In class six, I remember first coming across the concept of Compound Interest. Before that, interest automatically meant Simple Interest where the interest was calculated on an unchanging Principal throughout the period. It was only in Class six when the distinction was made for Compound Interest which simply implied that the interest earned would keep adding to the principal every year and also keep earning interest. However, in school, compound interest only meant a complex formula and little else. It is only now, as I explore the depths of Personal Finance that I realize just how magical Compound Interest really is.

What is Compound Interest?

As mentioned above, compound interest is the type of growth of money where any interest is continually added to the principal to increase it with every year. Confused? Let’s look at it with a simple example.

You have Rs. 2,000 with you. You decide to invest it for 5 years in two products – one returning a simple interest of 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} whereas the other returning compound interest at the rate of 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. They might sound like two similar financial products, but they are very different.

Let’s take the simple interest first. For Rs. 1,000 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} interest in one year comes to Rs. 100. The account will return the same interest to you every year which means the total interest will be Rs. 500. So, your final amount comes to Rs. 1500.

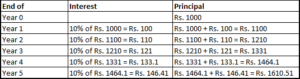

Now, with compound interest too, the interest in the first year will come to Rs. 100. However, your principal also changes to Rs. 1000 + Rs. 100 = Rs. 1,100 which will then lead to the following calculation for the 5 years.

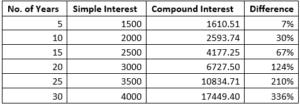

As you can see, even in 5 years the difference between a simple interest and a compound interest is 7.36{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} at the same rate of interest. The difference keeps exponentially increases in magnitude as the number of years go up. Sample this:

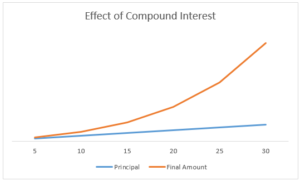

The magic of Compound Interest really kicks into gear with the number of years invested. Look at the visual representation of the scenario to make the reality even starker.

What does Compound Interest mean for you?

While I learned the formula for Compound Interest while I was still a teenager, there is almost no school today which teaches us the practical applications in our own lives. Today, most financial products compound the money invested. However, to really make the magic of compound interest work, there are a few things we must ensure.

Time invested can make or break the end result

This is probably the thing hammered in most by almost any article today on compound interest. You can see it even in the above table. Time invested is the most important variable for compound interest to kick in.

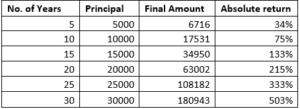

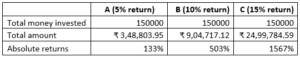

For another example, say you start investing Rs. 1000 at the start of every year. Depending on how many years you stay invested, your absolute returns could vary from 34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to a whopping 503{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}! Take a look.

Always reinvest the interest

There are some products that give us the choice of redeeming the interest or reinvesting it. For instance, when you auto renew a Fixed Deposit, you do it while reinvesting the interest earned along with the principal. However, if you choose to break the FD and withdraw just the interest, then you would be earning interest on the original principal alone.

As an analogy, dividends are another good example of the benefit of compounding. Dividends are the earning allotted to share holders by a company. Think about these dividends as interest. You can either reinvest this dividend and initiate the magic of compounding or withdraw it as a feel good factor time to time. While the stock will still show returns, with the dividend reinvested, the returns will be so much better.

One other product that I must mention while talking about reinvesting interest are mutual funds. There are two kinds of schemes in mutual funds – Growth and Dividend. Dividend schemes let you withdraw the dividend allotted by the stocks help by the mutual fund. On the other hand, growth schemes do not release those dividend amount, rather choosing to reinvest it. As you might have guessed by now, growth mutual funds will show exponential returns thanks to the magic of compounding while in dividend schemes those returns will be severely handicapped.

Get a better rate of interest

Have you noticed how any change in the home loan interest rate now makes front page news? It is because the rate of interest impacts all possible calculations and even minor changes can end up impacting in a big way. If you are wondering why I am changing tracks from investing to home loans, then you should know that loans are an instance where compound interest works against the borrower. More on that in another post. Let’s focus only on the positives of compound interest in this post 🙂

For instance, there are 3 friends A, B and C who have realised the importance of investing early. All three are 30 years of age and decide to invest Rs. 5000 every year for 30 years so as to have a retirement corpus in place. A decides to keep it in a Fixed Deposit which post tax ends up giving him a return of about 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} per annum. B decides to take some element of risk and keeps it in a mix of stocks and bonds with higher investment in fixed return bonds, in effect getting an interest rate of 10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} every year. C decides to wing it by taking on more risk and investing all this amount in equity, riding the volatility over the three decades and getting an annualised return of 15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} for the period.

Now, look at how the scenario is so different for each of these friends:

With compound interest, you can see taking some risk and increasing the probability of the rate of return becomes absolutely crucial.

Once the concept of compound interest is well drilled in, very few people negate the urgency of starting early, reinvesting the returns or interest and taking some risk to increase the rate of return. Surrender to the magic of compounding and let it make your money work in the most efficient manner!

Have you experienced the magic of compounding? What are your views on it? Let me know in the comments below.

Leave a Reply