Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Summary

Although SBI is the only fund in the category that has limited the allowed inflows, there are two funds with higher AUM – Nippon and HDFC.

Nifty Smallcap 100 TRI dropped with a -1.08{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} movement in October 2021 while Nifty Smallcap 250 TRI moved up slightly by 0.16{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. Funds in this category use either of these two benchmarks. The biggest two, Nippon and HDFC did beat Nifty Smallcap 100 TRI but fell short of Nifty Smallcap 250 TRI. Rest of the funds comfortably beat both the benchmarks.

The only movement in terms of AUM was Axis Small Cap moving ahead of Franklin India Smaller Companies Fund.

Among all these funds, Nippon is the only one to maintain a crazy number like 136 stocks!

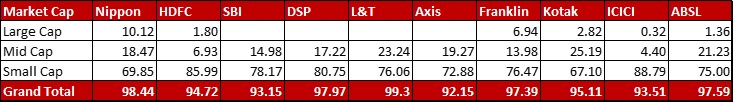

Market Cap Allocation

SBI, DSP, L&T and Axis are all in with no allocation to any Large Cap stocks. ICICI, DSP and HDFC are probably the purest in the category with 80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}+ in their namesake market cap stocks.

All funds continue to be mostly invested with very little left in cash.

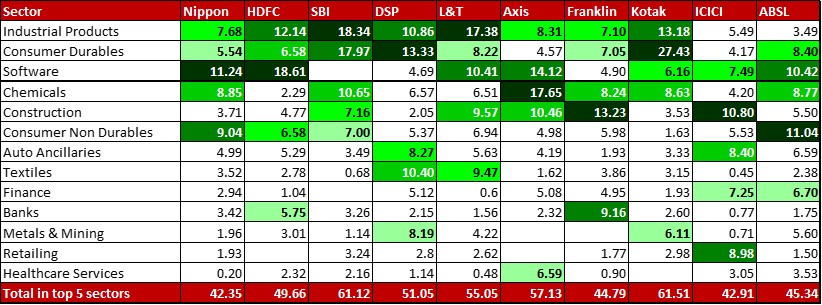

Top 5 sectors

Industrial Products, Consumer Durables, Software, Chemicals and Construction find a fair bit of representation being in the top 5 sectors for majority of the funds. Retail and Healthcare services are the unique sectors finding their place to top 5 only in one fund each.

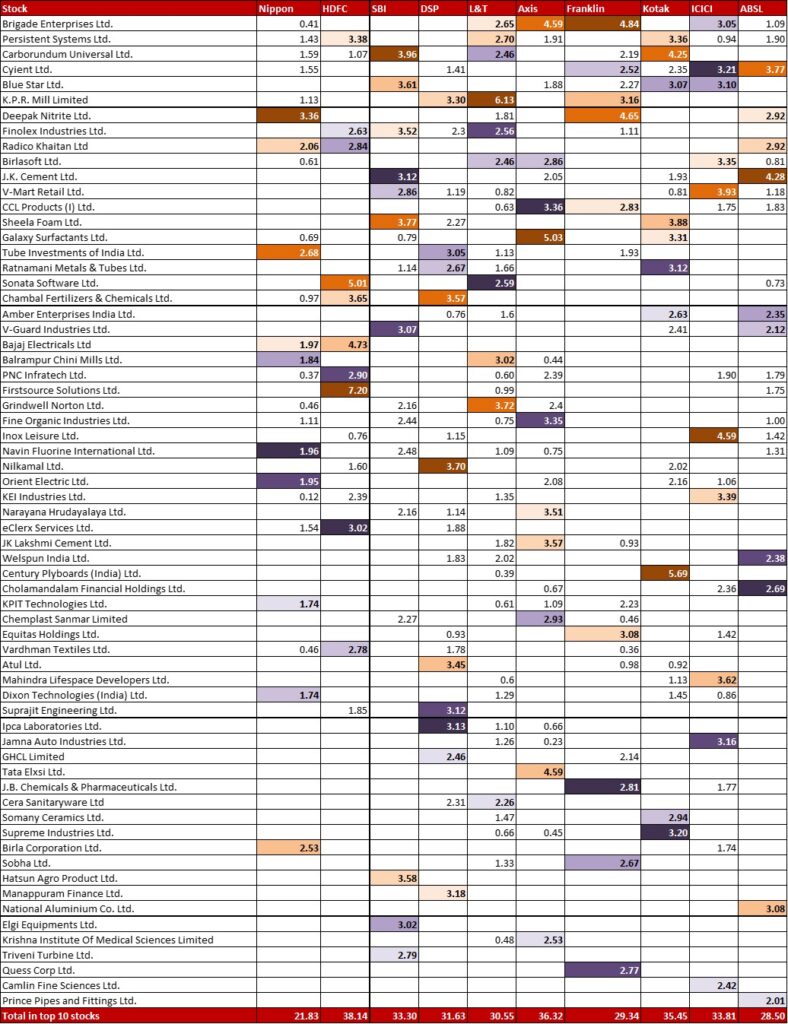

Top 10 stocks

Well, the scattering gets so much more difficult to handle in case of Small Cap funds. But, maybe you will find some interesting patterns that my data-fatigued brain is not able to particularly notice. If you do, feel free to mention it in the comments below.

Leave a Reply