A few days back I landed upon this wide global research undertaken by HSBC – The future of retirement. They surveyed over 18000 respondents across 17 countries (including India) to ask them all things related to retirement planning. Personally, I see the result as a major wake-up call. Most people fail to understand just how important retirement planning is. 47{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of working people in India have either not started saving for their retirement or have stopped or are facing difficulties while saving for their future.

I have one question for you. Do you know what your dream retirement looks like? Does it involve a beautiful Portuguese style bungalow in Goa with half of it converted into a café housing a wide collection of books and serving some awesome freshly made goodies? Oh wait, that is my dream retirement. Then what is yours?

Most of our dreams require us to plan for it financially and retirement is no different. Read on to know 11 reasons why you need to start right now:

1. Longer life expectancy

The life expectancy of humans is consistently increasing across the world thanks to technological advancement in medical sciences. In India too, the average life expectancy of an adult of age 60 has extended to almost 78. That means 18-20 years post the working years (depending on whether you retire at 58 or at 60). To put this into context, think about the oldest person that you personally know. I can tell that age would go easily above 85. What if you too end up living longer than the average of 78?

2. A government pension is no longer applicable

Most of us have grown up watching our parents work for government jobs. While that meant slightly lesser salary during the working years, it came with the comfort of a pension for a lifetime after retirement. Since 1st January 2004, the government has done away with the practice of providing a pension for new joinees and replaced it with NPS (National Pension System). What is then your source of income in the sunset years?

3. Escalating cost for healthcare

Picture this – you are a very health conscious person who watches what they eat and is regular at exercising as well. In the headiness of youth you might assume that health-wise you are bound to always remain fit. That, unfortunately, is not the case. Even the best-oiled machines develop enough faults with the wear and tear over years of use. And while a good updated health insurance policy can cover some costs, no health insurance policy will cover 100{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} costs.

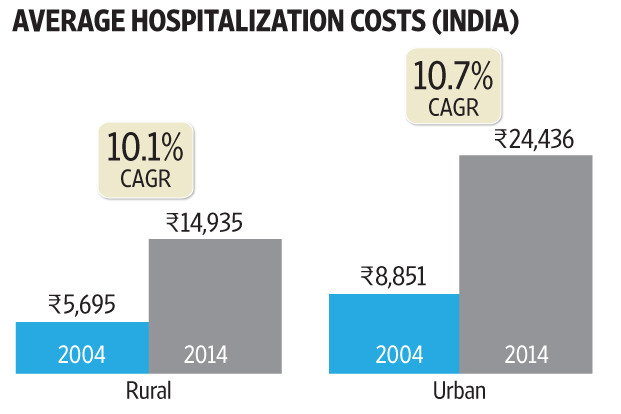

Another factor to remember is that healthcare costs in India are rising at an astonishing rate of over 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} per annum. That means for a surgery which costs you Rs. 1 Lakh today, it would cost you almost Rs. 17.5 lakh. You see, compound interest works both ways.

Healthcare costs in India are rising at a rate higher than inflation. Source

4. You cannot work forever

You might think that I am used to a busy work life, I will get bored and do not want to stop working. I say so because the thought has crossed my mind several times. That still is no excuse to not plan healthy finances for retirement. Also, with such a competitive and youthful workforce, older people are bound to be on the end of the priority list, experience not withstanding. In case you do end up working till later than planned, when has extra money ever harmed anyone? (rhetorical question, don’t take me up on this)

5. Depending on your children is unfair

For a lot of Indians, their retirement planning is their kids. I am not dissing the idea of joint families here. But depending on your kids for your finances is definitely unfair. For a young couple to be financially responsible for 3 generations (them, their parents and their kids) is not ok in any scheme of things.

Be responsible and plan well for your retirement in good time so that you are not dependent on anyone. It’s an old and a symbolic ad but I thought HDFC Standard Life retirement plans got it right with this one.

6. It is never too early to plan

It is never too early to plan for retirement. The earlier you start planning, setting aside money and investing it, the easier your path to retirement is bound to look. I am sure you are now tired of hearing the oft-repeated yet true quote:“Compound interest is the 8th wonder of the world. He who understands it earns it… he who doesn’t pays it” – Albert Einstein.

