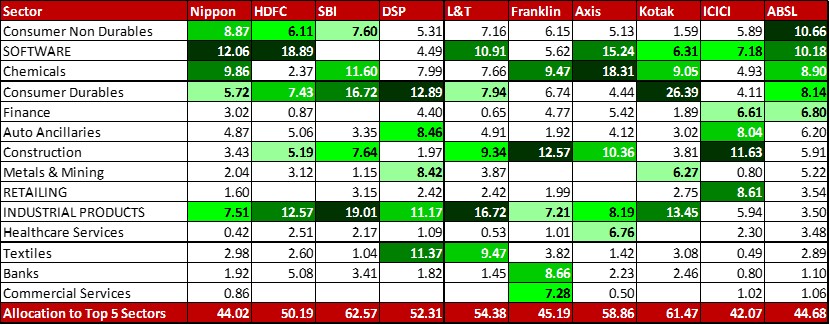

For the sector wise allocations, the different shades of green are to depict the ranking of the sector and if there are funds with uncoloured cells for the same sector, it means that’s their allocation but doesn’t make it to the top 5.

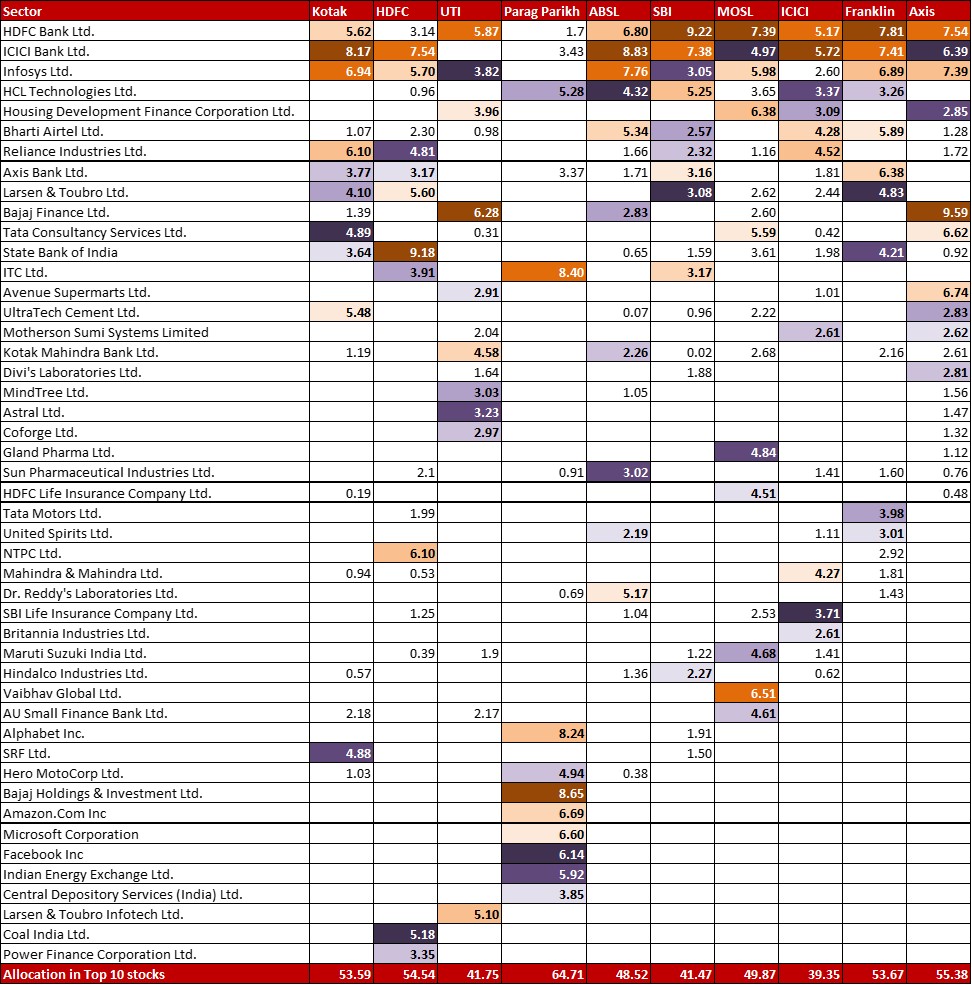

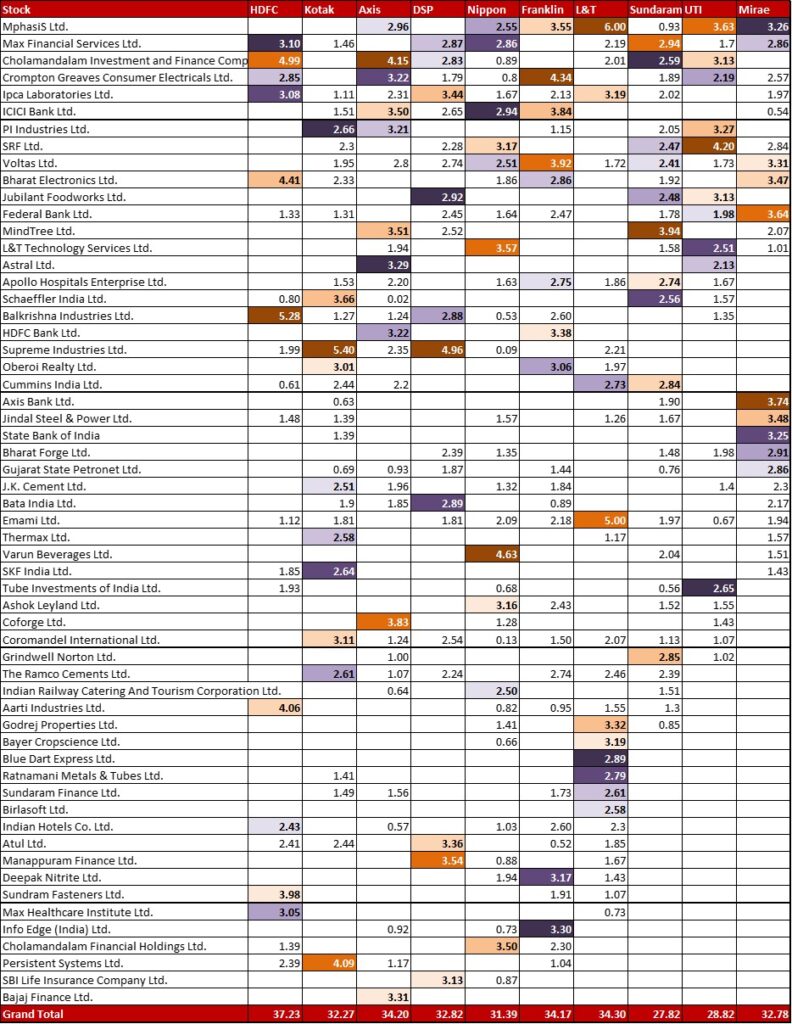

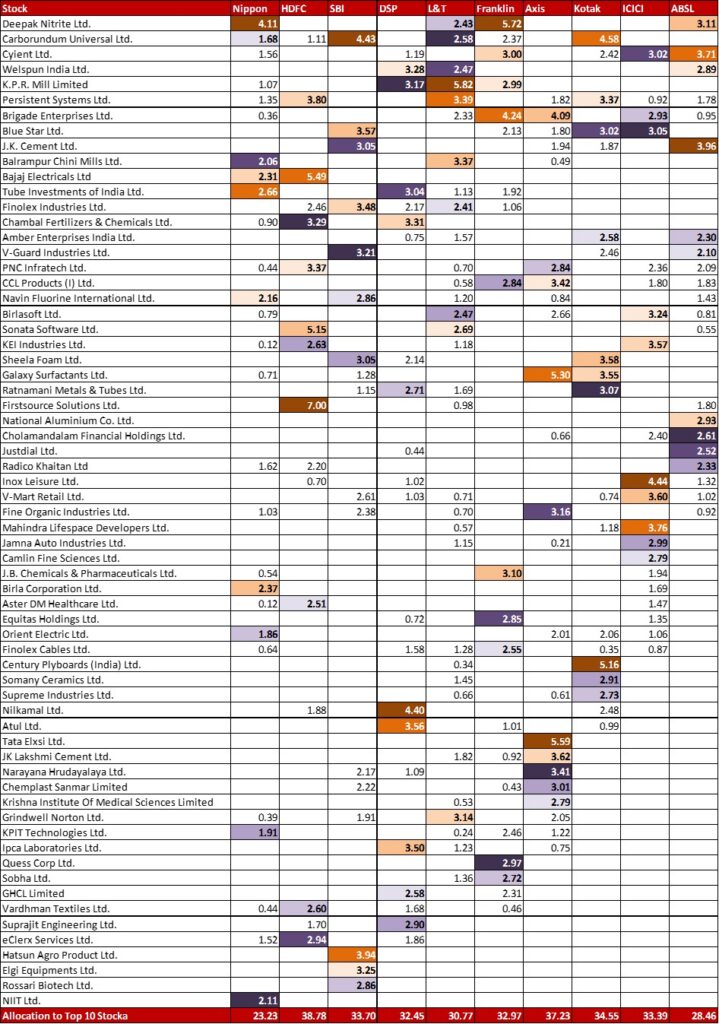

For the top 10 stocks also, there is a colour code. I have kept the colours distinct for 1-5 and 6-10 so that it is more obvious.

Remember the golden rule. Although returns mentioned are for direct schemes,

Pay for your investing advice and do not DIY unless you have professionally or passionately studied the hell out of it!

With the next few months, I think I will be able to streamline it better and definitely into seperate posts. However, for now I will keep it all confined to a single post here and use gallery form for easy navigation. In case, any image is unclear or you would like clarification on anything, feel free to write down in the comments or email me at aparna@elementummoney.com.

Large Cap Funds

This is probably the cornerstone of the industry with some of the oldest funds falling squarely in the category. Also, even the AUMs are biggest in the said category. I will reserve month-wise commentary to start from