“I love being married. It’s so great to find that one special person you want to annoy for the rest of your life.”

Rita Rudner

Not so long ago, about 3 and a half years to be precise, I got married (Visual reminder above). Sure marriage is a big word, and it takes quite a bit of time to just sink in. In fact even small things like the verbal switch from “boyfriend” to “husband” took some time for my head and tongue to get in sync with.

Marriage is a complex relationship. Just living with another person 24×7 including their annoying habits, sharing the most intimate things physically and emotionally, making adjustments to the other persons way of life and in some ways also being accountable to the other person in things big and small. Not surprisingly, money is then a big aspect of your life together.

I still remember when I was 10, I had taken a theatre workshop. While doing an improv about a married couple’s argument, the instructor started asking us, what do our parents fight about? Unsurprisingly, an overwhelming number of kids said it was all about Money.

Research supports this finding through an extensive study conducted and published in 2012 in Family Relations Journal. The study titled, “Examining the Relationship between Financial Issue and Divorce” concluded that money arguments early on in marriage are actually an indicator for divorce.

One of the basics to sort out before embarking on this journey would then be to decide on how to manage the money flow. In double income households, it can be even more crucial to figure out the inflows and outflows. In my experience and in conversations that I have had, there seem to be 3 ways to do it.

INE, YOURS AND OURS

This is the method that me and the husband have followed for 3 years of our marriage, just before the husband took the plunge to being a full-time marketing agency. We both had a fixed salary every month, some fixed EMIs and some variable costs every month. The one variable cost every month was the joint credit card which was used to pay for groceries, dining out together and any other expense made for the family. Other variable costs were generally unforeseen expenses that had a nasty habit of cropping up when least expected.

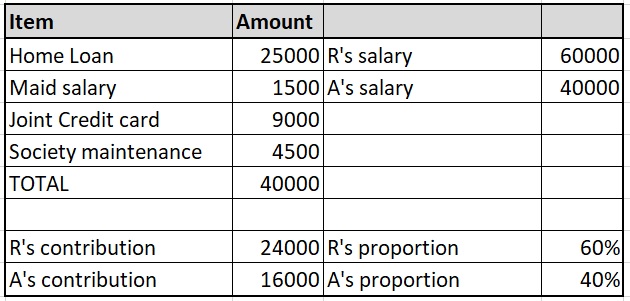

Every month I used to add up the entire joint obligation for the month for which both of us contributed into a joint Savings Bank Account (in the proportion of our salary). Rest of the money was ours individually to plan with and spend. Below is a snapshot of one of our monthly calculations.

Note: The above figures have been used only for reference.

While it might sound complex, it just gave us more control and more of a territorial as well as independent feeling over the money that we earned. We also felt that we were pulling our weight in the marriage. Sample sheet can be downloaded here (Monthly sheet sample)

2. ONE TEAM, ONE DREAM

Some couples prefer to pool all their money in one joint account

Some couples prefer to pool all their incoming money into a single joint account and use that for all the expenses as well. This is the best method in case of an individual salary as well as when you want to take only joint decisions for any money that comes into the family treasury. I have seen it working pretty well for years and it definitely helps in crystal clear transparency considering the control that both members of the couple have on the money.

3. I COVER A, YOU COVER B

This is a variation of the “Yours, Mine and Ours” strategy. Using that method, both members contribute to each of the joint expenses, but in this one, they can choose specific categories of expenses to be made by the particular spouse. A close friend of mine once told me how her dad’s salary was used for most of the household expenses whereas all holidays were planned on her mother’s salary. Yet another friend, married a month after us, also bifurcates his expenses in this way where his wife pays for the utilities and he pays for the rest.

While the best time for this conversation is just before you take the plunge, it is never too late to get this clarity and streamline your expenses. Whatever method you choose, ensure the emotions around money are kept in mind and both partners feel equally invested in the marriage.

So, how are you managing finances in your marriage? Any views, comments or questions, please feel free to comment below or email me at aparna@elementummoney.com

Leave a Reply