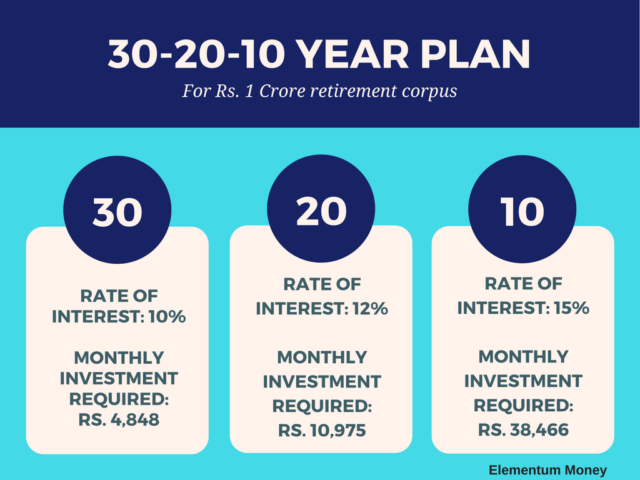

While the number of 1 Crore as a retirement corpus might sound daunting but the more you delay, the more risks you will need to take to get a higher expected rate of return. Even with higher returns, your outflow will continue to increase disproportionately just to be able to match that number. The table below illustrates that:

Starting early in investment always heaps rich results.

7. You always have money to save for retirement

Saving for anything is more of a mindset game than a numbers game. It involves ditching the paycheck to paycheck mentality and planning for the future. Is the end result important for you? If you make a comfortable retirement your priority, you will find a way to save for it.

8. Best time to fulfill lifelong aspirations

Our life is a sandwich – with the grind of working years stuffed between the softer periods of childhood and retirement. The grind of working years is all about running around, getting things done and also undertaking a fair amount of responsibilities, be it of aging parents or raising children. Childhood is a carefree time but you are still not really free per se since your parents are the commanding officers.

Retirement is the time then to fulfill all the things you might have wished you had time or money for – be it travel, contributing to a favorite social cause or devouring that list of must-read books that you have been collecting for years. Why add a stress of money and a probability of figuring out how to survive to what can be a fulfilling few decades of life?

9. Your future could have as many financial obstacles as your past/present

There is research to show that we humans have an optimism bias whereby we live on with the faith that our future will be better. I am all for optimism but a planned one. Confused? Here, I am not talking about abandoning all optimism for the retirement years. However, think about the speed bumps you might have faced in the past or in the present which might have required financial intervention. Know that planning for finances for a particular time period and being optimistic about it can go hand in hand.

One brand that does fantastic social experiments in order to get people more aware and driven to act to plan for retirement is the American brand Prudential. They did an interesting social experiment called the magnet experiment where they asked people to jot down things that happened in their past – good things in yellow and bad things in blue. Similarly, they asked people to jot down things that they thought might happen in the future with the same color coding. Not surprisingly, the past board was an even mix of blues and yellows whereas the Future board was yellow as a canary.

None of us really want to think we could be out of a job right? But can it happen, sure it can. It’s always better to be prepared for the future while keeping the outlook sunny.

10. Inheritance is always dicey

Do not think that since your parents might have done well or saved enough you don’t need to.

Firstly, it is really tacky to depend on your inheritance for retirement because personally it really speaks a lot about your ability to stand up for yourself. Second, you can never know when and how much will you really end up getting, so how can you depend on that anyway?

11. You could keep contributing to making your family happy

Imagine what your family might look like when you retire – maybe kids and grandkids scattered across the country or even the globe. I have always liked the warm fuzzy feeling which is an aftermath of the act of gifting. Would you not want to have complete freedom to book tickets and travel whenever you want to meet your family? More importantly, imagine the look when you gift a grandkid something they have always wanted, and you were able to dip into your retirement corpus without having to think much.

If retirement is something to which you have never given more than a passing thought, the first thing that you need to do is sit down alone or with your spouse, grab a piece of paper and pen and maybe steaming cups of coffee. Just talk about what do you see retirement years looking like? Only when you embrace the fact that retirement is something you need to think about is when you will probably plan your time post-retirement and the money required to fund that life.

Personally, I have made a digital vision board of sorts to tell myself how my ideal retirement period looks. It is just one slide in a powerpoint presentation with photos of a beachside cafe and a happy healthy old couple. Try doing that for yourself and the idea of retirement will become that much more real, appealing and worth saving for you.

Have you started planning for retirement? What motivates you to save for the future? Let me know in the comments below.

Leave a Reply