These days most of us equity enthusiasts are experiencing a mix of emotions. Awe at the rocket speed with which the Indian markets have raced from pit bottom to their all time high coupled with confusion at what is supporting this euphoria. However, at such times it is prudent to remember that in India extremely few people would actually be participating in this rally considering very few still invest in the asset.

More importantly, spare a thought for the people still too fearful of treading into the terrain of equities and choosing to put in their lot only with the erstwhile dependable Fixed Deposit! Especially think of the senior citizens who often depend on that interest income for their living expenses post retirement. With rates plunging to unimagined depths, even with the slight incremental interest, a lot of them are finding it difficult to reconcile to the fact that this is the same product that at one time used to give return of even 13{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!

However, this brings me to the topic on hand. The fact remains that the problem of managing for retirement is only going to keep compounding in the years to come. When it comes to retirement planning, there are two key components to it. One, accumulating funds while the money is incoming as per future forecast for requirement. Two, planning how to convert that lumpsum in a way to have appropriate money to spend in the sunset years.

In the second aspect, I have earlier covered a strategy namely Systematic Withdrawal Plan. It’s a fairly easy, almost invest and forget strategy apart from a regular check on whether the fund is still worth staying invested in. However, recently I got to know and became intrigued by another option to convert that pile of money into smaller chunks over a longer period. Presenting the Retirement Bucket Strategy.

What is a bucket strategy?

A bucket strategy is one where the sum of money is split into various categories with a defined objective and time horizon. On that basis, each bucket is invested in particular assets correlating the expected risk and time for which the money can remain untouched.

Originally devised by Harold Evensky, the idea was simply to divide the lumpsum in two buckets – cash bucket and long term bucket. But, today, enough advisors and brokers have more variations on it.

Yes, I know this can sound complicated with some necessary technical terms. Hence, let’s look at an illustration.

Retirement Bucket Strategy in Action

Suppose an investor has a Rs. 1 Crore corpus and is looking to draw 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} annually or approximately Rs. 50,000 per month from the same. Now, if we simply keep withdrawing without letting the money grow, it will all barely last about 16 years and with increasing life spans you want to stretch your corpus as well.

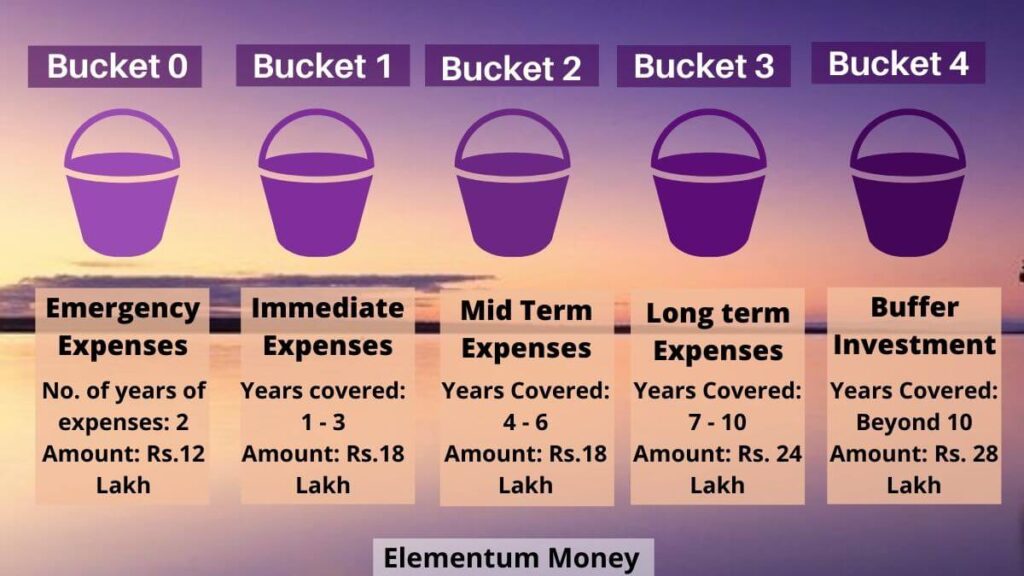

So, this lady takes a New Year Resolution in 2010 to take a bit of risk and professional help to set up a bucket strategy for her nest egg. Together, they agree to the following 4 buckets:

