Before I start off on any analysis in this segment, even at the cost of a repetitive bore I will put forth this disclaimer. All fund schemes are taken as direct. However, even if you are a direct investor, hire a financial advisor that you trust who can guide with investments. Pay for your advice.

Fund category definition: Funds with minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} portfolio allocation to Large Cap (top 100 by market cap size) stocks and 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Mid Cap (101-250 by market cap size) stocks. Remaining 30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} is as per fund management.

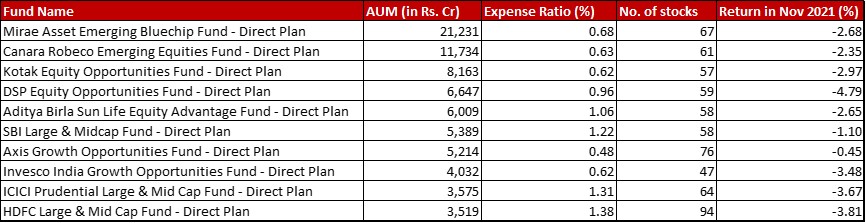

Benchmark: Nifty LargeMid Cap 250 TRI with return of -2.33{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in November 2021

All data as on: 30th November, 2021

Summary

This is personally one of my favourite fund categories. I have often been caught saying like an ad salesperson – stability of large cap, growth potential of mid caps.

But, when you look at the AUMs, you will see it’s not much of a favourite of investors apart from Mirae. In fact, it really is Mirae Emerging Bluechip which first got the AMC much popularity. Even now investors with high value SIP refuse to let go of it, concentration risk in the portfolio be damned.

Axis and HDFC (despite a performance of -3.81{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in the month) are the only two funds where the AUM has increased. SBI and Axis were the only two funds to have beaten the benchmark. Axis clearly had help from it’s 20-odd{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} foreign equity allocation.

SBI has also has quite a bit of reduction in it’s total expense ratio going down from 1.30{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 1.22{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

As for the number of stocks, Invesco, Axis, and HDFC have all been on a shopping spree adding 4, 5 and 10 stocks respectively to their portfolios.

Market Cap Allocation

For me, Axis remains a surprise here. In my understanding, the Large & Mid Cap funds are mandated to have a minimum 35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to Large Caps and Mid Caps. I have always understood this to mean domestic stocks. However, yet again I see the Large Cap number surprisingly low at 17.64{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Within the other funds, SBI Large & Mid almost acts as a multicap with a 20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} allocation to small caps.

As for equity exposure, SBI has increased it the most by about 3.20{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} whereas HDFC has done so by almost 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} while ICICI has gone up by 1.35{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Top 5 sectors

Banks and Software remain the two favourites for the fund category. However, Axis doesn’t really seem to favour banks that much. They have thrown in more of their weight behind NBFCs mostly via Bajaj Finance. Although this month, Software seems to have the highest allocation taking it a little higher than Finance.

Canara Robeco sees a shift with retail reducing by 1.07{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to give the fifth highest spot to auto ancillaries.

In SBI, with about a 0.94{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} reduction, industrial products sector has given way to Textiles becoming the fifth highest sector.

For Invesco, a big change is the trimming of allocation to Petroleum Products from 6.62{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 4.34{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} which shows in the slipping of position of the sector allocation as well.

Top 10 stocks

If you are looking for uniqueness, then Axis has to be right up there in this category. They seem to steer clear of most of the usual suspects, as seen from the initial few blank rows.

Most of the clustering remains prevalent in the tried and tested players – ICICI Bank, Infosys, HDFC Bank, SBI, Bharti Airtel, Reliance Industries, Bajaj Finance, Axis Bank etc.

There looks to be an intentional 2.40{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} trimming in the ICICI Bank allocation in the DSP portfolio, down from 10.06{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 8.66{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}. State Bank of India sees an increase in allocation of almost 2{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} in ICICI Large & Mid cap going up from 0.75{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886} to 2.74{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

ABSL, Axis and ICICI maintain a heavy concentration in the top stocks in the range of about 45{76b947d7ef5b3424fa3b69da76ad2c33c34408872c6cc7893e56cc055d3cd886}.

Leave a Reply