Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 65{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Mid Cap (101-250 by market cap size) stocks

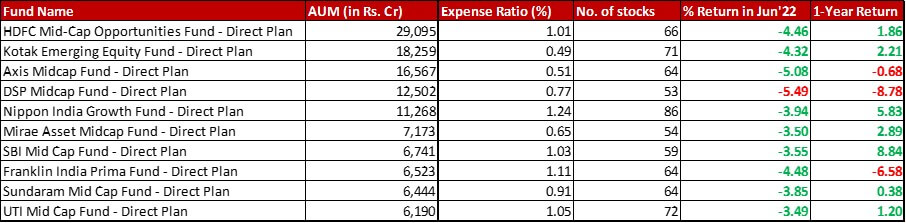

Benchmark: Nifty Mid Cap 150 TRI with a change of -5.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in June 2022 and a 1-year return of -0.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

All data as on: 30th June, 2022

Summary

Two funds have a slight increase in their expense ratios. Axis has increased by 4 bps inching up to 0.51{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while UTI has a 7 bps increase to go up to 1.05{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

On the number of stocks front, the funds have been fairly stable with very little to write home about.

In terms of performance, just one fund has under performed the benchmark marginally. That numbers goes up to three in terms of one-year performance but active funds still seem to be a better choice in Mid Caps.

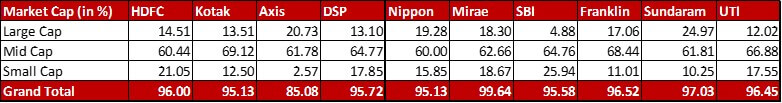

Market Cap Allocation

Thanks to the reclassification, automatically HDFC sees a big shift of over 9{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Mid Cap to Large Cap. Two of it’s big holdings, Cholamandlam Finance & Investment and Hindustan Aeronautics got promoted to Large Caps as per this reclassification.

A similar story plays out with an almost 5{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} jump in Mid Cap allocation for Kotak.

Nippon too sees about a 6{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction in Mid Cap and a simultaneous 4-odd{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} jump in Large Cap allocation.

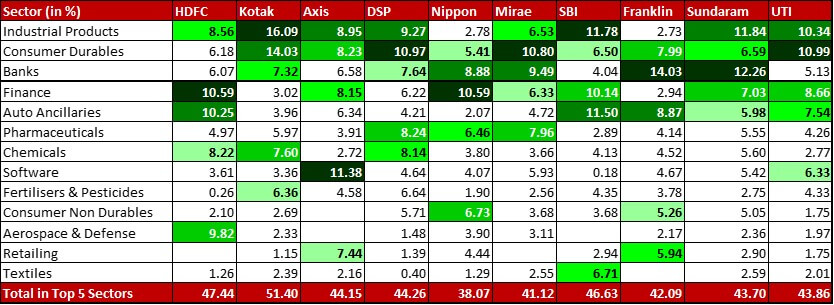

Top 5 sectors

Nippon has reduced it’s allocation to Software with two exits – Coforge (0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and L&T Tech Services (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) while increasing it’s Consumer Durables allocation with a new 0.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in 3M India. This shows in Consumer Durables entering the Top 5 Sectors while Software exiting it.

In Mirae, there is an organic swap between Software and Finance for the fifth spot, with the latter making it in this time.

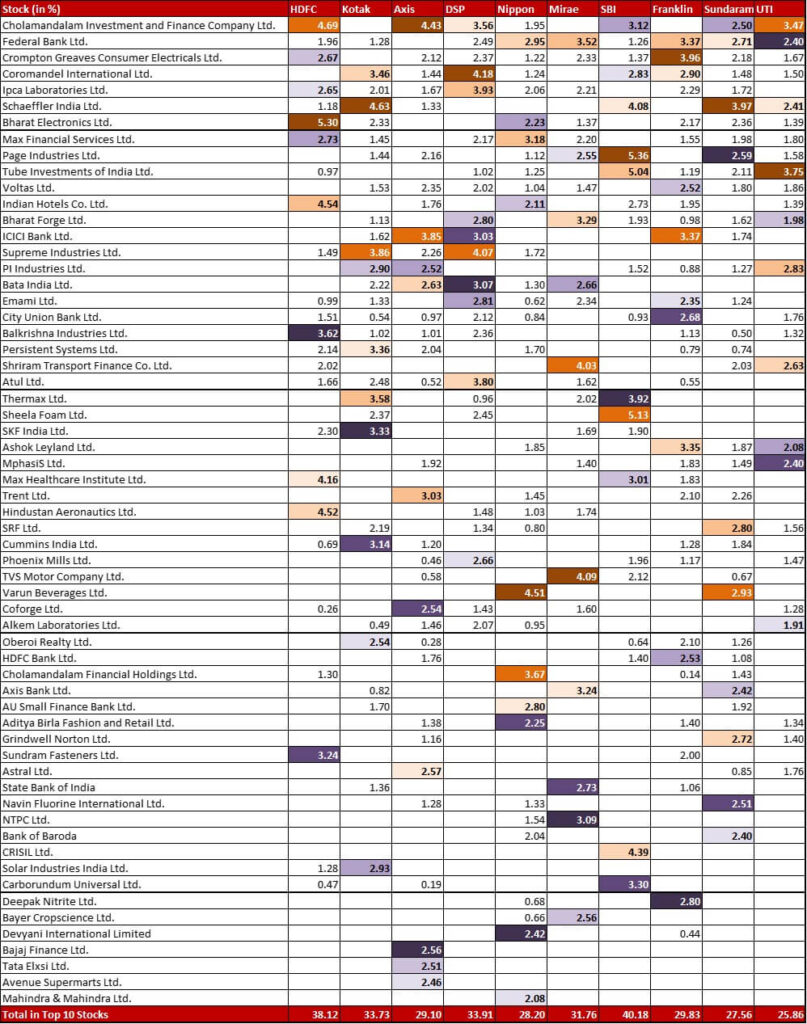

Top 10 stocks & Movement

HDFC has one new addition – Coforge (0.26{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Axis has one new entry (Pheonix Mills at 0.46{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and one exit (PB Fintech at 0.24{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Nippon has four exits Coforge (0.80{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), L&T Tech Services (0.49{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}), Aarti Industries (0.15{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}) and Aavas Financiers (0.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}).

Mirae has just the one exit of 0.77{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} from Varun Beverages.

SBI has increased it’s allocation in Tube Industries by 0.83{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go up to 5.04{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. There’s also a substantial new 1.10{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Aether Industries.

Franklin has increased it’s allocation in Tube Investments by 0.91{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to go up to 1.19{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. The fund has a new 0.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} position in Ajanta Pharma, while exiting it’s 0.61{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Bata India.

Having slashed it’s position in Honeywell by quite a bit last month, Sundaram has exited the remaining 0.38{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation in the stock this month.

Check out the other categories and what the funds there were up to:

Leave a Reply