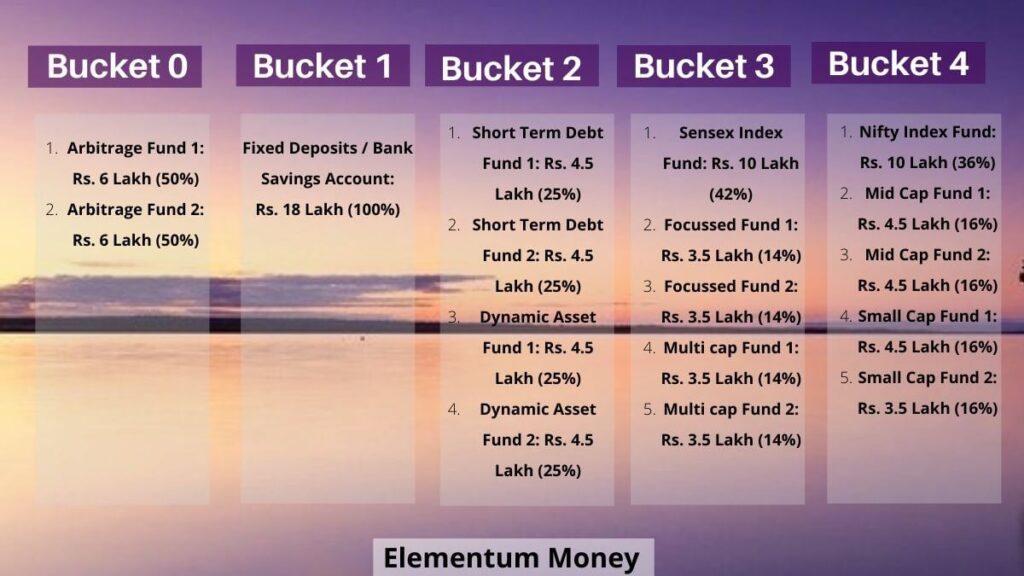

Considering the time frames, this is how the investment strategy looks for all the buckets. For Bucket #0, since there is no timeline to when the money might be needed arbitrage works well with it’s stable, decent and tax efficient returns. For bucket #1, since we are looking to exhaust it consistently over 3 years, it has been kept super conservative with Fixed Deposits. The risk and of course expected returns increase with each subsequent bucket.

In this illustration, the investors higher risk appetite is seen in the fact that Bucket #2 is divided equally into debt funds and dynamic asset allocation or balanced advantage funds (BAF). If an investor is hesitant, then this entire bucket can be changed to debt or BAF can be swapped with their more conservative sibling, Equity Savings Fund. Bucket #3 has been kept limited to large cap index or large cap dominant funds like Focussed and Multicap. Keep in mind, that this investor is a more aware investor and has agreed that she is okay to invest in mid and small cap funds for Bucket #4 which could have longish periods of under performance.

How does this perform over 10 years?

The illustration does not end here. This, in fact is just the beginning. Now, suppose they make all the investments on Feb 1, 2010. I chose two funds for each of the categories and have mapped their NAV movement over these ten years.

Also, in these ten years, instead of advisor or investor emotions run the roller coaster with the prices, they agree to the following methodology.

1. Check valuations on the 5th or appropriate whereabouts after every quarter end. Hence, 5th April, 5th July, 5th Oct and 5th Jan.

2. Wherever the funds breach the 15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} mark from the original amount, trim that and put it either in Bucket #1 or Bucket #2 debt funds

3. Very sparingly trim Debt Funds

For the purpose of illustration, I have tried to ensure that I did not choose only those funds which currently have a stellar performance. Also, funds with a more than 10-year history have been taken into account. As for large caps, I have taken a Sensex and a Nifty Index fund to test the efficacy of those even in the pre-market cap categorisation period.

Above is a summary of the times when the changes were made. While I have spared the long winded sheet with the full quarterly NAVs, in case this post whets your curiosity and investing chops write in the comments or email me at aparna@elementummoney.com. I will be happy to share the same and also have a discussion on the same.

