Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

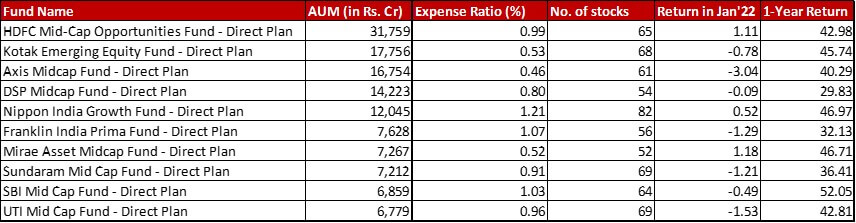

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

Benchmark: Nifty Mid Cap 150 TRI with a change of -1.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in January 2022 and a 1-year return of 46.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 31st January, 2022

Summary

Well, it’s a decent enough score card with six funds under performing the bench mark with two of them just missing the mark. Axis though is the biggest offender this month with a change of -3.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

In terms of AUM ranking, Mirae has inched up one more spot to go on to number 7. SBI has nudged ahead of UTI to be nestles at number 9.

Mirae sees a slight increase in expense ratio of 0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} (which is almost a 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} hike) while Sundaram has further brought down their expense ratio by 0.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

There is a big big development in terms of number of stocks. Sundaram has brought down their number from 106 to a much more manageable 69. Of what I could decipher, they have essentially cleared a lot of their tail after the merging of portfolio with Principal Mid Cap.

Market Cap Allocation

Most of the shift in market cap allocation is seen with a reduction in Large Cap and an increase in Mid Cap. Quite a bit of it could be the result of the bi-annual recategorisation and the resultant need for reshuffling.

The biggest such movement is in Nippon where there is a whittling down of almost 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} Large Cap and increase of approximately that much in Mid Cap.

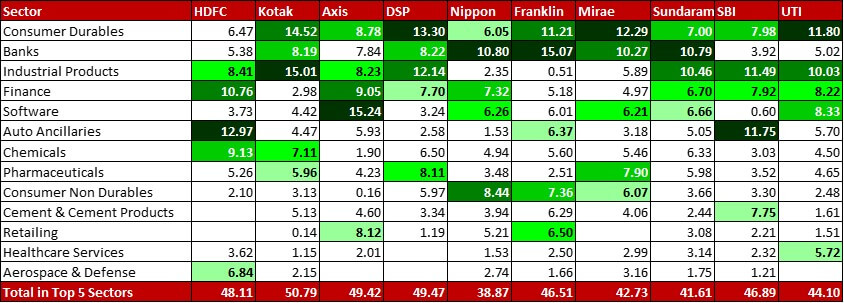

Top 5 sectors

For HDFC, Aerospace & Defence comes into the top 5 sectors with a 0.57{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} increase in Hindustan Aeronautics.

For Franklin, auto ancillaries replaced Cement and Cement Products in the top 5 sector. It just looks like a very static shuffle.

Sundaram though has beefed up it’s holding in Finance stocks with a new healthy 1.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Cholamandlam Investment & Finance, bringing the sector to top 5 by nudging out Chemicals.

SBI sees another placid shuffle between Finance and Textiles, with Textiles moving to the sixth spot and making way for Finance.