next month onwards. You will also see the maximum overlap in stocks in this category considering for 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of the portfolio, the universe is a mere 100 stocks.

Flexi Cap Funds

This, as the name suggests is the most flexible category with no market cap or number of stock restrictions. Hence, most funds will have quite a variation in their market cap allocation. In this, Parag Parikh remains unique with the top sector being Internet & Technology (as per Nasdaq) as almost 21{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is allocated to tech stocks in the US.

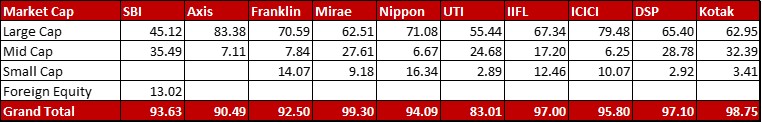

Focused Funds

A category that chooses to have a concentrated portfolio of high conviction bets. Considering no market cap allocation mandate from SEBI, there is quite a bit of variation here as well.

Large & Mid Cap Funds

A favourite category of mine, as I often tell investors, this combines the stability of Large Caps (minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation) and high growth potential of Mid Caps (minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation). However, Axis came about as a surprise on 2 counts. Large Cap seems to be 17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} and there is less than 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in banks as a category. Let’s see if the story changes next month.

Mid Cap Funds

With minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to mid cap stocks, this category remains a good bet for some alpha generation and diversification in a portfolio.

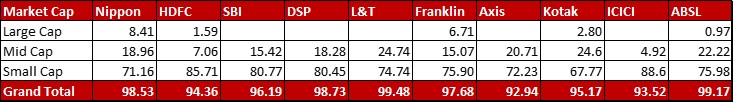

Small Cap Funds

The riskiest and of course, the most exciting category. In some ways, the world is their (the fund manager’s) oyster. What is surprising though is the 130+ stock portfolio of Nippon. Over load of diversity, eh? Of course, this category also makes investors pretty jittery for longish periods and super charged up for short spurts. This shows in the much smaller AUMs which though is helpful for the funds to be able to invest in smaller market cap companies as well.

September, the category did rule the roost. Let’s see how long the party lasts 🙂

So, that’s how September 2021 looked for the main equity fund categories. Over the next few months, I will try and make it a smoother, seamless journey to tracking the monthly changes so that we are able to see what the funds are up to and how is that working out for them.

After all, being vigilant is the least we can do for our money, right?

Has this been helpful? Is there any change you would want to see in this? Let me know in the comments below.

Leave a Reply