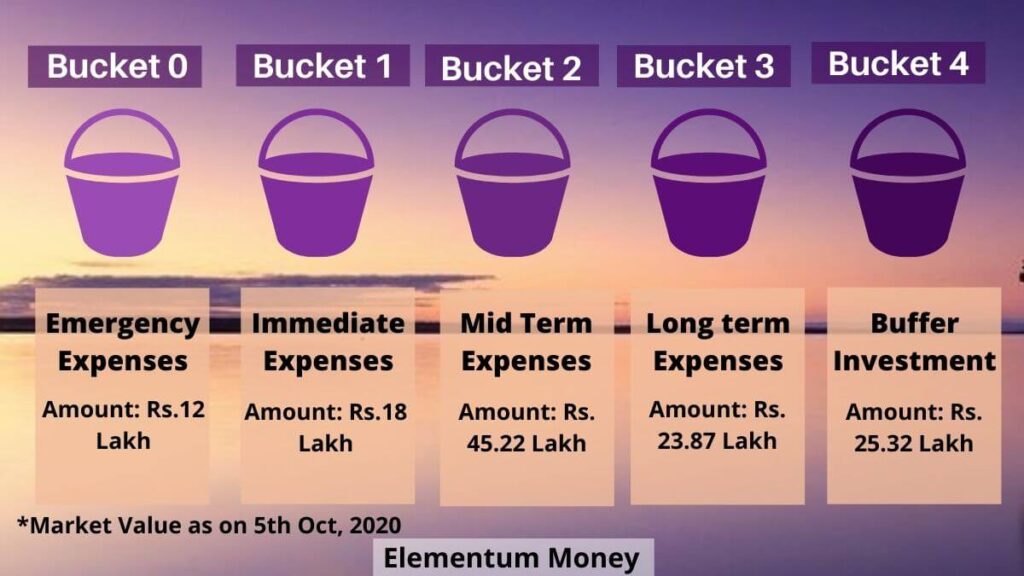

Also, most importantly take a look at how the funds are valued on 5th October 2020. Hence, these funds have been through the roller coast of the peak of coronavirus crisis as well. The main thing to note is that while the equity heavy Bucket #3 and Bucket #4 are a little less than the original value, Bucket #2 has been heavily beefed up using the equity gains from erstwhile bull runs. This further takes care in case of any prolonged corrections while having bucket #1 ready to support living expenses till 2022.

Some points to note

Before you think it’s all hunky dory and rush in to invest this way, take note of the following points.

1. Can you stomach risk?

Investments need to be made keeping the risk appetite in mind. If you notice, there have been two or three year periods of market correction whereby barely any gains could be taken from equity buckets. In fact, the faint hearted who would check valuations on their portfolio every day could end up taking not so conducive actions.

2. Requires regular monitoring

While I have mentioned only 9 quarters when changes have been made, I checked some 42 quarters over a period of these ten years. All in all, unlike SWP which requires minimal intervention this needs a disciplined approach.

3. Professional management is advisable

Not only does this have more bifurcations in the corpus but it also requires a stronger emotional makeup. With SWP, there are very few decisions or transactions to be made. In this case, there are more moments of reckoning and often clinical plunges required. Ideally, with SWP while you could easily do with a one-time advise, this works better with a long term professional arrangement.

4. Aims to fill in the buckets

When we check or analyse every quarter, the aim is not regular rebalancing. Hence, even at times of deep market correction at no time have I reversed the direction of money flow from debt to equity. That’s why with investing it is extremely important to know your why. In this case, the idea is not to compound and grow your wealth. Rather, it is about safeguarding and squirreling away the bounty gifted by gods of equity into safe havens.

5. Take into account inflation and emergency expenses

For the purpose of simplification, there are two things I have not considered in the case of this illustration. One, I have kept the withdrawals consistent at Rs. 6 Lakh per annum. Two, while we defined Bucket #0 for emergency expenses at the beginning, I haven’t refilled it from any of the gains choosing to either buffer up debt investments or forward plan the annual expenses.

At first glance, this can seem complicated. I know for while doing the calculations for this illustrations, I almost went bald pulling out all that hair. But, in the background of longer retirement periods and lower interest regimes, this might be the holy grail to financial peace of mind.

Have you heard of the retirement bucket strategy before this? Would you do anything differently? Let me know in the comments below.

Leave a Reply