When I joined my first bank, I was a part of the Loans team. My first few days were spent in the credit or loan processing centres. It was a fascinating look at the back end of how the calculations are made as to the loan amount to be sanctioned and the process involved in it.

One term which I heard for the first time and which was thrown around multiple times in the conversation was – credit or CIBIL score (CIBIL being the oldest bureau). Over time I realized two facts about credit scores – one, it is a fundamental personal finance fact to know and understand and two, it is a recent concept in India for which awareness is still very limited.

With this post, I hope to cover the main concepts that need to be known about the credit score.

WHAT IS A CREDIT SCORE?

When you apply for a loan, a bank lends with the expectation of getting the money (along with the interest) paid back to them.

The only way to check this ability of a loan applicant is using the submitted documents. However, most documents go back only to 6 months. Banks try to get over this weakness by using a credit score.

A credit score is a number computed by third-party agencies using data from participating banks. The score is a reflection of the applicant’s creditworthiness and the risk he/she poses to the bank. A score of 720-750 is generally accepted as a good score as per most credit bureaus.

Wonder what was Nirav Modi’s credit score? 😉

CREDIT SCORE BUREAUS

CIBIL

CIBIL or Credit Information Bureau (India) Limited was established in 2000 and is the oldest and biggest credit bureau in India. Recently, in 2016 it was acquired by the American multi-national Trans Union. As per Wikipedia, it keeps a record of 600 million individuals 32 million businesses.

Equifax

Operational in 24 countries, Equifax established its’ presence in India in 2010 after an RBI approval. Equifax Credit Information Services Private Limited (ECIS) is a joint venture between the American multi-national Equifax Inc. (USA) and seven leading Indian financial institutions (https://www.equifax.co.in/about_equifax/india/en_in)

Experian

Established in India 2010 and operational across 37 countries, Dublin-based Experian is the first company to be licensed under the Credit Information Companies (Regulation) Act 2005. The company has tied up with more than 2900 banks, financial institutions, telecommunications companies and microfinance companies. (Source)

Highmark

Founded in 2007 with a license to operate in 2010, Highmark is an Indian credit bureau that was acquired by the Italian multi-national CRIF in 2014. Following the acquisition, the bureau is now called CRIF High Mark Credit Information Services.

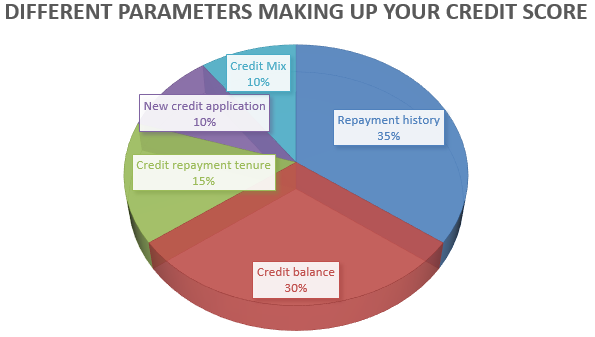

PARAMETERS TO CALCULATE THE CREDIT SCORE

While researching, only CIBIL seemed to give a clear bifurcation of the components that go into its’ score calculation. (Source). Taking that as an industry standard might be a fair assumption.

Let’s look at a basic definition of each of these components:

Repayment history

The main aspects taken into account to check your repayment history are credit card bills and loan EMIs. Not only do you get charged a hefty amount when you don’t repay these on time, you also pay for it with a bad credit score that can take some time to be reversed.

I still remember when I forgot to pay my credit card bill for a tiny amount and was charged a fine which was almost the same amount as my bill. I ranted about the penalty on Facebook. My ex-boss, who has been working in the loans team for over a decade now actually messaged to shout at me, saying I should know better how it impacts my credit score. Such is the life of a banker, I guess.

Credit balance

There is merit to not using the bank-gifted credit balance every month EVEN if you repay it every month. Similarly, once a loan is sanctioned (often a larger amount than required) sign up only for the necessary amount. Unused balance on the credit card and loans shows that there is scope for more credit which has not been required by the applicant.

Credit repayment tenure

To me, this is a counter-intuitive aspect. In fact, most people start with a negative credit score till the time they are a loan newbie. With a longer period of smooth loan repayment (no bounced EMIs) you are building credit history as a less-risky candidate.

New Credit Application

Every time you apply for a credit card or a loan, any lender is required to check your credit score. This qualifies as a hard inquiry, contrary to when an individual checks his/her own score which is a soft inquiry.

Confused? Suppose you apply for a Rs. 3 Lakh personal loan. The lender will check your credit score and then sanction the loan. Then you apply for a home loan and soon enough apply for another personal loan to renovate the house. For every loan, you like to shop around with at least 5 banks. The bank representatives tell you that only after checking all documents can he confirm the best deal for you. In this scenario, there will be 15 hard inquiries on your credit score in a short span, which is bound to lower it.

Credit Mix

Yet another counter-intuitive aspect of the credit score. In order to have a good score, you must have a mix of secured loans (backed by an asset like car or house) and unsecured loans (credit card, personal loan etc).

WHAT CAN A CREDIT SCORE DO FOR YOU

In India, credit score is a relatively new concept. With only 17 years behind it and the awareness just about building up, it is yet to assume the powerful status it enjoys in other countries.

In India, lower interest rate due to a high credit score is still unheard of. Click To TweetHowever, banks do stretch the loan amount sanctioned or the tenure they can look at giving for a particular application.

HOW CAN YOU IMPROVE YOUR CREDIT SCORE?

In my humble opinion, looking at trends elsewhere, credit score is only going to increase in power in India. Knowing about it and maintaining a high score can help. Below are 5 ways for you to improve your credit score:

- Check your credit score once a year

The distinction between a hard inquiry made by a lender and soft inquiry made by the score holder is something I got to know while researching for the post. Checking your score once a year is a good practice to spot and get any discrepancy corrected.

- Pay your credit card bill on time

Since most loan repayment is automated, it’s easier to not let the EMI bounce. However, most of us (including yours truly) keep the credit card bill payment at a manual setting. Ensure you pay your credit card bill on time.

- Check all repaid loans are closed

When I and the husband applied for a loan as co-borrowers, the bank came back to us about one of the husband’s old loans. Turns out, the loan had been completely repaid but that bank had not closed it in its books. So, we had to go to the bank and ensure closure. When you check your credit score, check all details are up to date, including live loans.

- Do not max out your credit cards every month

Not taking up on the entire loan sanctioned is a one-time call. However, every month, ensure that you do not end up maxing the credit limit on your credit card either. If need be, utilize multiple credit cards to ensure there is unused credit limit.

- Do not shop at too many banks for a loan

While you might be looking for the best deal in your loan hunting skills, giving your documents to too many banks for processing is inviting multiple hard inquiries to your credit score. This is bound to result in lowering of the score.

If you are looking for still more ideas on how you could improve your credit score, check out this valuable detailed post.

As you can see, credit score is an important aspect of your personal life, especially when you need to borrow money from the bank. In case of any unanswered questions, let me know in the comments or email me at aparna@elementummoney.com

Take your first step today. Sign up for the Elementum Money Weekly Newsletter to download the Financial Feminist checklist. Also, get nuggets of financial wisdom with our 3 posts every week, directly to your inbox. Have more questions, feel free to send any of them my way at aparna@elementummoney.com.

Leave a Reply