Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

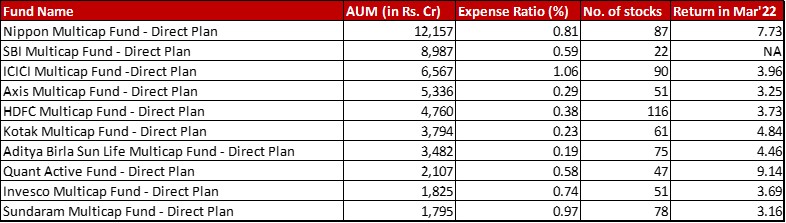

Fund category definition: Funds with minimum 25{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} each in Large, Mid and Small cap stocks

Benchmark: Nifty 500 50:25:25 TRI with change of 4.67{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in March 2022 and a one-year return of 25.86{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}

Data as on: 31st March, 2022

Summary

I love the idea of this fund because it just gives quite a balanced exposure to all market caps. In my view, especially for beginners who do not want too many funds, this can fulfil so many needs like growth as well as stability.

Since it is still a recent category, funds are of two types – either those that changed the stripes of existing funds or new launches in the past few months or an year. Hence, for the next few months I won’t include a 1-year performance for the funds in this category.

Another thing to note is that the category overall seems to have quite a low expense ratio. This could be related to how recent the funds are. Either way, the 0.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of Aditya Birla, 0.23{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of Kotak and 0.29{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of Axis are still a shocker for me. Even Small cap index funds come at a cost of 0.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}!

HDFC continues it’s legacy of 100+ stocks in this category as well.

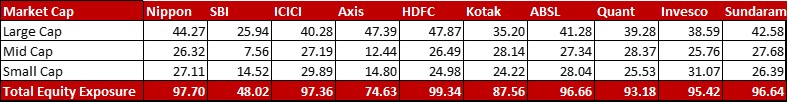

Market Cap Allocation

SBI got listed on the 8th of the previous month itself. Hence, only 48{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} of the portfolio has been deployed thus far. Axis and Kotak are also choosing to go slow in deployment, still being in the sub-90 zone.

Also, while the linked index is Nifty 500 50:25:25, a lot of funds are hovering around the 40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} range in Large Caps. It will be interesting to see how this allocation changes with evolving market dynamics.

Top 5 sectors

Banks rule the roost in this category too with two exceptions – Axis where the highest sector is Software and Quant which is heaviest in Metals & Mining.

As for Software, Quant in it’s popular Active Fund has chosen to give the sector a miss. SBI too has kept it a miniscule 3.11{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Consumer Durables find favour with half the junta to feature in the top 5 sectors, while Consumer Non Durables and Construction are popular with 4 of the funds.

Rest of the featured sectors make up the top 5 in two of the funds each. This section should get more interesting with time as we start to see the movements.

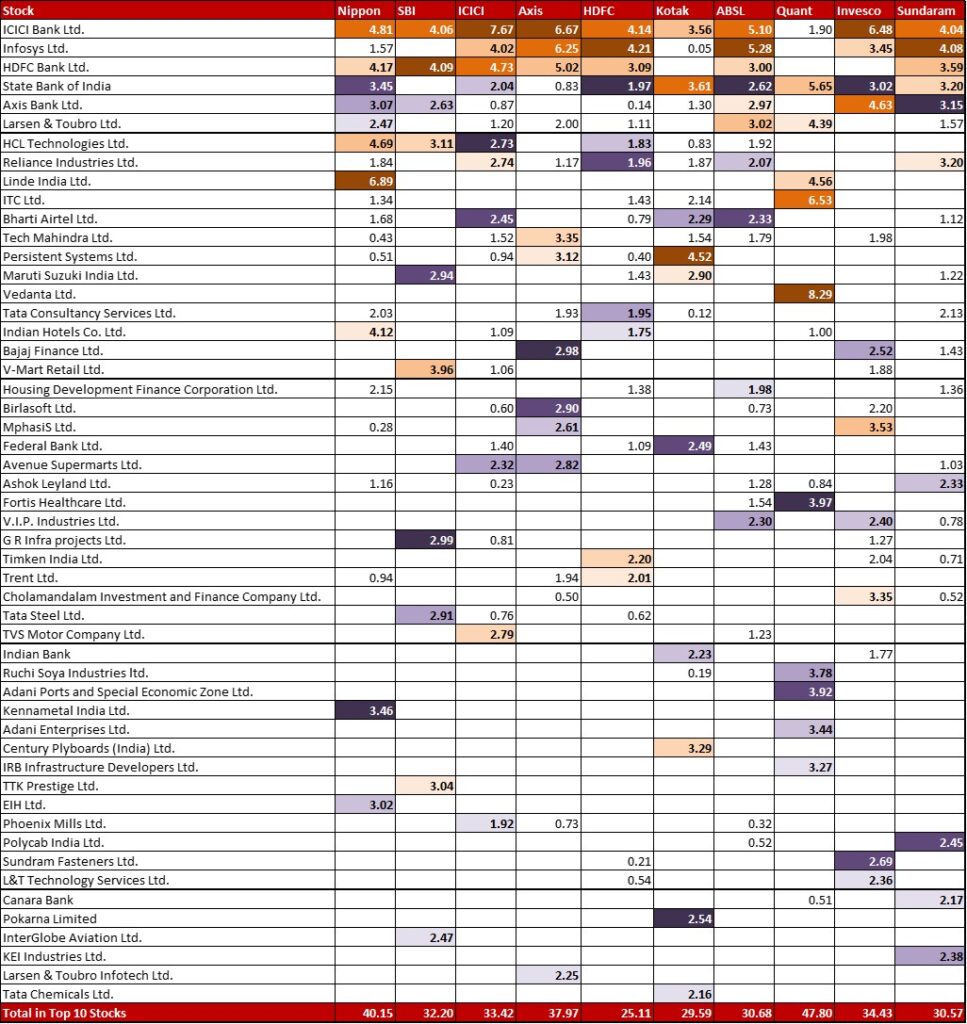

Top 10 stocks & Movements

The only stock to feature in all ten funds is the current hot favourite – ICICI Bank. Some of the other usual suspects do make their appearance but as you can see it’s quite a fragmented landscape.

Some method in this madness might evolve as I track it over the next few months.

Check out the other categories and what the funds there were up to:

Leave a Reply