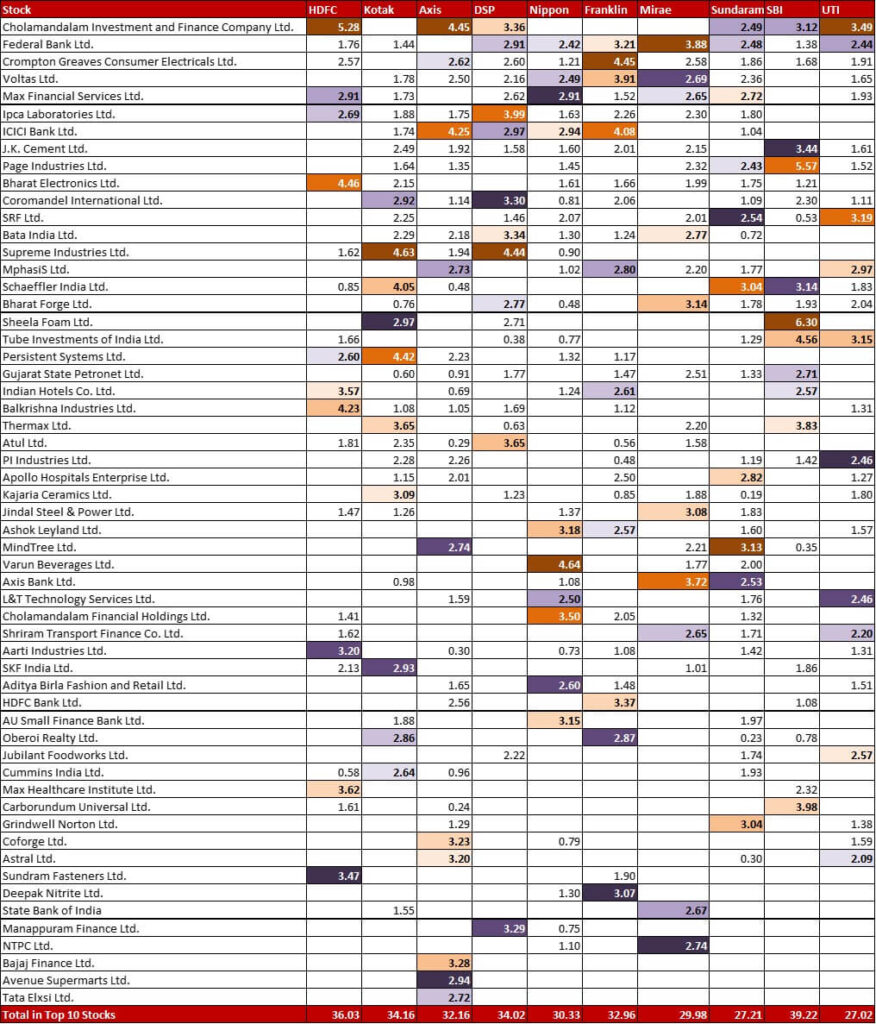

Top 10 stocks

HDFC has a slightly increased allocation to Indian Hotels zooming it up from 8th to the 5th spot.

Kotak has a slightly increased allocation in Kajaria Ceramics bringing it to number 5.

Axis has increased it’s allocation in Cholamandlam Investment and Finance by almost 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to move it from number 3 to numero Uno! Tata Elxsi used to be in that spot but has now gradually pushed down to number 9. They have also beefed up their chemicals exposure with new positions in Atul Ltd. and Aarti Industries, while exiting Indraprastha Gas and Torrent Pharma completely.

DSP sees some big shifts, to the tune of more than 1{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each. They have completely exited Mindtree (1.50{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Siemens (1.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while taking a new position of 1.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Tata Chemicals.

Nippon has increased it’s exposure to Banks with a new 1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in Axis Bank and a 0.71{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Bank of Baroda. They have also made a string of exits, most significant being Apollo Hospitals (1.60{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Tata Consumer Products (1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Franklin has significant new positions in Prestige Estate Projects (1.12{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and HCL Tech (1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while completely exiting Kotak Mahindra bank (0.73{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and BPCL (1.52{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886})!

Mirae has kept their actions limited but chunky – New positions in Container Corp (1.70{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Hindustan Aeronautics (1.17{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) along with complete exits from Sun Pharma (1.44{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and BPCL (1.02{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Sundaram has too many exits to really keep count. But, two movements are of significance – 1.32{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} new holding in Cholamandalam Financial holdings and complete exit of 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in HCL.

UTI doesn’t have much to be talked about. As for SBI, the trims have been little here and there but there is a big new allocation of 2.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in P&G Hygiene.

Check out the other categories and what the funds there were up to:

Leave a Reply